South Korean display makers stand to gain from a possible US import ban on organic light-emitting diode (OLED) panels from China’s BOE Technology Group Co. after a preliminary ruling by the US International Trade Commission (ITC).

According to sources in the investment banking industry on Wednesday, the US trade watchdog has recently ruled to ban imports of BOE’s OLED panels for 14 years and eight months under a “limited exclusion order,” which came about two years after Samsung Display Co. filed a lawsuit against the Chinese panel maker in October 2023.

The ruling, which is not final, said that BOE and its seven affiliates have violated the US Tariff Act in importing and selling certain OLED display modules and components in the US through misappropriation of the Korean rival’s trade secrets.

The final verdict is due in November, but industry watchers expect the US tribunal to uphold the ruling, noting its finding that BOE infringed Samsung Display’s trade secrets, as well as the ongoing US-China trade tensions.

If it is confirmed, BOE and its US subsidiary’s sale of new OLED panels and inventories, as well as related marketing activities in the US will be prohibited for nearly 15 years.

CHINESE PLAYERS’ RAPID ASCENT IN OELD

Samsung Display, which competes with BOE to supply OLED panels to clients including Apple Inc., has sought a limited exclusion order and cease-and-desist orders against the Chinese rival.

The ITC identified BOE in Beijing and its affiliates in other areas of China, and BOE Technology America Inc. in Santa Clara, California, as the respondents in its investigation.

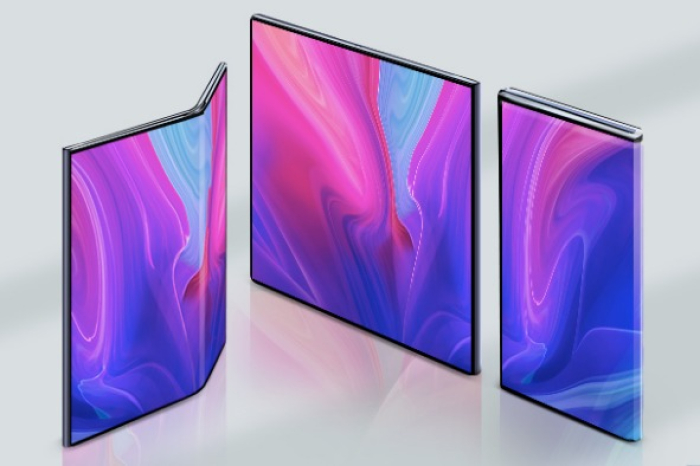

OLED panels, known for their self-illuminating pixels that enable thin, flexible and lightweight displays, have become a key differentiator for high-end smartphones.

Korean players such as Samsung Display and LG Display Co. pioneered the OLED market, but Chinese rivals have rapidly gained ground with lower prices.

According to the securities industry, BOE is estimated to supply 20-30% of OLED panels for iPhone models. It is also believed to be a supplier for other brands’ refurbished models.

As of the second quarter of this year, BOE commanded 22.7% in the iPhone-specific small OLED panel market, beating LG Display with 21.3%.

KOREAN DISPLAY STOCKS FLY

In anticipation of a favorable ruling for Samsung Display, Korean display and parts companies’ shares zoomed on Wednesday.

LG Display surged 22.5% to end at 13,290 won ($9.65), and Duksan Neolux Co., an OLED materials supplier to Samsung Display, soared 24.6% to 46,600 won.

Other OLED materials and components suppliers also galloped, with S-Chem Co. skyrocketing 26.2%, Poongwon Precision Co. rising 8% and Innox Advanced Materials Co. jumping 7.8%.

OLED panel substrate producers, BH Co. and Chemtronics Co., climbed 15.8% and 5.5%, respectively.

Samsung Display is not listed on the stock market.

Analysts, however, said the ruling is unlikely to dent BOE’s market share immediately because finished products using its panels, such as Apple’s iPhones, are not subject to the ban.

Instead, they expect the decision to benefit Korean OLED display and parts companies over the medium to long term.

“As the ruling is likely to make it harder for smartphone and set makers like Apple, Dell ad HP to actively use BOE panels, competition in the OLED market could ease over the mid and long term,” said Kwon Min-gyu, an analyst at SK Securities Co.

“The decision is projected to provide a mid- to long-term boon for the Korean iPhone display value chain.”

By Han-Gyeol Seon

always@hankyung.com

Sookyung Seo edited this article.