Air Liquide SA, a French multinational industrial gas and services company, has signed a share purchase agreement to acquire South Korea’s DIG Airgas Co. from Macquarie Asset Management, in a deal estimated at slightly over 4 trillion won ($2.9 billion).

Under the deal signed on Thursday, Air Liquide will acquire a 100% stake in DIG Airgas, Korea’s third-largest industrial gas supplier, people familiar with the matter said on Friday.

The transaction marks Air Liquide’s return to the Korean industrial gas market ten years after the Paris-based company exited Korea by selling its stake in Daesung Industrial Gases.

The deal follows a protracted auction process, in which Air Liquide outbid global rivals, including New York-based Brookfield Asset Management and global alternative investment firm Stonepeak. Sources said Air Liquide offered the highest bid among contenders.

JP Morgan and Goldman Sachs are the lead advisors for the DIG Airgas sale.

DEAL PRICE: MEET HALFWAY

Negotiations with Macquarie centered on price.

The Australian buyout group originally sought to receive closer to 5 trillion won, while Air Liquide wanted to cut prices, citing weaker near-term earnings at DIG Airgas.

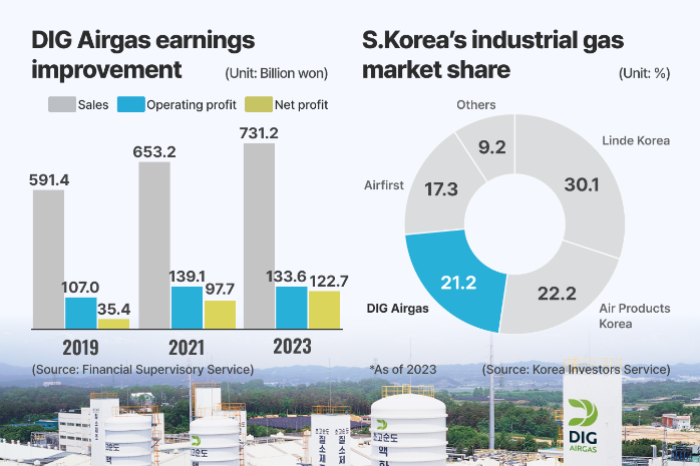

Falling demand from key clients such as SK Innovation Co., LG Chem Ltd., LG Display Co. and POSCO, combined with the ongoing government-led restructuring in the petrochemical sector, weighed on the sale process, sources said.

The two sides ultimately settled in the low-to-mid 4 trillion won range, according to people briefed on the talks.

Linde Korea Co. is the domestic market leader, followed by Air Products Korea. DIG Airgas is the No.3 player and AirFirst Co. is the fourth-largest industrial gas supplier in the country.

DIG Airgas produces specialty gases such as nitrogen, helium and oxygen used in semiconductors and the display, solar cell and LED sectors. The company counts the world’s two largest memory chipmakers, Samsung Electronics Co. and SK Hynix Inc., among its major clients.

RETURN TO KOREAN SPECIALTY GAS MARKET IN 10 YEARS

Paris-based Air Liquide is the world’s second-largest industrial gas company after German giant Linde plc.

Air Liquide’s acquisition of DIG Airgas marks its comeback to Korea 10 years after it exited in 2014 by selling its entire stake in Daesung Air Liquide, a joint venture set up with Daesung Industrial Gases in 1979. The JV has been renamed DIG Airgas.

In 2017, DIG Airgas was taken over by private equity firm MBK Partners for 1.8 trillion won. Two years later, it was sold to Macquarie for 2.5 trillion won.

Last year, Air Liquide attempted to re-enter Korea, bidding for a 30% stake in AirFirst Co. and management control of Air Products Korea, but without success.

Still, the latest deal faces potential hurdles before closing.

Industry watchers said persistent weakness in the petrochemicals cycle and the risk of policy-driven restructuring could complicate integration.

Analysts also noted that Air Liquide has left room for further price adjustments and that other assets, such as Air Products Korea, could re-emerge for sale, potentially reshaping competitive dynamics.

By Da-Eun Choi and Jun-Ho Cha

max@hankyung.com

In-Soo Nam edited this article.