South Korea’s two largest cosmetics makers, Amorepacific Corp. and LG H&H Co., are recovering from years of lackluster overseas business performances, particularly in China, where patriotic consumption is elbowing out foreign companies.

Reeling from a sharp sales drop in China, Korea’s top beauty products maker Amorepacific Group has rebalanced its China-heavy global business to focus on the US, Japan and Europe.

LG H&H, formerly LG Household & Health Care, meanwhile, doubled down on improving its business structure within China.

Although they pursued different strategies, both companies achieved a strong rebound in business performance last year.

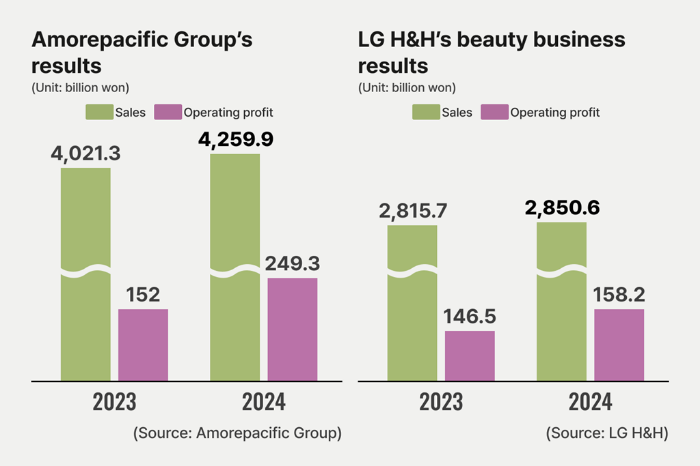

On Thursday, Amorepacific Group said in a regulatory filing that it posted 249.3 billion won in operating profit on sales of 4.26 trillion won in 2024, up 64% and 5.9%, respectively, from the previous year.

The beauty conglomerate’s flagship unit, Amorepacific Corp., saw its overseas sales rise 20.6% on-year to 1.68 trillion won, although its Korean business sales fell 2.4% from a year earlier.

The company’s overseas business, which remained in negative territory for long, made a turnaround in 2024.

MORE SALES IN THE US THAN IN CHINA

AmorePacific said its strong overseas results were led by the growing “K-beauty boom” in North America, where its major brands such as Cosrx and Laneige performed well.

The two brands are known for their cost-effectiveness, with serums priced at around 20,000 won ($13.8) and lip balms at 10,000 won each.

During Amazon’s biggest annual sales event, Black Friday & Cyber Monday, Laneige’s lip balm products ranked first in that category, beating well-known US and French brands.

Amorepacific said its US sales outpaced its sales in China for the first time last year.

LG REVIVES IN CHINA WITH HIGH-END BRAND THE WHOO

While AmorePacific gained traction in the mid-to-low price segment in the US, LG H&H focused on the premium market in China with its luxury brand, The History of Whoo.

LG shut offline outlets for brands like SU:M and O HUI and prioritized an overhaul of The Whoo brand.

The company changed the product design and ingredients of cosmetics under the brand, targeting young Chinese consumers through online short-form platforms such as Douyin and Kuaishou.

The strategy paid off.

With growing demand for high-quality cosmetics products among Chinese youth, The History of Whoo products ranked top in luxury beauty sales on Douyin during China’s largest shopping festival, Singles’ Day, or Guanggunjie.

A group of officials from Tmall, an e-commerce platform operated by China’s Alibaba Group and Chinese department stores as well as online influencers flew to Seoul last April to attend a seminar hosted by LG H&H in a renewed interest in K-beauty products.

LG’s 2024 BUSINESS PERFORMANCE

The resurgence of The History of Whoo translated into LG’s strong financial recovery.

Last year, LG H&H’s beauty division posted 158.2 billion won in operating profit on sales of 2.85 trillion won, up 8% and 1.2%, respectively, from the previous year.

The company’s overall operating profit fell 5.7% in 2024 from a year earlier.

In the fourth quarter, its sales rose 5.4% while operating profit gained 50.3% from the year-earlier period.

GUOCHAO

The burgeoning Chinese fashion fad, known as guochao, has pushed out or significantly reduced the popularity and influence of Korean and Western brands.

Guochao, a combination of the Chinese word “guo,” meaning nation and “chao,” meaning fashion, has become an industry buzzword in recent years, as Chinese millennials born between 1980-95 and Generation Z born between 1995-2010 became the main followers of the trend.

With their Chinese sales struggling, Korean companies have been reducing the number of their outlets in the country and instead are increasing marketing efforts in other countries, particularly in the US.

Amorepacific and LG said they will push even more aggressively into other global markets this year, diversifying from China.

By Sun A Lee

suna@hankyung.com

In-Soo Nam edited this article.