Doosan Skoda Power, a Czech-based power plant equipment-making unit of South Korea’s Doosan Enerbility Co., plans to list its shares on the Prague Stock Exchange in February to raise funds as much as 160 billion won ($111 million).

Doosan Group, parent of Doosan Enerbility, said part of the proceeds from the initial public offering (IPO) will be used to finance the expansion of its facilities at Doosan Skoda Power.

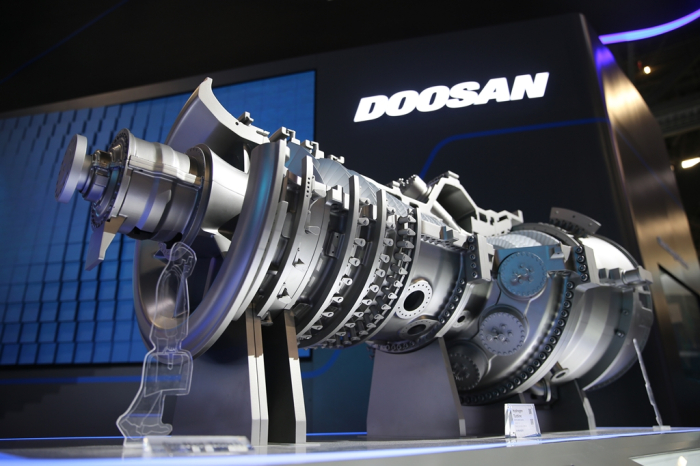

Funds raised through the IPO will also go to finance the Korean conglomerate’s growth businesses such as nuclear power plants, small modular reactors, more commonly known as SMRs, and gas turbines, according to Doosan officials.

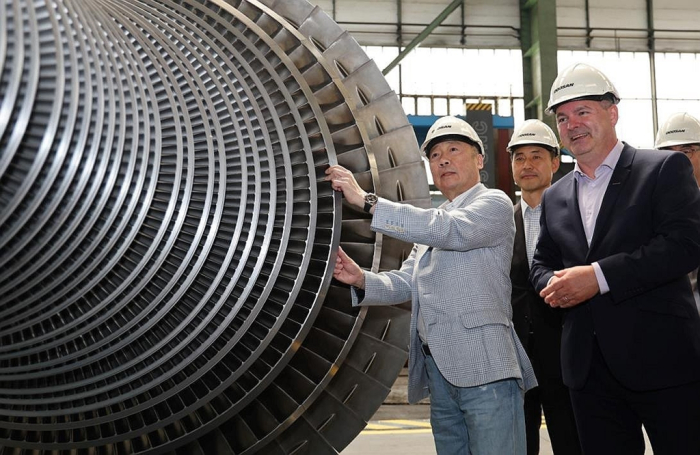

Headquarters in Plzen, Czech Republic, Doosan Skoda Power makes and supplies equipment for power stations and machine rooms specially equipped for steam turbines.

IPO SCHEDULE

Doosan Skoda plans to list 9.57 million to 10.52 million shares on the Prague stock market on Feb. 6.

For the IPO, Doosan is holding an investor relations session through Feb. 5 to provide information on the share listing and business strategies. The subscription period is set to conclude on Feb. 5.

Doosan plans to sell up to 33% of its existing and new shares, priced between 13,200 won and 15,600 won (220-260 koruna) per share, raising between 120 billion won and 160 billion won.

BRIGHT PROSPECT

Doosan Skoda Power is reaching out to investors as it anticipates new contracts both within the Czech Republic and globally.

Industry officials said new contracts will mainly be driven by investments in nuclear and gas-fired power stations.

Doosan Enerbility acquired Doosan Skoda from a Czech firm in 2009 for 800 billion won and has since supplied more than 540 steam turbines to nuclear power plants across Europe.

When Doosan Group was under creditor-led restructuring in 2020-2021, it held onto Doosan Skoda Power, anticipating a nuclear power industry boom.

With European countries such as the UK, Sweden and the Netherlands actively pursuing new nuclear power projects, industry officials said Doosan Skoda Power has emerged as a highly valuable company.

By Hyung-Kyu Kim

khk@hankyung.com

In-Soo Nam edited this article.