Coupang Inc. and Naver Corp., the top two players in the South Korean e-commerce market, are expected to further tighten their grip this year after seeing remarkable growth in their commerce business last year.

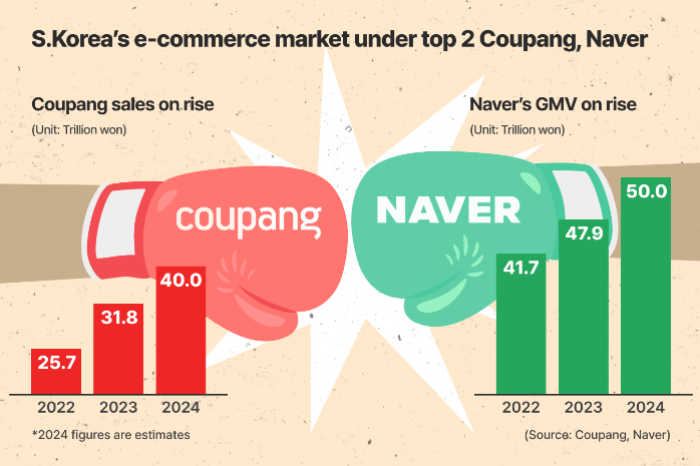

According to the local securities industry on Monday, Korea’s No. 1 e-commerce platform Coupang is estimated to have raked in 40 trillion won ($27.7 billion) in sales in 2024, its highest-ever annual sales and a record high in the country’s retail market, including both offline and online stores.

Its cross-town archrival, Korean search engine and internet portal giant Naver’s commerce business is also expected to report its largest gross merchandise value (GMV) of over 50 trillion won for 2024.

Their stellar results are largely credited to their membership programs, paid subscription services like an Amazon Prime membership that gives members access to various perks and services, including free delivery options, video streaming services and food delivery.

While the country’s top two e-commerce players enjoyed such brisk sales, their smaller peers staggered with decreasing sales over the same period, making Coupang and Naver the matchless two in the Korean e-commerce market.

WITH OR WITHOUT FULFILLMENT CENTERS

Naver operates a commerce business that connects merchants with consumers without its own fulfillment centers and receives 4% to 5% commissions per purchase, which are recorded as its sales.

The Naver commerce business reported its highest-ever GMV of over 50 trillion won last year after a steady increase from 41.7 trillion won in 2022 to 47.9 trillion won in 2023.

Thanks to the solid GMV growth, the Korean search engine giant’s commerce business reaped 2.15 trillion won in sales in the first nine months of last year, the second largest after its mainstay search business sales.

Coupang, which operates fulfillment centers across the nation, is also estimated to have earned more than 40 trillion won in sales last year, marking record-high sales for the company and in the Korean retail industry.

The country’s traditional retail giants Lotte and Shinsegae have never topped the sales milestone of 40 trillion won.

Coupang, the Amazon of South Korea, generates over 90% of its sales from direct selling of products stored in its logistics centers across the nation. The remaining is from commissions from operating a marketplace connecting individual merchants with consumers.

If its marketplace GMV is included, Korea’s No. 1 e-commerce player’s total GMV is estimated over 60 trillion won, according to the industry.

LOCK-IN EFFECT WITH MEMBERSHIP SERVICES

Coupang’s ascent comes despite a hike in its membership fee, its version of the Amazon Prime fee, last year.

The company offers WOW membership services, subscription-based services for a monthly fee, to its members, including free delivery services for shopping and food, online shopping discounts and video streaming services.

Even after it raised its monthly membership fee by 58% last year, an individual WOW member spent 8% more on Rocket Delivery and Rocket Fresh products in the third quarter last year compared to a year ago.

Naver also offers Naver Plus Membership, a monthly paid subscription service that allows its members to access free shopping delivery, as well as video streaming and food delivery services in partnership with Netflix and local food delivery platform Yogiyo without extra charges.

Such a monthly subscription service with various perks has succeeded in making it hard for their members to switch to a competitor, industry observers said.

UNDERDOGS’ REBELLION ON THE HORIZON?

The two are expected to continue dominating the Korean e-commerce market as their smaller rivals suffer from falling sales.

Gmarket Inc. and SSG.COM, the two online shopping subsidiaries of E-Mart Inc. under Korean retail conglomerate Shinsegae Group, saw their sales for the first nine months of last year down 16.4% and 6.2%, respectively, from the same period of the prior year.

SK Square Co.’s e-commerce unit 11Street Co. also grappled with a 28.9% drop in sales over the same period.

But some industry observers expect the upcoming Shinsegae-Alibaba union would crack the Coupang and Naver’s dominance in the Korean e-commerce market.

Late last month, Shinsegae Group announced a plan to set up an e-commerce joint venture with Chinese online shopping giant Alibaba Group Holding Ltd. to better compete in Korea’s fast-paced online retail sector.

The JV, tentatively named Grand Opus Holdings, will be officially launched in March.

The two strategic partners expect great synergy from their collaboration, which will allow the JV to tap Shinsegae’s extensive domestic distribution know-how and Alibaba’s global network.

But some others doubt whether the JV could make any tangible change in the Korean e-commerce market, citing Naver and Coupang’s unrivaled sourcing and distribution network.

The top two are also seeking to diversify their services to attract more users.

Coupang has recently introduced a new service called R.LUX, where Coupang users can buy premium beauty brands’ products, including those by Jo Malone, Lancôme, Laura Mercier and Estée Lauder.

Naver also plans to separate its commerce business into an independent app in March.

By Sun A Lee

suna@hankyung.com

Sookyung Seo edited this article.