South Korea’s accommodative fiscal and monetary policies, including a sharp budget increase in 2026, is considered appropriate to boost private consumption in the near term, a senior official of the International Monetary Fund (IMF) said on Wednesday.

However, Asia’s No. 4 economy needs to accelerate reforms to the pension system and rigid labor market to brace for long-term spending pressures and strengthen fiscal sustainability, Rahul Anand, the IMF’s mission chief for South Korea, told reporters at a press briefing.

“To create fiscal space for long-term spending pressures from aging, structural fiscal reforms — reforming the pension system, mobilizing revenue, enhancing expenditure efficiency — remain essential,” Anand said.

“While the accommodative policies will support near-term growth, achieving the authorities’ 3% growth target would require advancing structural reforms to raise productivity, address demographic headwinds and improve capital allocation,” he added.

Reforms should focus on narrowing the productivity gap between small and medium-sized enterprises and larger firms, while harnessing the benefits of innovation and AI transformation, Anand noted.

The briefing followed IMF’s annual consultations with South Korean officials during Anand team’s Sept. 11-24 visit to Korea.

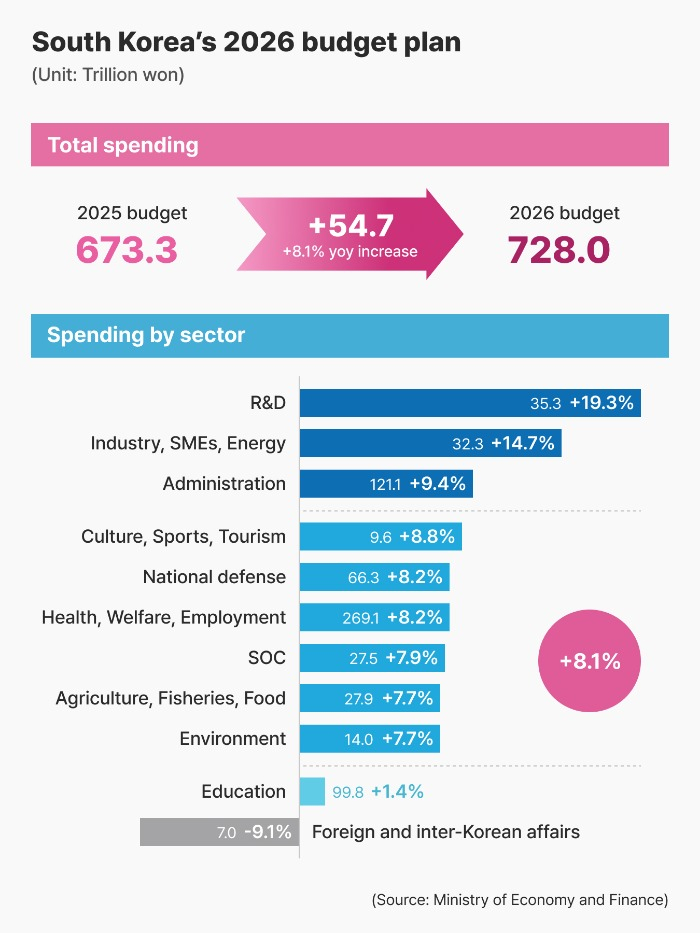

In August, South Korea’s finance ministry proposed a 8.1% rise to 728 trillion won ($521 billion) in 2026 budget from the year prior, which represented the steepest annual increase in national spending.

DEBT-TO-GDP RATIO

The proposed budget is expected to raise the country’s debt-to-GDP ratio to 51.6%, according to the Statistics Korea, marking the first time in history that its national debt would exceed 50%.

According to the government’s 2026 national fiscal management plan, South Korea’s national liabilities are projected to soar to 1,415 trillion won in 2026.

In 2029, its debt is forecast to rise to 1,788 trillion won. It is equivalent to 58% of the GDP, approaching the 60% threshold considered the upper limit for countries with non-reserve currencies.

“Adopting a credible medium-term fiscal anchor, supported by an enhanced medium-term fiscal framework, would help safeguard long-term fiscal sustainability,” Anand said.

Meanwhile, the IMF maintained its growth forecast for South Korea at 1.8% for 2026, compared to a projected 0.9% expansion in 2024, citing easing uncertainties and accommodative policies, as well as base effects.

By Yeonhee Kim

yhkim@hankyung.com

Yeonhee Kim edited this article.