US auto giant General Motors Co. is regarding its South Korean factories as central to its global supply chain, particularly for compact SUVs and electric vehicle components.

During a conference call with analysts on its second-quarter earnings on Tuesday, Chief Executive Mary Barra sought to quell speculation that the US automaker could exit Korea, pledging to continue importing Korean-made vehicles despite steep US tariffs on foreign cars.

GM has no plans to scale back shipments from its Korean operations, she said.

The CEO called GM’s Korean manufacturing base “a very efficient operation” and praised its longstanding role in producing high-quality vehicles.

The comments come as GM grapples with the financial burden of elevated import tariffs under the trade policies championed by President Donald Trump.

Earlier this month, Washington confirmed a sweeping 25% tariff on Korean imports, the same rate as the “reciprocal” levy announced on April 2.

While Barra’s public backing offers a temporary reprieve, industry watchers said concrete steps, such as new model investments, will ultimately determine whether GM’s Korean gamble continues or winds down.

NEW VEHICLE PRODUCTION ASSIGNMENTS?

Sources said Barra’s reassurances could pave the way for new vehicle production assignments to Korean factories, a crucial factor in its long-term survival.

Korea exports nearly 90% of its GM-made vehicles to the US, raising fears that any sustained tariff pressure could trigger a strategic retreat.

“Korean plants have long been efficient and capable of delivering quality vehicles. The vehicles produced there remain in high demand and contribute positively to our margins,” she said.

Her comments are a clear signal that the Detroit automaker intends to maintain production in Korea even under the pressure of steep US tariffs.

The remarks came as GM reported a 35.4% on-year drop in second-quarter net profit to $1.9 billion, although revenue was more resilient, dipping just 1.7% to $47.12 billion.

GM blamed the earnings slump largely on higher costs tied to global trade disputes and said it is actively reviewing its production footprint in countries such as Mexico, Canada and Korea.

SHIFTING PICKUP TRUCK PRODUCTION FROM MEXICO TO THE US

The company announced that it would begin shifting some pickup truck production from its Mexican plant to US-based factories.

GM Chief Financial Officer Paul Jacobson added that the company expects to mitigate “a significant portion” of tariff-related costs over time and hopes for a normalization of trade negotiations.

GM currently sources about half of its US-bound vehicles from overseas, primarily Korea and Mexico.

Yet a full reshoring is unlikely.

Producing compact models like the Chevrolet Trax and Trailblazer – currently made in Korea – in the US would not be cost-effective due to higher labor costs and slimmer margins.

Moreover, a wholesale relocation of the supply chain would be logistically and financially prohibitive, analysts said.

GROWING POSSIBILITIES

The possibility of new model allocations to GM Korea has grown bigger following Barra’s remarks, according to industry officials.

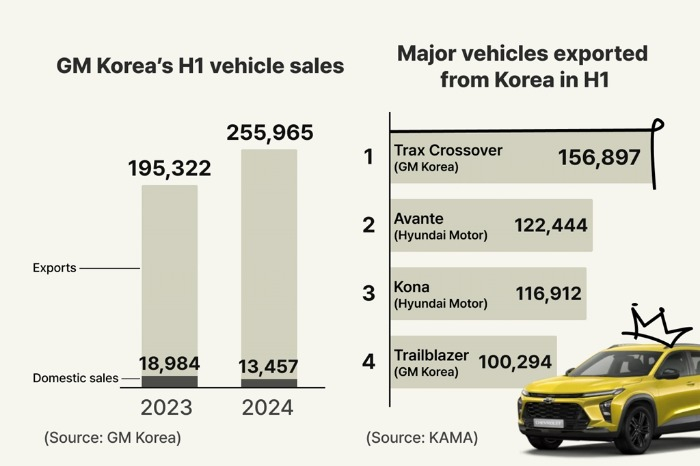

Korean plants currently build just two export models: the Trailblazer, introduced in 2020, and the Trax Crossover and its derivative, the Buick Envista, both launched in 2023.

Industry officials said the Trailblazer will require a successor within three years to sustain output levels.

In 2018, GM received a lifeline from the Korean government in the form of public funds, provided that it would retain its majority stake in GM Korea for at least a decade.

Market watchers see any assignment of next-generation vehicles as a key litmus test of GM’s long-term commitment to its Korean operations.

HEADWINDS

Still, serious headwinds remain.

GM Korea’s domestic sales have plunged, while labor unrest is escalating.

Last year, GM Korea sold 499,559 vehicles – its highest in seven years – and 95% of those were exported. The US accounted for nearly 90% of total exports.

In contrast, domestic sales tumbled 35.9% to 24,824 units in 2024, and have dropped a further 39.7% to 8,121 units in the first half of this year from the year-earlier period.

Adding to the uncertainty, GM Korea’s union launched a partial strike earlier this month amid a deadlock in wage negotiations.

Meanwhile, the company is moving to divest domestic assets, including nine service centers and part of its Bupyeong Plant 2 complex, raising fresh concerns about its long-term presence in the country.

“If GM Korea only uses an export-oriented strategy, it will eventually end up being reduced to an OEM plant,” said a Seoul-based auto analyst.

By Jung-Eun Shin

newyearis@hankyung.com

In-Soo Nam edited this article.