South Korea’s two largest automakers, Hyundai Motor Co. and Kia Corp., are making a bold push into the Japanese market, long been dubbed a “graveyard for imported vehicles,” with their latest electric models.

The two automaking units of Hyundai Motor Group, which also owns premium brand Genesis, are participating in this year’s Japan Mobility Show, which opens on Oct. 30.

It marks the first time the sister firms will appear together at Japan’s premier motor exhibition, in a coordinated effort to challenge the dominance of local automakers such as Toyota, Honda and Nissan through electric vehicles.

Hyundai Motor Group is zeroing in on what it sees as the Achilles’ heel of Japanese carmakers: their sluggish transition to electrification.

Both Hyundai and Kia will unveil all-electric and zero-emission models as they look to carve out niches in Japan’s still-nascent EV market.

Their challenge, however, is China’s BYD Co., whose aggressive expansion and marketing blitz have already made it a formidable contender in Japan.

INSTER, INSTEROID, NEXO, PV5

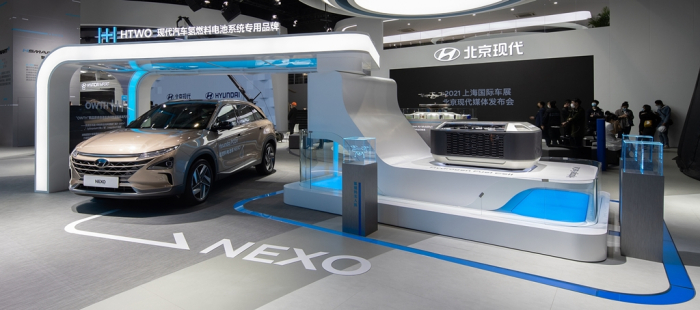

Hyundai will premiere The All-New NEXO, its updated hydrogen fuel-cell SUV, at the Japan Mobility Show.

The company will also showcase its flagship EV, the IONIQ 5; the Inster Cross, a variant of the compact crossover city car Inster, known in Korea as the Casper; and a concept Inster model, Insteroid.

Kia, meanwhile, will take the wraps off its first purpose-built vehicle, the PV5, aimed at Japan’s commercial EV market.

The model will make its global debut at the show before its official launch in Japan next year, followed by a larger electric van, the PV7, in 2027.

All vehicles presented by Hyundai and Kia at the event will be electric, underscoring their shared strategy to avoid direct confrontation with Japan’s well-entrenched internal combustion engine segment and instead compete where Japanese incumbents remain vulnerable, sources said.

HYUNDAI’S RENEWED BID IN JAPAN

In 2022, the Korean automaker said it was re-entering the Japanese car market after a 12-year hiatus, starting with the IONIQ 5 and the NEXO.

Hyundai made inroads into Japan in 2001 but gave up its passenger car business in 2009 due to weak sales there.

The Inster, or the Casper Electric, sold via Hyundai’s online platform in Japan, has shown strong traction among Japanese consumers.

Hyundai sold 759 vehicles under its brand in Japan from January through September, surpassing last year’s full-year total of 618.

The company’s best-seller is the Inster Cross, which fits Japan’s small-car preference and lower tax categories, Hyundai officials said.

BYD’S JAPANESE OFFENSIVE

Still, Hyundai’s market share in Japan’s EV segment remains in the low single digits, squeezed between local manufacturers and fast-rising Chinese and US rivals.

According to market tracker SNE Research, Nissan led Japan’s EV market in the first half of 2025 with 11,695 units, accounting for about 40% of the total 29,857 sales. Following Nissan were Tesla with 5,542 units, Mitsubishi with 4,793 units, and BYD with 1,409 units.

At the same Tokyo mobility show, BYD plans to exhibit a full line-up, including the Sealion 6 DM-i hybrid, the Atto 3 crossover and the Yangwang U9 supercar under its luxury brand.

The Chinese automaker has also struck a deal with Japanese retail giant Aeon to expand its sales network, targeting around 30 outlets nationwide.

It is also preparing to launch a compact EV next year, meeting Japan’s regulations and consumer preferences.

JAPAN’S INCUMBENTS STRIKE BACK

Japan’s traditional automakers are not standing idle.

Toyota will unveil a new orange Century Coupe positioned above its luxury Lexus range, starting at around 25 million yen ($164,780), along with at least three concept models, including a six-wheel Lexus prototype.

Honda will showcase its upcoming Honda 0 Series EVs, set for launch next year, and its HondaJet Elite II business aircraft.

Analysts said the competition underscores a shifting dynamic in Japan’s auto market, long a fortress for domestic brands but now facing disruption from Korea’s and China’s EV ambitions.

For Hyundai and Kia, success in Japan will be more than just a sales milestone: it will mark a symbolic breakthrough in one of the world’s most insular car markets, they said.

On Monday, Hyundai Motor was named Korea’s top-performing company in Time magazine’s annual ranking of the World’s Best Companies this year. Hyundai ranked 33rd on the list, beating Toyota, which ranked 48th.

By Jung-Eun Shin

newyearis@hankyung.com

In-Soo Nam edited this article.