South Korea’s four largest financial holding groups posted stellar profits in the second quarter, bolstered by a sharp increase in non-interest income driven by a stronger won against the greenback, even as interest income growth came to a virtual halt.

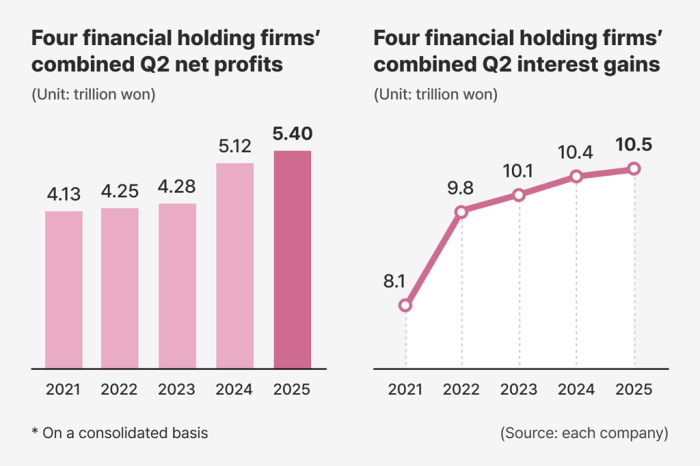

Combined net profits at the top four – KB Financial Group, Shinhan Financial Group, Hana Financial Group and Woori Financial Group – reached 5.4 trillion won ($3.85 billion) in the three months to June, up 5.3% from a year earlier.

According to their regulatory filings on Friday, the earnings mark their highest level on record for a single quarter, underscoring their resilience amid tighter monetary policy and an evolving regulatory environment.

The result beat market expectations, which earlier anticipated flat or lower earnings amid pressure on interest margins from a persistent downtrend in local interest rates.

HANA: STANDOUT PERFORMER

The standout performer was Hana Financial, which saw net income rise 13.4% to 1.17 trillion won from a year earlier.

Despite a 2.4% quarter-on-quarter drop in interest income to 2.2 trillion won, Hana capitalized on favorable currency moves and increased fee-based income.

Trading gains surged 28.1% to 826.5 billion won, driven by profits from securities and foreign-exchange derivatives as the won strengthened. Fee income from pension, bancassurance and structured finance deals rose 7.1% to 559 billion won.

Shinhan Financial posted 1.55 trillion won in net profit, up 8.7% from a year ago, despite virtually flat interest income.

Gains came largely from currency-related profits and a diversified fee income stream, including credit card fees, mutual fund commissions and investment banking services.

KB Financial, the largest banking group of the four, reported 1.7 trillion won in net profit, while Woori Financial posted 934.6 billion won. Both avoided year-on-year declines, thanks in large part to the outperformance of non-interest business segments.

Total non-interest income across the four groups jumped 15.5% to 3.96 trillion won, significantly outpacing the 0.4% rise in interest gains, which stood at 10.45 trillion won.

TOUGH SECOND HALF AS GOVT MOVES TO REIN IN HOUSEHOLD DEBT

Despite the record performance, banks are bracing for a tougher second half.

Net interest margins (NIM) – a key gauge of lending profitability – continued to compress, falling to an average of 1.82% in the second quarter from 1.86% a year earlier. That’s down from a recent peak of 1.96% at the end of 2022.

Adding to the pressure is the government’s ramped-up effort to rein in household debt.

Under its June 27 property market stabilization package, the cap on home mortgage loans in the Seoul metropolitan area has been lowered to 600 million won.

Authorities have also slashed the annual household loan growth cap for banks by half for the second half of the year.

Regulatory tightening is extending to unsecured credit as well.

New guidelines will limit credit card loans to within a borrower’s annual income – a move expected to weigh on earnings at the groups’ card units.

HIGHER LOSS PROVISIONS

Lenders are also preparing for a possible deterioration in asset quality amid weakening consumption and external uncertainties such as US trade policy.

The four financial holding firms’ loan-loss provisions rose 15.7% year-on-year to 2.13 trillion won in the second quarter.

“With domestic demand still weak and US tariff risks in play, uncertainties remain high,” said Bang Dong-kwon, chief risk officer of Shinhan Financial. “We’ll stay focused on maintaining soundness.”

Despite the risks, shareholder return remains a top priority.

KB, Shinhan and Hana each unveiled fresh plans for share buybacks and cancellations – 850 billion won, 800 billion won and 200 billion won, respectively.

Woori reaffirmed its cash dividend of 200 won per share – the same as the previous quarter’s. Woori also announced that it would begin offering tax-exempt dividends from year-end.

The stock market responded favorably.

Shares in Shinhan Financial rose 2.6% on Friday, while Hana, KB and Woori gained 1.5%, 1% and 0.2% respectively, reflecting investor confidence in both earnings resilience and capital return strategy.

By Eui-Jin Jeong and Jin-Seong Kim

justjin@hankyung.com

In-Soo Nam edited this article.