South Korea’s leading chemicals maker, LG Chem Ltd., has set out to raise as much as 3 trillion won ($2.2 billion) through a stock-linked financing deal backed by its holding of shares in battery subsidiary LG Energy Solution Ltd.

According to investment banking sources on Monday, LG Chem has begun talks with a syndicate of securities houses to execute the deal as early as the end of this month, when a three-month lock-up on share sales related to an exchangeable bond issue conducted in June expires.

The agreement is expected to monetize, for the first time, between 2.2% and 3.7% of LG Energy Solution, based on the stock’s closing price of 343,000 won on Sept. 5.

LG Chem is the largest shareholder of LG Energy, holding 191.5 million shares, or an 82% stake, in the world’s second-largest electric vehicle battery maker.

LG Chem has been weighing liquidity options for months to finance its ongoing corporate restructuring.

Sources said the chemicals maker plans to raise funds via a price return swap (PRS) transaction, in which securities firms advance cash against the future value of the pledged shares.

KOREA’S LARGEST SUCH DEAL

Through the scheme, LG Chem aims to raise between 2 trillion won and 3 trillion won in what would be the country’s largest ever PRS deal.

The size of the PRS deal dwarfs other such financings, which have surged in Korea’s corporate sector over the past year.

Korea’s large companies have raised close to 10 trillion won through PRS deals since last year. The proposed LG Chem transaction could account for nearly a third of that.

Bankers expect the annual interest rate to be paid by LG Chem on the PRS facility to be between 4% and 4.5%, which is higher than LG Chem’s three-year bond yield of 3%.

To spread the exposure, the syndicate is expected to involve multiple securities firms, each committing about 500 billion won, according to sources.

FALLING EARNINGS AMID CHEMICALS INDUSTRY DOWNTURN

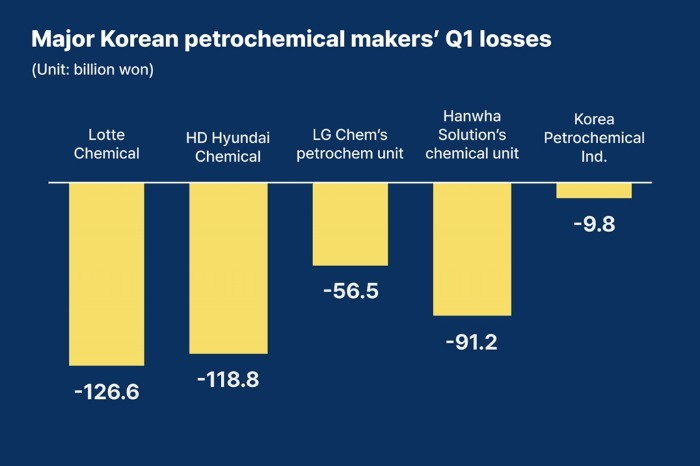

The fundraising comes as LG Chem is grappling with falling earnings amid a chemicals industry downturn.

The company reported 916.8 billion won in operating profit on sales of 4.89 trillion won on a consolidated basis last year, down 64% and 11.5%, respectively, from the previous year.

Profitability in its once-reliable petrochemicals division has deteriorated since 2023, while LG Energy Solution’s operating profit also slid to 600 billion won in 2024 from 2.2 trillion won in 2023 as EV demand slowed in North America and Europe.

LG Chem’s Chief Financial Officer Cha Dong-seok said during an earnings conference call with analysts last month that the company views its LG Energy Solution stakeholding as a “strategic resource” that could be unloaded to support new growth.

ECOPRO TO RAISE $505 MILLION IN PRS SCHEME

Analysts said the latest move underscores the urgency of restructuring and securing funds for new business models.

“Major conglomerates facing restructuring needs are turning to large-scale liquidity injections through various means, including PRS, and LG Chem is no exception,” said an investment banker in Seoul.

EcoPro Co., a secondary battery materials maker, also plans to raise 700 billion won through a PRS contract, using its shareholding of affiliate EcoPro BM Co.

Despite accounting debates over whether PRS should be recognized as debt on the buyer’s balance sheets, regulators have refrained from tightening rules amid concerns about funding constraints in Korea’s capital markets.

That has encouraged large conglomerates to embrace the financial vehicle as an alternative to equity sales or conventional bond issuance.

By Jeong-Cheol Bae

bjc@hankyung.com

In-Soo Nam edited this article.