South Korea’s top automaker Hyundai Motor Co. on Thursday posted its largest-ever sales for a second consecutive year, driven by robust sales of pricey cars under the Genesis brand, sport utility vehicles and eco-friendly cars.

The flagship unit of Hyundai Motor Group said in a regulatory filing that its sales revenue in 2024 reached a record 175.23 trillion won ($122 billion), up 7.7% from 162.66 trillion won a year earlier.

Last year’s sales exceeded the market consensus of 173.3 trillion won.

Its 2024 operating profit was 14.24 trillion won, down 5.9% from 15.13 trillion won. The profit missed the market consensus of 14.84 trillion won.

Its net profit rose 7.8% to 13.23 trillion won.

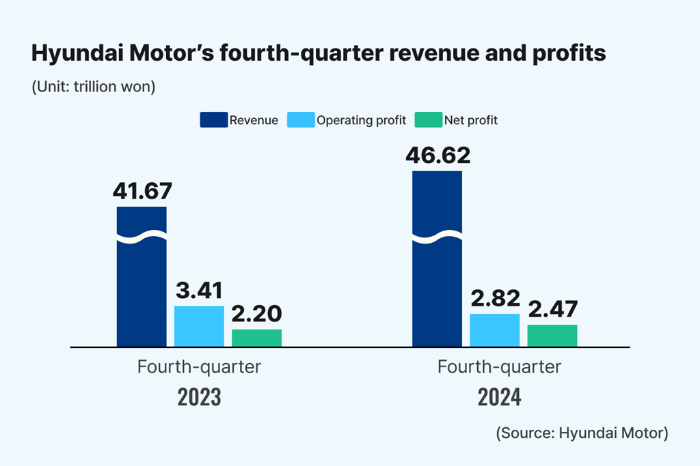

For the fourth quarter of last year, Hyundai’s net profit rose 12.3% to 2.5 trillion won from 2.2 trillion won in the year-earlier period.

Quarterly operating profit, however, dropped by 17.2% on-year to 2.82 trillion won. Sales gained 11.9% to 46.62 trillion won. Fourth-quarter operating profit margin stood at 6.1%, lower than 8.2% a year earlier.

The company attributed its yearly and quarterly sales growth to its luxury Genesis models, pricey SUVs and hybrids, whose brisk sales boosted average selling prices.

Its operating profit margin declined, however, due to higher incentive payments to dealers and increased sales warranty provisions in the wake of the rise in the year-end dollar-won exchange rate.

Hyundai posted a full-year operating profit margin of 8.1% in 2024, down from the previous year’s 9.3%.

SALES OF ECO-FRIENDLY VEHICLES RISE

Hyundai sold 4.14 million vehicles globally in 2024, down 1.8% from 4.22 million units in 2023, weighed down by a global economic slowdown.

Sales of eco-friendly vehicles, however, rose 8.9% year-on-year to 757,191 units, which included 218,500 EVs and 496,780 hybrid models.

Hyundai has shifted its focus toward hybrids amid the slowing EV uptake worldwide.

In the fourth quarter, its global sales increased by 21% on-year to 209,641 units, including 145,732 hybrids and 53,035 EVs, as the automaker strengthened its hybrid lineup and increased SUV hybrids, particularly in the North American market.

“Although the market’s volatility has increased due to the rapidly changing external environment, we continued to grow globally on higher sales in North America, led by hybrids,” said a Hyundai Motor official.

Hyundai and its sister firm Kia Corp. plan to increase their US production to respond to President Donald Trump’s protectionist policies in his second term.

Hyundai Motor America’s operations include its North American headquarters in California, the Hyundai Motor Manufacturing Alabama assembly plant, the all-new Hyundai Motor Group Metaplant America (HMGMA) and several cutting-edge R&D facilities.

HMGMA, which started operations late last year, is slated to begin full-scale production in the second quarter. The plant has an annual capacity of 300,000 units.

AMBITIOUS 2025 GUIDANCE

In a bid to build investor confidence, Hyundai Motor unveiled ambitious annual guidance that projects a revenue increase of 3-4% and an operating profit margin of 7-8% for 2025 despite growing concerns about a slowdown in the global EV uptake.

Hyundai Motor said it aims to sell 4.17 million cars globally this year, up from last year’s sales of 4.14 million vehicles.

The company said it will spend 169 trillion won this year, including 6.7 trillion won in research and development projects and 8.6 trillion won in facility investment.

Hyundai said it will pay 6,000 won per common share in dividends for 2024 shareholders. With quarterly interim dividends included, its full-year dividend payout will be 12,000 won.

Shares of Hyundai Motor finished 0.2% higher at 209,000 won after the earnings announcement. The broader benchmark Kospi index ended down 1.2%.

Meanwhile, Hyundai Motor’s brand recognition has risen above Tesla Inc. to rank third on the 2025 brand value list compiled by Brand Finance, a UK-based market tracker.

In the latest survey, Hyundai rose by three notches from last year to become the automaker with the world’s third-highest brand value after Toyota and Mercedes-Benz.

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.