Hyundai Motor Co. aims to more than double its hybrid vehicle lineup by the end of the decade, as the top South Korean automaker bets on a mix of eco-friendly and premium models to withstand tariffs, slowing electric-vehicle demand and intensifying global competition.

At its first overseas CEO Investor Day, held in New York on Thursday, Chief Executive José Muñoz also said the company will spend 77.3 trillion won ($55.8 billion) globally over the next five years, 7 trillion won more than the five-year plan announced last year.

“We are facing a period of uncertainty, but just as we have done in the past, Hyundai will overcome these challenges and lead the transition to future mobility,” said the chief executive.

At CEO Investor Day 2025, company executives unveiled a new mid- to long-term strategy that centers on hybrid expansion, high-performance cars and tailored electric models for regional markets.

The event, launched in 2019, marked its seventh edition but the first time staged abroad, underscoring the importance of the US to Hyundai’s global plans.

Muñoz, Hyundai’s first non-Korean CEO, said the company plans to increase its hybrid portfolio from eight to at least 18 models by 2030, adding options across the Avante, Grandeur and Palisade ranges as well as smaller entry-level cars.

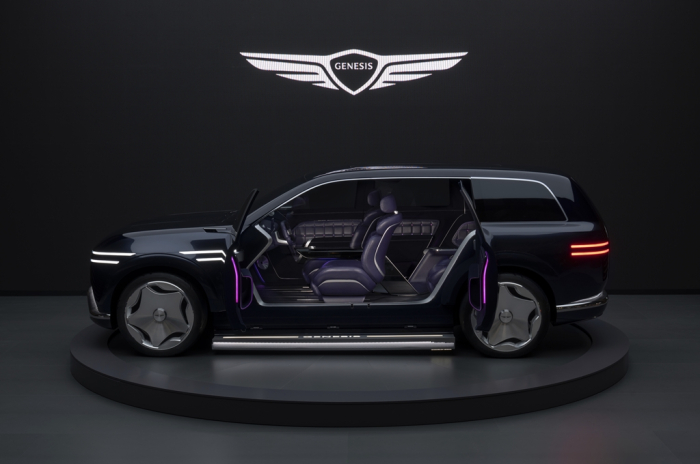

Genesis, Hyundai’s luxury brand, will launch its first hybrid next year, with the GV80 SUV and G80 sedan seen as frontrunners.

Hyundai also committed to rolling out electric vehicles customized for Europe, China and India.

An extended-range EV (EREV), capable of travelling more than 900 km on a single charge thanks to an engine-powered generator, will debut in 2027 with a 55% smaller battery than a standard EV, boosting affordability.

Executives said the automaker aims to triple annual sales of eco-friendly models, to 3.3 million units by 2030 from about 1 million this year.

That would lift Hyundai Motor’s share of eco-friendly vehicles to 60% of its total sales from 24% over the same period.

LOCALIZATION, PREMIUM PUSH

Hyundai said it will step up localization in its key markets.

In North America, it plans to expand supply chains alongside production, launching an electric commercial van in 2028 and a mid-size pickup before 2030.

An autonomous IONIDQ 5, fitted with Waymo LLC’s sixth-generation self-driving system, will begin road testing in the US later this year.

China and India are central to the group’s diversification drive.

Hyundai will release a compact electric sedan in China next year, following this year’s launch of the Elexio SUV.

In India, it will begin producing a small electric SUV from 2027 while expanding capacity at its Pune plant above 1 million units annually from the current 800,000 vehicles.

In Europe, the IONIQ 3, based on its Concept Three prototype, will debut in 2026.

PERFORMANCE VEHICLES

Alongside eco-friendly offerings, Hyundai is also leaning into performance.

The N brand, which celebrates its 10th anniversary this year, will expand its lineup from five to seven models, targeting 100,000 annual sales by 2030, more than four times last year’s volumes, according to Hyundai executives.

Genesis will add high-performance trims, including the GV60 Magma, set to launch later this year, while aiming to sell 350,000 hybrid and EV units annually by the end of the decade.

INVESTMENT PLAN

To support the strategy, Hyundai pledged to invest 77.3 trillion won globally over the next five years, an increase of 7 trillion won from last year’s five-year commitment.

The outlay will cover 38.3 trillion won in facility investment, 30.9 trillion won in R&D and 8.1 trillion won in strategic investment.

US spending will rise to 15.3 trillion won, up from 11.6 trillion won, including the expansion of its Georgia-based Hyundai Motor Group Metaplant America (HMGMA).

Lee Seung-jo, Hyundai’s chief financial officer, said the company plans to channel funds into “software-defined vehicles (SDVs) and other technology-driven competitiveness.”

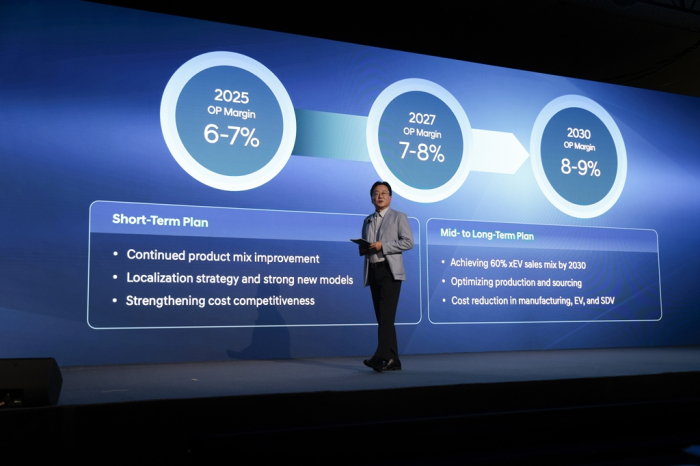

Hyundai is targeting a consolidated annual operating profit margin of up to 9% by 2030, compared with 8.1% last year.

Profitability gains are expected to come from hybrids, SUVs and Genesis, as well as lower costs from localized production, according to the company.

The automotive group expects its sales this year to rise 5-6% from last year, an upward revision from the 3-4% rise estimated earlier this year.

But it cut its operating profit margin guidance for this year to 6–7% from 7–8%, citing the impact of higher US import tariffs imposed in April.

By Bo-Hyung Kim, Jung-Eun Shin and Gil-Sung Yang

kph21c@hankyung.com

In-Soo Nam edited this article.