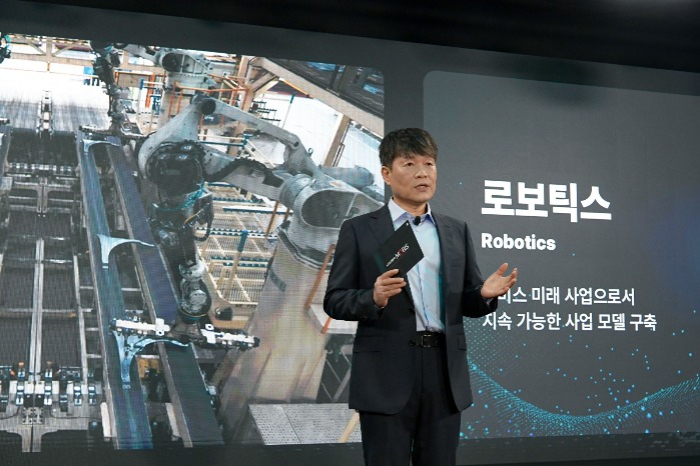

Hyundai Mobis Co., the auto parts arm of Hyundai Motor Group, will expand into robotics and automotive semiconductors in a bid to secure new growth engines as the industry braces for the humanoid robot age.

Unveiling the plan at its 2025 CEO Investor Day in Seoul on Wednesday, Hyundai Mobis said it will first develop actuators, the joint-moving devices essential for robots.

Actuators, which combine motors and reduction gears to power and position robot joints, are the most expensive component in humanoid robots, accounting for more than 60% of total production costs.

Because actuators are similar in design to automotive electronic steering systems, South Korea’s top auto parts maker will leverage its engineering expertise in developing them.

The company will later develop robot sensors, controllers and robotic hands, or hand grippers.

The announcement comes a day after its parent Hyundai Motor Group disclosed plans to build a plant in the US capable of producing 30,000 robots annually, signaling coordinated efforts within the Korean motor behemoth to establish a foothold in what is expected to be one of the fastest-growing future industries.

The global robot actuator market is forecast to reach $40 billion by 2032, according to Global Market Insights.

Hyundai Motor is advancing robotics technology through its US robotics subsidiary Boston Dynamics Inc. and its in-house Robotics Lab.

Hyundai Motor has pledged an additional investment of $5 billion in the US, which includes the robot plant, on top of its previously announced $21 billion.

The new commitment is part of South Korean companies’ concerted efforts to secure more favorable tariff terms in Washington.

AUTOMOTIVE CHIPS AND NEXT-GEN CAR TECH

Hyundai Mobis is also ramping up efforts in automotive chips, seeking to boost its design capabilities in both system-on-chips and power semiconductors, which are critical to electric vehicle drivetrains.

The company has developed 16 semiconductor types in-house, outsourcing production to contract manufacturers.

In parallel, it is advancing next-generation vehicle components.

It plans to roll out a holographic head-up display around 2029, co-developed with German optics giant Zeiss, which can project driving and navigation information across the front windshield in panoramic form. The technology was first showcased at CES 2025 earlier this year.

Hyundai Mobis, also the world’s sixth-largest automotive parts maker, is working on standardized platforms for software-defined vehicles (SDVs), to commercialize the technology after 2028.

Often described as smartphones on wheels, SDVs enable continuous software upgrades of a car’s functions through an over-the-air system throughout a car’s lifecycle. Hyundai Motor Group has identified the technology as a key growth driver.

Hyundai Mobis also plans to develop battery systems designed to block thermal runaway and prevent EV fires.

To bolster profitability, the company will reorganize its portfolio with a focus on high-value mobility components and expand orders from emerging markets such as China and India.

It also plans to raise the share of sales from outside its Hyundai Motor Group sibling companies to 40% by 2033, from about 10% today.

The company targets annual revenue growth of at least 8% through 2027, with operating margins between 5% and 6%. The margin improved to 5.4% in 2024 from 3.9% in 2023.

“We will concentrate investment and R&D resources on future key technologies to secure new growth momentum,” Hyundai Mobis President and CEO Lee Gyu-suk said at the 2025 CEO Investor Day.

By Bo-Hyung Kim

kph21c@hankyung.com

Sookyung Seo edited this article.