In a pivotal shift for the North American electric vehicle battery landscape, South Korea’s two leading battery makers – LG Energy Solution Ltd. and Samsung SDI Co. – plan to install lithium iron phosphate (LFP) battery production lines at their respective US plants co-owned with General Motors Co.

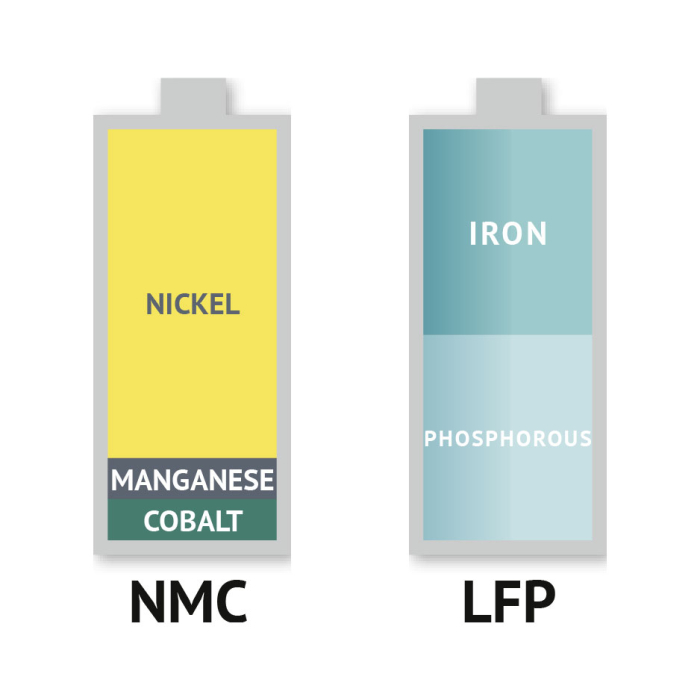

The plans mark the first foray into LFP production for Korean battery makers, traditionally focused on high-nickel-cobalt-manganese (NCM) chemistries, people familiar with the matter said on Tuesday.

The move reflects mounting pressure from GM to lower EV costs amid a slower-than-expected market transition, sources said.

By swapping out NCM batteries for more affordable LFP cells in several of its mid-range models, GM aims to make EVs accessible to a broader customer base – a strategy analysts said could redefine the market’s structure into a two-tiered system: LFP for mass-market vehicles and NCM for premium offerings.

DETAILED PLANS FOR SAMSUNG, LG

Samsung SDI will retrofit part of its $3.5 billion Indiana joint venture with GM, originally planned to produce nickel-rich NCM batteries, to accommodate LFP production lines. The JV is on course for commercial operation in 2027.

Samsung is now coordinating raw material procurement and equipment redesign to support the shift in chemistry, according to sources.

LG Energy Solution will similarly convert segments of its Ultium Cells LLC plants in Tennessee and Ohio, completed in 2024 and 2022, respectively, to enable LFP cell manufacturing.

Currently, these facilities only produce pouch-type NCM batteries, but LG and GM are considering switching to prismatic cells, which are structurally better suited for LFP chemistry, sources said.

In a longer-term bet, LG and GM are also developing lithium-manganese-rich (LMR) batteries – an emerging format that retains LFP’s cost advantages while promising superior performance.

If R&D proves successful, the partners plan to integrate LMR production lines at existing US sites by 2028, sources said.

GM’S STRATEGIC PIVOT

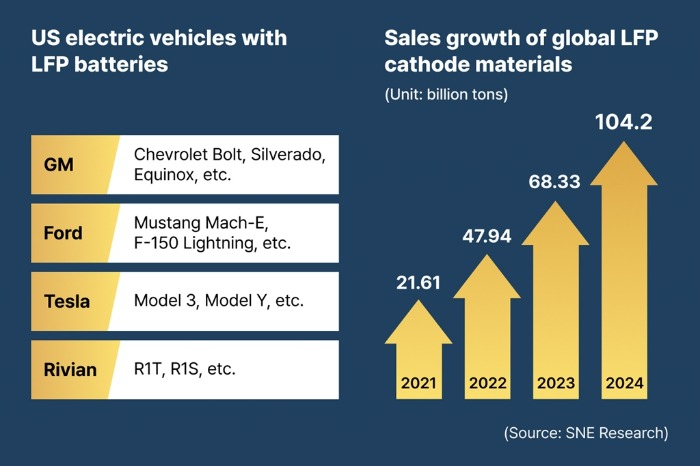

GM’s strategic pivot is driven by its intention to equip five out of its seven EV models, including the Chevrolet Bolt, Equinox, Blazer and Silverado EV, with LFP batteries.

Only luxury models such as the GMC Hummer EV and Cadillac Lyriq will continue to use high-performance NCM batteries, according to sources.

The company is also known to be planning to launch sub-$30,000 EV models using LFP cells, aiming to overcome what industry insiders describe as an “EV adoption chasm.”

According to industry estimates, switching from NCM to LFP could cut battery costs by 20–30%, lowering per-vehicle costs by at least $6,000.

“GM’s decision is likely a harbinger of what’s to come across the industry. With cost pressure mounting, more automakers will turn to LFP for their volume models,” said an auto industry executive.

GM’s rivals, such as Ford Motor and Stellantis, are also preparing LFP-compatible vehicles.

Analysts expect LFP’s share in the US EV battery market to rise sharply, ending Korean manufacturers’ long-held reliance on NCM chemistry.

The global LFP market, long dominated by China’s Contemporary Amperex Technology Co. Ltd. (CATL) and BYD, has drawn renewed interest from Korean suppliers, which until recently had strongly bet on NCM batteries.

PLAYING CATCH-UP

Now playing catch-up, battery and battery materials makers are ramping up development of next-generation LFP cathode materials for EVs and energy storage systems (ESS).

On Tuesday, POSCO Future M Co., a battery material specialist, said that it has secured key technology for mass-producing LMR battery cathodes, with plans to begin full-scale production by the end of this year.

Industry officials said LMR batteries, seen as a technological bridge between LFP and NCM, could offer enhanced driving range while avoiding the high costs of nickel and cobalt.

POSCO’s two domestic rivals – L&F Co. and EcoPro BM Co. – are advancing production of what industry sources call “Gen 4.5” high-density LFP materials, with pilot lines expected to begin operation this quarter.

“The global EV market is no longer just about energy density. Cost, supply chain resilience and policy are just as important. With LFP’s resurgence, Korea must adapt or risk losing ground,” said a Korean battery executive.

By Sang-Hoon Sung and Woo-Sub Kim

uphoon@hankyung.com

In-Soo Nam edited this article.