DB Insurance Co., a leading South Korean non-life insurance company, is in advanced talks to acquire US-based insurer Fortegra in a deal that could be worth as much as 2 trillion won ($1.48 billion), people familiar with the matter said on Tuesday.

If the deal is clinched at the estimated price, it would mark the largest-ever overseas acquisition by a Korean insurance company.

Sources said that the non-life insurance unit of DB Group, which also owns DB Securities Co., recently completed due diligence on Fortegra and is now negotiating terms with its owner, New York-listed financial holding company Tiptree.

The concerned parties aim to reach a final agreement by August, with DB seeking to purchase 100% of Fortegra’s equity, according to sources.

The move underscores the Korean insurer’s ambition to establish a more significant foothold in global markets, as growth prospects at home dim due to the country’s rapidly aging population and falling birth rates.

It also signals rising competitive pressure in the domestic industry, where top-tier players are seeking to secure longer-term growth engines.

AUTO & NICHE INSURANCE PRODUCTS

Founded in 1978 and headquartered in Jacksonville, Florida, Fortegra specializes in niche insurance products and vehicle service contracts.

As of the end of 2024, it held $5.4 billion in assets and reported $1.97 billion in annual revenue, a 23% increase from the previous year.

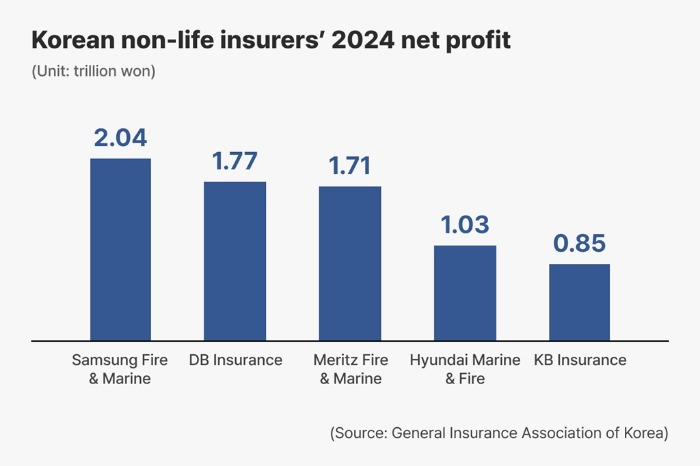

If completed, the deal would account for about a quarter of DB’s capital and exceed its 2024 net profit of 1.77 trillion won.

A DB Insurance official said the company is pursuing the acquisition, but “nothing concrete has been decided yet.”

DB’S GLOBAL EXPANSION MOVE

The acquisition would be DB Insurance’s most aggressive global expansion move to date.

Although DB operates a US branch in California, offering commercial property, personal residential and trucking insurance services, the potential Fortegra takeover would be its first full acquisition of a local player in the US market.

DB has been building a presence in Southeast Asia.

In June 2023, DB signed a deal to acquire Saigon-Hanoi Insurance Corp. (BSH), following its acquisition of Vietnam National Aviation Insurance (VNI) early that year.

In 2015, DB also purchased a 37.32% stake in Post & Telecommunication Joint Stock Insurance Corp. (PTI), another Vietnamese insurer.

DB’S BID TO SPUR RIVALS’ OUTBOUND M&A ACTIVITY

DB Insurance’s overseas business, which swung to profit last year with 38.4 billion won in net profit, still accounts for less than 2% of its total earnings.

Analysts said a successful acquisition of Fortegra would significantly accelerate that shift, giving DB a platform to challenge domestic industry leader Samsung Fire & Marine Insurance Co. and pull ahead of fast-rising rival Meritz Fire & Marine Insurance Co.

Market watchers expect DB’s bid to spur outbound M&A activity among Korea’s top insurers, many of which are facing similar structural growth headwinds in their home market.

“If the Fortegra deal goes through, it won’t just boost DB’s international profile. It could also be a turning point for the entire Korean insurance industry,” said a Seoul-based investment banker advising on insurance-sector deals.

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.