The Bank of Korea will likely leave its policy rate unchanged at 2.5% at Thursday’s rate review meeting due to concerns over financial stability, elevated household debt and the difficulty of cutting rates ahead of the US Federal Reserve.

According to a recent survey of 20 economists who belong to the Korea Economic Daily (KED) Economists Club, 18 of them expect the South Korean central bank to stand pat on the base rate.

Only two predicted a quarter-percentage-point rate cut to 2.25%.

“Property market risks remain elevated,” said Shin Kwanho, economics professor at Korea University.

Park Seok Gil, head of research at JPMorgan in Seoul, said that “financial stability considerations will weigh heavily” on the monetary policy committee’s decision this Thursday.

Former BOK deputy governor Lee Seung-heon, Hyundai Research Institute’s senior research Joo Won and Kiwoom Securities Co. strategist Kim Yoo-mi also cited elevated property prices and household debt as key constraints.

NO MOVES UNTIL FED CUTS

A majority of respondents stressed that the central bank would not move before the Fed.

“A widening interest-rate gap with the US would put pressure on the won,” said Lee Sang-ho, head of economic research at the Federation of Korean Industries.

Hana Securities strategist Lee Jae-man noted that while Jerome Powell’s comments at Jackson Hole last week were interpreted as dovish, “they are not enough to change the Fed’s trajectory. The BOK will likely follow the Fed’s lead.”

BOK Gov. Rhee Chang-yong has called for a cautious approach to monetary easing, warning that excessive interest rate cuts could stoke asset bubbles and currency volatility, even as the country faces mounting pressure to revive the flagging economy.

TWO ECONOMISTS EXPECT A RATE CUT THIS TIME

Two KED economists forecast that the BOK would opt for an early cut.

Kathleen Oh, chief Korea and Taiwan economist at Morgan Stanley, said higher US tariffs may justify the BOK’s preemptive move.

Lee Yoon-soo, economics professor at Sogang University, said the BOK could move this week, and if not, an October cut will be on the table, given Powell’s dovish comments from Jackson Hole.

Survey participants expect the BOK to cut rates just once before the year’s end, bringing this year’s base rate to an average of 2.23%.

GDP FORECASTS

Growth prospects remain subdued, with KED economists projecting a 0.94% GDP expansion this year, broadly in line with the Finance Ministry’s 0.9% forecast and the 0.98% average among eight global investment banks.

“Two rounds of supplementary budgets will only boost GDP growth by 0.1 percentage point,” said Seok Byoung-hoon, economics professor at Ewha Womans University.

Mirae Asset Securities Co. analyst Min Jihee said that while private consumption is likely to recover, “construction and facility investment will remain weak and net exports’ contribution to the economy is declining.

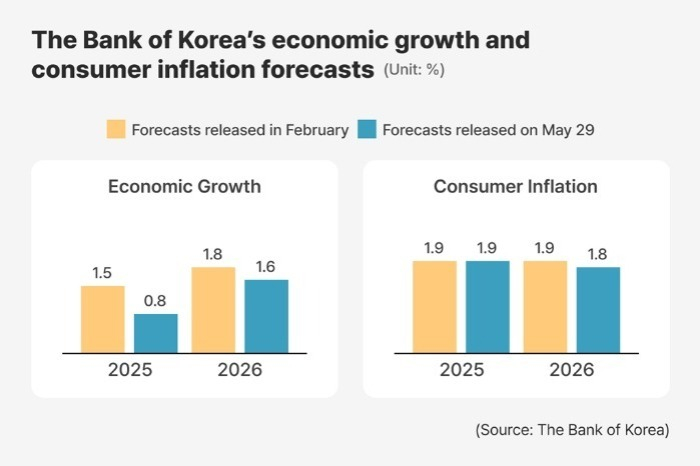

The BOK in May revised its full-year growth forecast to 0.8% from 1.5% earlier. The GDP expanded 2% in 2024.

During its monetary policy review meeting on July 10, the central bank held its policy rate steady at 2.5%, citing the stable inflation rate and lower growth rates.

Korea’s headline inflation stood at 2.2% in June, just slightly above the BOK’s 2% target.

By Jin-gyu Kang

joseph@hankyung.com

In-Soo Nam edited this article.