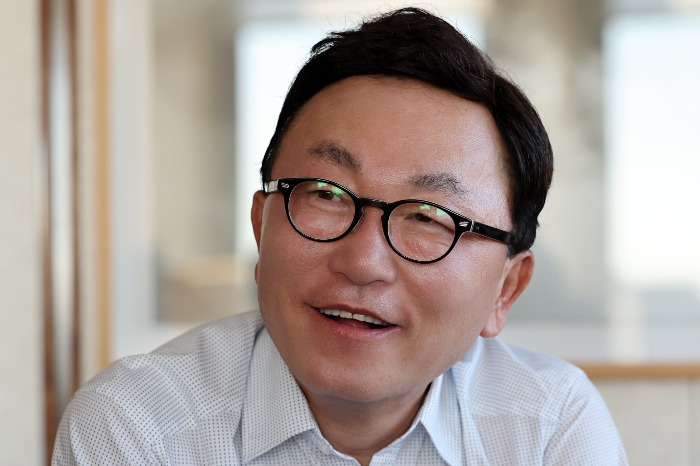

Mirae Asset Financial Group founder and Chairman Park Hyeon-joo has warned that Tesla Inc. and quantum computing stocks are trading at inflated valuations, urging investors to exert caution and diversify portfolios as speculative bets increase.

His remarks suggested a notable shift from his earlier optimism about Tesla and CEO Elon Musk’s long-term vision. The South Korean mutual fund pioneer has logged a return of over 150% on around 740 billion won ($512 million) investment in Elon Musk’s SpaceX and X, formerly Twitter, since 2022.

“Korean investors were overexposed to Tesla and some thematic stocks,” Park said in an interview with The Korea Economic Daily on Monday. “It is time to take a more balanced approach to portfolios.”

Tesla remains the most-bought foreign stock among South Korean retail investors. They have collectively invested $21.6 billion in the automaker as of Monday, exceeding their combined investments in Nvidia Corp. ($12.4 billion) and Apple Inc. ($4.6 billion).

Tesla’s stock surged to an all-time high of $479.86 on Dec. 17 following Donald Trump’s presidential election victory, but has since fallen 26%. The world’s No. 1 electric vehicle maker is trading at over 130 times earnings.

Despite ongoing controversy over its valuation, South Korean individual investors continued their buying spree on Tesla. Their net purchase of the stock reached 1 trillion won in December last year and 1.3 trillion won in January.

“Tesla is an innovative company with strong long-term potential,” Park said. “However, it will take considerable time for its earnings to justify its current valuation.”

“For Tesla to sustain a price-to-earnings ratio (P/E) exceeding 100, it must either dominate the global electric vehicle market, deliver consistent profit growth, or establish itself as the sole leader in robotics technology,” the chairman added.

Tesla is facing intensifying competition from Chinese rivals such as BYD Co. and Geely, which are rapidly expanding in Tesla’s key areas — EVs, autonomous driving and humanoid robotics, leveraging price competitiveness, said Park.

Wall Street analysts have also become more cautious on the stock. JPMorgan recently slashed its target price for Tesla to $135, while Wells Fargo suggested $125 for the stock — roughly a third of its current price.

EXCESSIVE HYPE SURROUNDING QUANTUM COMPUTING

Beyond Tesla, Park cautioned against the speculative frenzy surrounding quantum computing stocks, likening it to the overheated battery stock boom in 2023.

Google Inc.’s release of its Willow quantum computer in December ignited quantum computing hype, driving shares of IonQ, Rigetti Computing and Arqit Quantum and D-Wave Quantum Systems sharply higher.

Willow performed a calculation in five minutes that would take the fastest supercomputer 10 septillion years (10²⁴).

“These companies have yet to deliver meaningful earnings,” Park noted. “If financial results fail to meet expectations, these stocks could collapse immediately.”

IonQ is a Nasdaq-listed quantum computing firm with a market capitalization of $8.1 billion. South Korean investors own 30% of its outstanding shares worth $2.5 billion. Another quantum computing stock Rigetti Computing has 11% of its shares held by Korean investors.

“Future technologies like AI and quantum computing are increasingly becoming a battle of capital expenditures, making it difficult for smaller companies to compete,” he warned.

By Man-Su Choi, Ahla Cho and Ji-Yoon Yang

bebop@hankyung.com

Yeonhee Kim edited this article.