With banks retrenching from real estate under Basel IV, transitional lending is emerging as a resilient financing channel, offering borrowers flexible capital and investors attractive spreads.

Transitional lending is a form of debt financing that provides borrowers with critical funds to execute on transitional business plans and redevelopment opportunities. Funding is provided to improve the underlying property fundamentals and enable the asset to reach a stabilized condition.

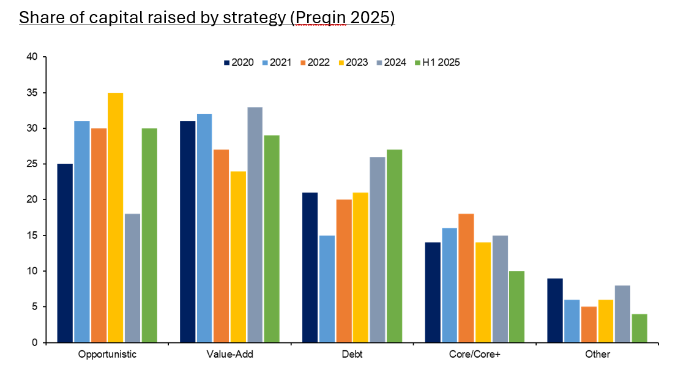

In a sustained higher interest rate environment, investors are demanding higher-returning real estate strategies, particularly value-add and opportunistic approaches, which can generate greater potential returns through active asset management and repositioning.

Real estate managers are, therefore, focusing on value creation through strategic enhancements to underlying assets rather than relying on future yield compression to achieve target returns.

BANKS RETREAT, ALTERNATIVES STEP IN

Traditional lenders continue to scale back their exposure to real estate.

In response to Basel IV capital requirements, many banks have reassessed their risk-weighted asset allocations, resulting in a notable decline in transitional real estate lending.

This has presented a compelling opportunity for alternative real estate debt managers, who can provide borrowers with flexible and efficient capital solutions.

“At the moment, we are seeing significant demand for debt financing from our higher-return-seeking borrower clients,” said Cyrus Korat, managing partner of DRC Savills Investment Management. “Borrowers are demanding whole loan solutions, enabling them to execute on refurbishment and value-add business plans.”

“We believe the most compelling opportunity right now is the provision of senior whole loans that are generally backing property improvement loans,” Korat noted.

Such loans can generate high returns for senior risk, with spreads of 4-5% over the risk-free rate.

“Excess returns versus traditional senior lending are high, and compared with mezzanine, you are achieving only a fractionally lower return for a much lower risk,” said the managing partner.

In transitional lending, the lender has the benefit of de-risking their position over the course of the loan as value-add led business plans provide a significant upgrade to property fundamentals.

VALUE CREATION AND MARKET OPPORTUNITY

“We typically only back high-quality sponsors with a proven track record in executing business plans focused on improving building quality/footprint and ESG characteristics,” Korat stated.

“These initiatives contribute to improved tenant profiles and sustained rental growth. The resulting value creation not only mitigates risk throughout the loan term but also enhances asset liquidity, facilitating exit strategies via asset sale or, more commonly, refinancing with a senior lender.”

A distinct opportunity currently lies in the mid-market lending segment, particularly for loans ranging from €20 million to €75 million, where competition from larger institutional lenders remains limited.

Market data indicates that approximately 93% of pan-European real estate transactions occur below the €100 million threshold, underscoring robust demand for mid-sized financing solutions.

In this space, alternative lenders enjoy strong pricing power, greater structuring flexibility and the ability to retain the full slice of risk – an important differentiator when managing downside risk in transitional lending transactions.

(This article was contributed by Cyrus Korat, managing partner of DRC Savills Investment Management.)