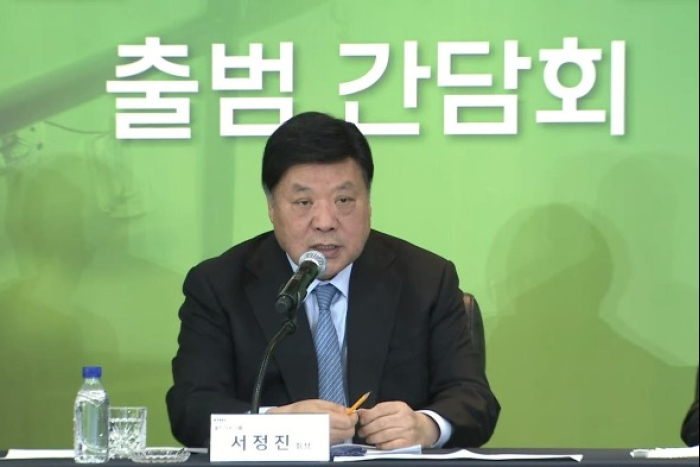

Celltrion Inc. on Tuesday launched its contract development and manufacturing organization (CDMO) unit Celltrion BioSolutions Co. in its foray into the market. As a newcomer to the field, it will produce a wider range of products than its competitors, said its founder and Chairman Seo Jung-jin.

The South Korean biosimilar maker will break ground on its first CDMO plant in Korea in the first half of next year, on which it will spend around 800 billion won ($556 million), according to Seo. It has yet to reveal the site where the factory will be construted.

The facility will have an annual production capacity of 100,000 liters, then will boost it to up to 200,000 liters. Depending on demand, it may build a new CDMO plant abroad.

“We have continuously received requests from small domestic and foreign bio companies to develop and produce their drug candidate substances,” Seo said in a press conference.

“We have also received many requests from the world’s big cancer hospitals to provide CGT-specific services, so we have decided to start our CDMO business.”

CGT stands for cell and gene therapies.

“Our plant will be optimized for producing a wide range of products in small quantities and in automated process,” said Seo. It plans to offer CDMO services for research as well.

Seo expects Celltrion BioSolutions to start generating revenue in 2028. The unit aims for 3 trillion won in sales by 2031.

DIFFERENTIATION STRATEGY

To differentiate itself from competitors such as Samsung Biologics Co. and Switzerland-headquartered Lonza, the world’s No. 1 CDMO company, Seo stressed that it will produce various drug modalities from monoclonal to trispecific antibody drugs, subcutaneous injection formulation and CGT.

Specifically, it will introduce hyaluronidase, an enzyme used to convert intravenous formulation to subcutaneous injection formulation, for CDMO drugs from next year.

It will also expand its CDMO portfolio to mRNA vaccines and oral and inhalation drug delivery solutions. mRNA vaccines direct cells to produce copies of a protein that increases an immune response to viruses such as coronavirus.

“The most important thing is how efficiently we build small facilities that meet current good manufacturing practice (cGMP) standards next to large hospitals,” he explained.

“We will complete cGMP platforms optimized for CGT services within the next two to three years.”

CGMP is enforced by the FDA.

Lee Hyuk Jae, senior vice president of Celltrion, will take over as chief executive of Celltrion BioSoultions.

Seo expressed confidence about its venture into the CDMO market, saying its experience in the development, production and sales of biosimilars will give it a competitive edge.

“I think Lonza and Celltrion are the only companies that can provide all types of CDMO services,” he added.

Three years later, he expects both CDO and CRO to generate a combined 100 billion won in sales. Sales from CMO are forecast at 500 billion won three years later.

Meanwhile, Seo said he will unveil new biosimilar candidates at J.P.Morgan Health Care Conference in the US next month.

Samsung Biologics is South Korea’s leading CDMO player, chased by smaller local rivals like Lotte Biologics Co. and stem-cell therapy company Medipost Co.

By Jeong Min Nam

peux@hankyung.com

Yeonhee Kim edited this article.