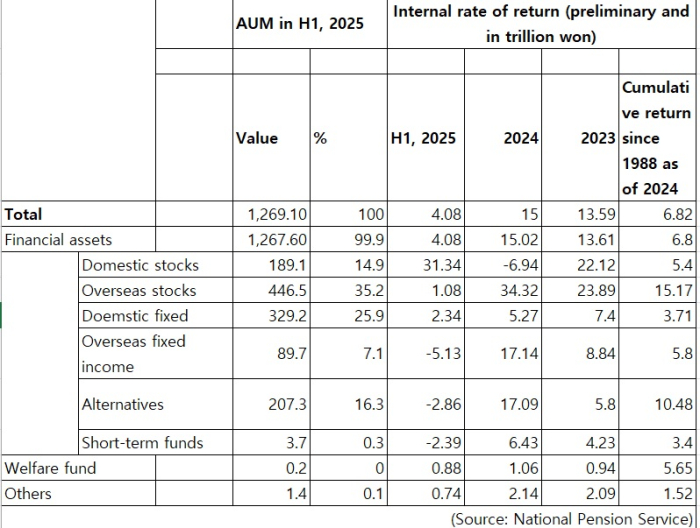

The National Pension Service (NPS), the world’s third-largest pension scheme, posted a 4.08% return on investments in the first half of this year, with robust gains in domestic equities offsetting negative returns from overseas bonds and alternative assets.

Domestic stocks at South Korea’s state-run fund delivered a 31.34% return, outperforming the Kospi index’s 28.01% gain over the same period.

The South Korean stock market has extended an upward streak since President Lee Jae Myung took office in early June. Lee has vowed policy efforts to drive the Kospi to 5,000 points, a milestone unseen in South Korea’s stock market.

Overseas assets underperformed, weighed down by a weaker dollar amid concerns over the fallout of Washington’s tariff policies. The softer dollar eroded returns when translated into the Korean won.

Returns from alternatives consisted primarily of interest income, dividends and foreign exchange gains or losses, without reflecting changes in fair-value assessments.

Assets under management (AUM) at the NPS rose by 56 trillion won to 1,269 trillion won ($915 billion) as of the end of June, compared to the end of 2024.

By Gyeong-Jin Min

min@hankyung.com

Yeonhee Kim edited this article.