Kia Corp., South Korea’s second-largest carmaker, will start producing its entry-level electrified model EV2 from its plant in Slovakia next year to regain ground in Europe against Chinese peers, which face up to 45% countervailing import duties in the region.

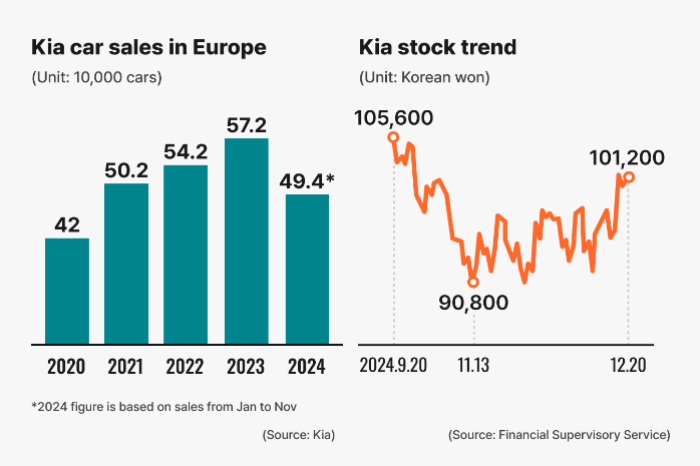

According to sources in the auto industry on Sunday, Kia plans to churn out 80,000 units of the EV2 from a plant in Slovakia in 2025 to sell them in Europe only and then expand its output to 100,0000 units in 2026, which would account for 17.5% of Kia’s entire car sales of about 570,000 units in the region in 2023.

The EV2 is Kia’s new entry-level electric sport utility vehicle model, smaller than the Korean carmaker’s currently most compact volume electrified model EV3, which recently hit the EV market in Europe.

It will be released in two models – one powered by nickel-cobalt-manganese (NCM) batteries and the other equipped with more affordable lithium iron phosphate (LFP) batteries.

The LFP battery-powered EV2 will be priced between 20,000 euros ($29,000) and 30,000 euros to compete better with Chinese EVs, which have rapidly increased their share in the EV market in Europe from 2.9% in 2020 to 18.2% in the first half of 2024 thanks to a flurry of affordable EV models.

Kia pins high hopes on the EV2 to regain ground against Chinese EVs in Europe after the European Commission in October decided to slap definitive countervailing duties of up to 45% on Chinese EVs based on the discovery of Beijing’s unfair subsidization for Chinese EV exports to the European Union member countries from its investigation.

Since cheap Chinese EVs flooded the bloc, most multinational finished carmakers have seen their market share in Europe shrink this year, including Kia selling about 490,000 units from January to November this year, down 8.1% from the same period last year.

“Kia is expected to be the leading compact EV brand in Europe, offering drivers the most bang for their buck with the EV2, which will hit the market early next year, coupled with the recently released EV3,” said an unnamed official from Kia.

The company plans to roll out additional strategic models in Europe to meet its sales target of 800,000 units in the region four years later, added the official.

EV2 FACES FIERCE COMPETITION IN THE ENTRY EV MARKET

The EV2 measures 4,000 millimeters (mm) long and has a wheelbase of 2,555 mm, while the EV3 measures 4,300 mm long with a wheelbase of 2,680 mm.

The LFP battery-powered EV2 will travel up to 300 kilometers on a single charge versus 440 km for the NCM-run EV2.

It is expected to compete with BYD’s Dolphin, Volkswagen’s ID.2, Peugeot’s e-2008 and the Mini Cooper Electric in Europe.

Global automakers have been rushing to introduce entry-level EVs to revive the eco-friendly automobile industry.

Tesla Inc., the world’s second-largest EV manufacturer, plans to launch the Model Q, an affordable EV priced below $30,000, next year, while Toyota Motor Corp. recently launched electric compact crossover SUV, the bZ3X, in China.

BETTER QUALITY AND BRAND AWARENESS

Despite growing fears of higher US tariffs on car imports from Mexico, Kia has also decided to keep its mid-size K4 sedan output at its plant in Mexico unchanged and import all of them to the world’s second-largest car market.

US President-elect Donald J. Trump has warned of slapping about 25% duties on all imports from Mexico.

Considering that such tariffs would be imposed on all car imports from plants of other major automakers, such as General Motors, Ford, Stellantis and Nissan, in Mexico, the Korean carmaker does not need to cut production or change a production site for now, said an official from Kia.

Kia churns out 120,000 units of the K4 every year from the plant in Mexico, with an annual production capacity of 400,000 units, and exports them to the US.

The sibling of Korea’s biggest carmaker Hyundai Motor Co. is confident about its car sales in Europe and the US thanks to its enhanced brand awareness and quality.

Especially, the residual value of Kia cars has significantly improved in recent years. A car’s residual value is the estimated value, or price, after depreciation, which determines the car’s price in the used car market.

Kia’s Telluride was named the best three-row midsize SUV for the fourth consecutive year this year during JD Power’s 2025 US ALG Residual Value Awards.

Its used cars are priced better than Chinese and American or European peers in general, said a Kia official.

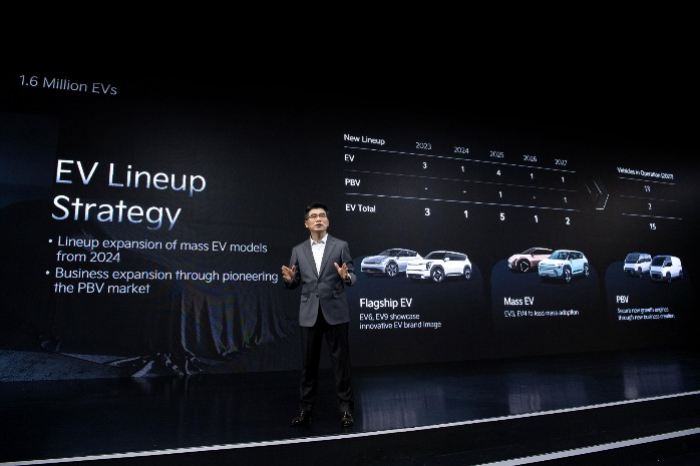

Earlier this month, Kia announced a plan to sell 4.3 million units of its cars around the globe annually by 2030.

It also plans to increase the global sales share of eco-friendly vehicles, including electric and hybrid cars, from the current 24% to 58% by 2030.

Last year, it announced plans to develop more low-cost models to boost its EV sales and release 15 EVs priced from $30,000 to $80,000 by 2027.

By Jae-Fu Kim and Jin-Won Kim

hu@hankyung.com

Sookyung Seo edited this article.