South Korea’s initial public offering (IPO) market is set to regain momentum after the mid-autumn harvest festival holidays with biotechnology, semiconductor and content companies lined up to go public amid the booming local stock market.

Twelve companies have submitted their securities registration statements to a financial watchdog to list on the junior Kosdaq market, according to industry sources on Wednesday. Those companies plan to conduct bookbuildings as early as this month, speeding up their IPO processes.

Among those companies, Aimed Bio Inc., an antibody-drug conjugate (ADC) developer, is targeting the highest valuation of up to 705.7 billion won ($497.3 million) based on its desired IPO prices.

Aimed Bio targets such a high valuation such a high valuation despite net losses, given the growing interest among investors in an ADC, a targeted cancer therapy that combines a specific monoclonal antibody, a potent cytotoxic drug and a stable linker to deliver the drug precisely to tumor cells while sparing healthy tissue.

Retail and institutional investor subscriptions will be accepted Nov. 13-14.

SUPPLIER TO TSMC, BABY SHARK CREATOR

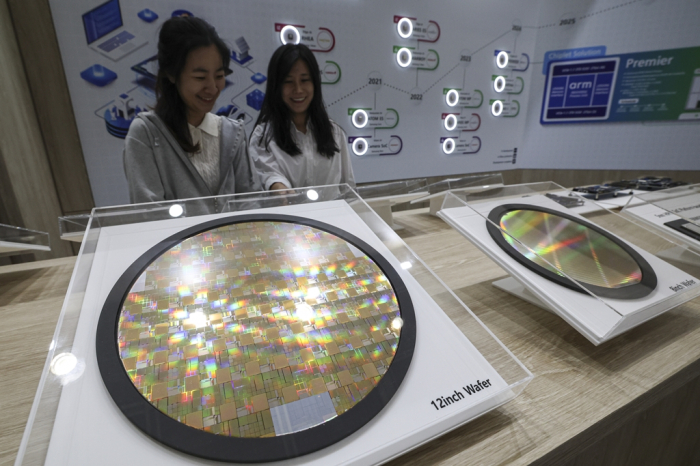

CMTX Co., a semiconductor equipment and materials company, is targeting a maximum market cap of 561.2 billion won.

CMTX, South Korea’s first tier 1 supplier to Taiwan Semiconductor Manufacturing Co. (TSMC), reported an operating profit of 26.3 billion won in the first half, surpassing a profit of 23.6 billion won last year.

The maker of silicon electrodes and rings, critical consumable components of etching machines used in semiconductor fabrication, plans a subscription for retail and institutional investors on Nov. 10-11.

The Pinkfong Company Inc., the creator of the billion-view video Baby Shark, is scheduled to receive subscription from individual and institutional investors on Nov. 6-7 with a target market cap of up to 545.3 billion won.

Its operating profit more than quadrupled to 18.8 billion won last year as the company aggressively expanded overseas businesses with popular intellectual properties, including Bebefinn and Sealook.

Smaller firms such as Nota Inc., Vitzronextech Co., Green Optics Co. and Innotech plan IPOs this month with target market caps of 100 billion won-200 billion won.

Curiosis Inc., SENA Technologies Inc., Aromatica Co., Nara Space Technology Inc. and Rznomics Inc. are set to open subscriptions next month.

MORE TO COME

Several other companies received preliminary approval for listing from the Korea Exchange but have yet to submit their securities registration statements.

SemiFive Inc., a designer of integrated circuits (ICs) for semiconductor chips, is aiming for a valuation close to 1 trillion won.

SemiFive produced chips for artificial intelligence (AI) and high-performance computing (HPC) in partnerships with leading domestic AI fabless companies such as FuriosaAI Inc. and Rebellions Inc.

QuadMedicine, Fescaro Co., Acryl Inc. and others are expected to submit their securities registration statements for IPOs soon.

HIGH RETURNS

Investor interest in IPOs is expected to stay healthy thanks to high returns on recent listings.

Myungin Pharm Co. closed its first trading at 121,900 won on Oct. 11, more than double its IPO price of 58,000 won. S2W Inc., which recently listed on the KOSDAQ, also saw its stock jump 81.44% above its IPO price on the debut day.

IPOs in the third quarter delivered an average 51,5% return on their first trading day.

Investors are likely to prefer IPOs with lock-up periods, market sources said.

Starting from July, South Korea requires more than 40% of the shares allocated to institutional investors to be preferentially assigned to those who agree to a lock-up period.

If the committed amount falls short of 40%, the underwriter must purchase 1% of the total public offering and hold it for six months.

By Hanjong Choi and Seok-Cheol Choi

onebell@hankyung.com

Jongwoo Cheon edited this article.