South Korea’s stock market extended its record-breaking run on Friday, surging past the 3,600-point mark for the first time in its history.

Semiconductor stocks, including SK Hynix Inc. and Samsung Electronics Co., led the charge. The two world’s largest chipmakers scored their highest-ever closing prices after digesting upbeat news released during the weeklong Chuseok holiday that ended on Thursday.

On the first trading day following the Korean Thanksgiving holiday, the benchmark Kospi index soared to a new record high, closing up 1.73% at 3,610.60.

It took just one day to surpass its previous peak of 3,500, set on Oct. 2, the last trading day before the longest holiday this year.

The junior Kosdaq market ended up 0.61% at 859.49.

PREMATURE TO TAKE PROFITS

Analysts say domestic equities will maintain their upward momentum through the end of the year and it is premature to take profits from the market rally that began in June.

On Friday, foreign investors scooped up a net 1.06 trillion won ($745 million) worth of stocks on the Kospi market and 238.6 billion won on the Kospi.

They were undeterred by the Korean won’s slide to 1,421 per dollar in domestic trade, its weakest finish since April 29, 2025.

SOFTENING KOREAN WON

The won is not alone in its decline. Other major currencies such as the euro and the Japanese yen face similar headwinds amid political uncertainties.

While tariff negotiations with the US remain at an impasse, domestic investors have been flooding into US stock markets.

The trend is expected to exert further downward pressure on the won. Foreign exchange dealers forecast the won could soften past the 1,440 level to the dollar in the short term.

SEMICONDUCTOR STOCKS

Shares in SK Hynix surged 8.22%, closing at 428,000 won. Samsung Electronics gained 6.07% to finish at 94,400 won.

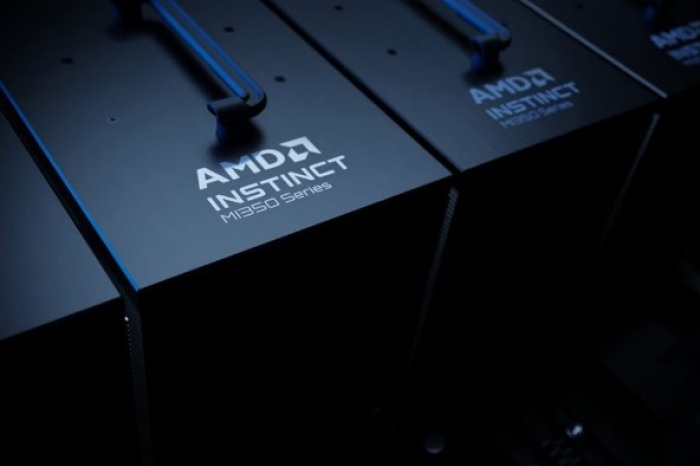

They reacted positively to the announcement that OpenAI, the creator of the generative AI ChatGPT, will deploy 6 gigawatts of Advanced Micro Devices’ (AMD) Instinct graphics processors over multiple years and across multiple generations of hardware.

The deal is expected to fuel a prolonged boom in memory chip demand, with Samsung among AMD’s suppliers.

Investors also cheered the news that the Donald Trump administration has approved the United Arab Emirates to import some Nvidia Corp.’s most advanced AI chips.

SK Hynix is a key supplier of high-bandwidth memory (HBM), often referred to as AI chips, to Nvidia.

Analysts say the semiconductor industry has entered a supercycle and chipmakers’ valuations have yet to fully reflect the windfall they are expected to reap.

“The semiconductor industry will see a strong rebound for at least the next six months,” said Kim Tae-hong, head of Growth Hill Asset Management. “It’s worth considering buying whenever they undergo short-term corrections.”

LG ENERGY SOLUTION

Bucking the rally, the share price of LG Energy Solution Ltd. plunged 9.90% to close at 359,500 won, wiping out its market capitalization by 9.24 trillion won to 84.12 trillion won in a single day.

Investors dumped the stock following the announcement that LG Chem Ltd., LG Energy Solution’s largest shareholder, has entered into a three-year price return swap deal, backed by a portion of its shares in LG Energy Solution, with domestic brokerage companies.

Under the derivatives transaction, LG Chem has raised 2 trillion won ($1.4 billion) in fresh capital.

Analysts speculate the LG Energy shares offered as collateral will likely be released into the open market upon the expiration of the deal and raise an overhang risk.

The move is seen as a preparation for a new global tax regulation, set to take effect in 2026, which requires companies that hold more than an 80% stake in another enterprise to pay a portion of the taxes imposed on that enterprise if the latter’s effective tax rate falls below 15%.

However, some analysts played down the impact as a one-off event, citing LG Energy’s solid business fundamentals and expectations for a turnaround in the battery industry.

By Ahla Cho and Jeong-Cheol Bae

rrang123@hankyung.com

Yeonhee Kim edited this article.