WASHINGTON, D.C. – LS Cable & System Ltd., South Korea’s leading wire and cable manufacturer, has broken ground on its first subsea cable manufacturing facility in the US, aiming to strengthen its foothold in the critical energy infrastructure market and preempt supply chain challenges amid a shifting US trade environment.

The new plant, operated by the Korean firm’s US subsidiary, LS GreenLink, is located in Chesapeake, Virginia, close to the US East Coast’s burgeoning offshore wind development sites.

LS said on Tuesday it plans to invest $681 million in the facility, which is scheduled for completion by the third quarter of 2027 and to begin mass production in early 2028. LS Cable expects the project to create over 330 jobs in the region.

The move marks the first major US manufacturing project initiated by a Korean company under Donald Trump’s second presidency, as companies reassess their US strategies in response to renewed trade pressure and evolving industrial policies.

“The construction of the plant is a turning point for LS Cable to leap forward as a global energy infrastructure company,” Koo Bon-kyu, chief executive of LS Cable & System, said during the groundbreaking ceremony. “We will respond to the rapidly increasing demand for submarine cables based on our world-class manufacturing infrastructure.”

LS Cable emphasized the strategic significance of boosting local production capabilities in a market with limited subsea cable infrastructure.

The company is known globally for its long-distance and high-pressure cables, giving it a key competitive edge in the growing underwater high-voltage cable market.

INITIAL PRODUCTION TO FOCUS ON EXPORTS TO EUROPE

Subsea cables are critical for transporting electricity from offshore wind farms to mainland grids – a sector that had been projected to grow rapidly under the Biden administration’s clean energy push. Chesapeake’s proximity to the East Coast’s major offshore projects made it an ideal location.

Demand for such cables is rising at a fast rate as offshore wind farms are gaining momentum in the production of renewable energy to combat environmental pollution.

With the Trump administration reversing many of its predecessor’s energy policies, however, LS Cable indicated that initial production at the facility would focus on exports to Europe rather than the US domestic supply.

According to an LS GreenLink official, the company has already secured orders covering the first 18 months of production.

In 2023, LS Cable signed a 2.5 trillion won ($1.74 billion) long-term cable supply deal with TennetT, Europe’s largest power network operator, for power transmission to Germany and the Netherlands from the North Sea.

At the upcoming Chesapeake plant, LG plans to produce high-voltage direct current (HVDC) electric power transmission cables.

An HVDC electric power transmission system, also called a power superhighway or an electrical superhighway, uses direct current (DC) for power transmission, unlike the more common alternating current (AC) transmission systems.

Speaking at the groundbreaking ceremony, Virginia Governor Glenn Youngkin praised the investment as a “symbol of Virginia’s innovation and manufacturing competitiveness,” while Senator Tim Kaine and Chesapeake Mayor Rick West also welcomed the project.

ROAD WILL BE RENAMED ‘1 LS WAY’

Mayor West even announced that the road leading to the facility would be renamed “1 LS Way” in honor of the company.

The Chesapeake facility is set to become the largest subsea cable manufacturing plant in the US and position LS Cable to respond swiftly to global demand surges as the energy transition gathers pace.

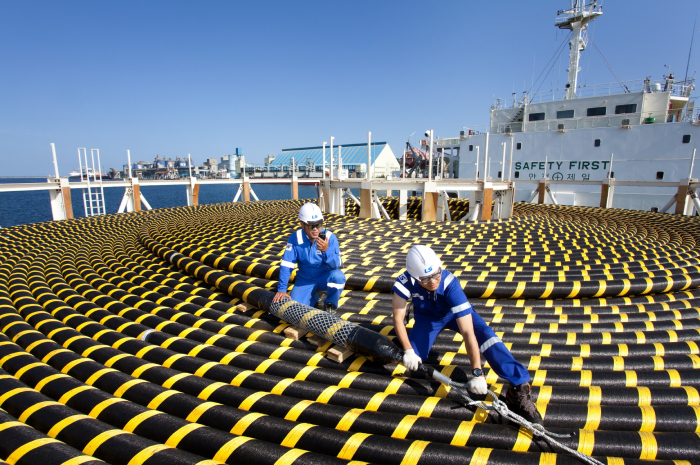

Built on a 396,700-square-meter site near the Elizabeth River, the plant will feature 70,000 square meters of floor space and will include a dedicated port facility.

A key highlight is the construction of a 201-metre cable production tower, which will become the tallest cable manufacturing structure in the US upon completion.

LS Cable will receive about $147 million in combined state and federal incentives, including a $48 million package from Virginia and a $99 million investment tax credit under the Inflation Reduction Act (IRA).

However, there is growing uncertainty around the future of the IRA as the Trump administration considers repealing key provisions that support clean energy initiatives.

An LS GreenLink executive said that the IRA tax credit was a critical factor in the company’s decision to invest in the US, adding that LS has actively sought bipartisan support in Washington to safeguard the program.

Potential new tariffs on copper – a key raw material for cable production –also pose risks.

“Tariffs could be an issue,” said LS Cable CEO Koo at a press briefing. “But given the limited manufacturing capacity for such cables in the US, we believe market demand will remain strong even with price adjustments.”

By Sang-eun Lucia Lee

selee@hankyung.com

In-Soo Nam edited this article.