Meritz Financial Group Inc., South Korea’s second-most valuable financial holding firm, has dropped its bid to acquire financial distressed MG Non-Life Insurance Co. after failing to reach an agreement with unionized MG workers on job security.

With the MG Non-Life’s sale having fallen through several times already, the insurer is now more likely to be doomed for liquidation, analysts said.

Meritz Financial Group said in a regulatory filing on Thursday that it is abandoning its bid for MG Non-Life by relinquishing its status as the preferred negotiating partner.

Last December, state-run Korea Deposit Insurance Corp. (KDIC) picked Meritz Fire & Marine Insurance Co., a flagship unit of the financial holding firm, as the preferred bidder for MG Non-Life.

“Although we were selected by the KDIC as the preferred negotiating partner to acquire MG’s assets through a purchase and assumption (P&A) transaction, differences with the MG labor union have led us to relinquish our status,” Meritz Financial said n the public disclosure.

Meritz said it had formally notified the KDIC of its decision following a board decision earlier in the day.

MG’S LABOR UNION REJECTS REFORM PROPOSAL

Meritz has been unable to conduct due diligence on MG Non-Life since December amid strong opposition from MG’s labor union, which demanded employment guarantees as a precondition for negotiations.

Meritz Fire & Marine wanted to acquire MG Non-Life via a P&A transaction, which did not legally require the guarantee of existing employment contracts, meaning significant restructuring post-acquisition.

In a bid to address labor concerns, Meritz offered to retain 10% of the existing workforce and proposed a severance compensation package worth 25 billion won ($17.2 million) in total, which MG’s unionized workers rejected.

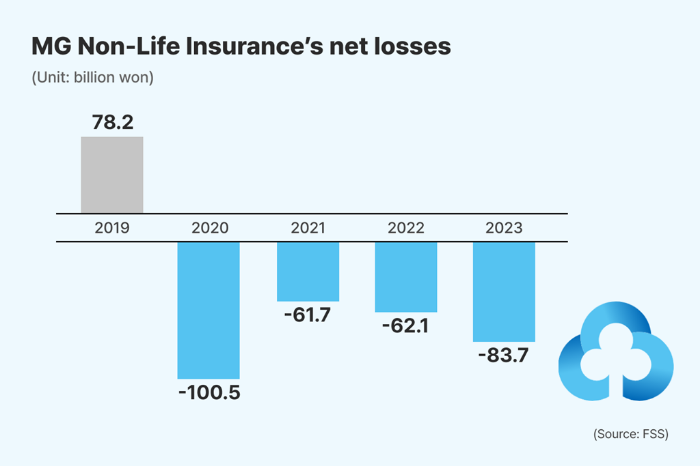

MG Non-Life Insurance has been put up for sale after Korea’s financial regulator, the Financial Services Commission (FSC), designated it as a distressed financial institution in April 2022.

The insurer’s capital adequacy ratio under the Korean Insurance Capital Standard (K-ICS), a barometer of a financial firm’s financial stability, stood at 43.4% at the end of September, far below the legally required threshold of 100%.

Potential buyers that showed interest in MG but eventually dropped their bids over the past couple of years include Korea’s Dayli Partners and New York-based J.C. Flowers & Co.

LIQUIDATION LOOMS LARGE

Following Meritz’s withdrawal, financial regulators and the KDIC issued statements acknowledging the situation.

“It has been over three years since MG Non-Life was classified as a distressed financial institution. Prolonged delays in the sale process have further weakened the insurer’s financial health,” said the Financial Supervisory Service in its statement.

The government is now seriously considering other methods to handle the MG Non-Life issue, with officials emphasizing that future actions will be taken in accordance with legal principles and regulatory frameworks.

The KDIC earlier said a failure to conclude the sale could lead to more drastic measures, including liquidation or court receivership.

If MG Non-Life is liquidated, it would mark the first liquidation case for an insurance firm in the country.

Should liquidation proceed, it would affect 1.24 million policyholders.

Under Korea’s deposit protection laws, policyholders are guaranteed reimbursement of up to 50 million won in surrender values.

Liquidation would also result in the loss of employment for some 600 MG Non-Life employees.

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.