South Korea’s Aekyung Group has put its flagship subsidiary, Aekyung Industrial Co., up for sale as part of a broader restructuring effort to shore up its weak financial status.

The conglomerate, ranked 62nd in the country’s business hierarchy, is divesting its consumer goods and cosmetics affiliate, marking a strategic shift toward its aviation and chemicals businesses.

According to investment banking sources on Tuesday, AeKyung Group has initiated the process of selling its controlling 63% stake in Aekyung Industrial, currently owned by AK Holdings Co. and Aekyung Asset Management Co.

Some non-core assets, including the golf course business, Jungbu Country Club, are also up for sale, people familiar with the matter said.

Accounting and advisory firm Samjong KPMG has been named to lead the sales process.

The group is already in early-stage negotiations with large domestic and international private equity firms (PEFs) regarding the sale, they said.

UNDER INCREASING STRAIN

Established in 1954 as Aekyung Oil & Fat Industry Co., Aekyung Industrial is one of the group’s founding businesses.

Aekyung Industrial owns popular household brands such as Kerasys for hair care products, 2080 for oral care goods and Luna for cosmetics.

The company posted 46.8 billion won ($31.8 million) in operating profit on sales of 679.1 billion won last year.

AeKyung Group’s financial health has come under increasing strain, with AK Holdings’ net debt surpassing 2 trillion won as of the end of 2024.

The conglomerate’s debt-to-equity ratio stood at 328.7%, and its financial troubles have been exacerbated by the deadly plane crash of its affiliate Jeju Air Co. in December, which has led to a sharp decline in the stocks of subsidiaries.

STAKE SALE LIKELY TO FETCH $407 MILLION

The potential sale of Aekyung Industrial is expected to significantly improve the conglomerate’s financial structure.

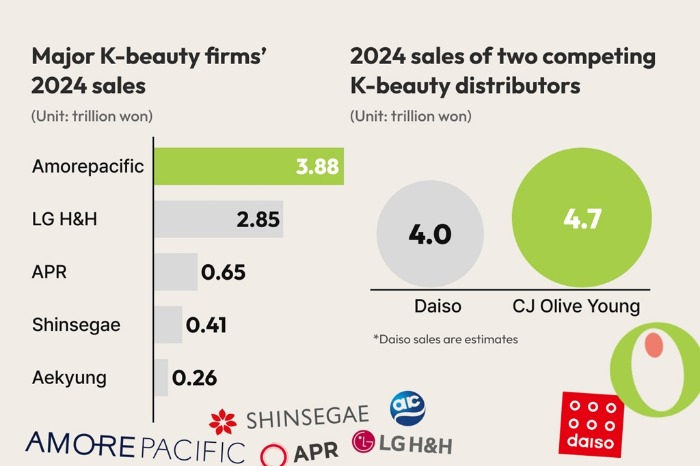

Analysts said Aekyung Industrial is undervalued compared to its peers, with its market capitalization of around 380 billion won.

The 63% stake owned by AK Holdings and Aekyung Asset Management is estimated at 240 billion won based on its current market price.

When the control premium of the firm is included, however, the sale will likely be priced at some 600 billion won ($407 million), sources said.

STABLE CASH FLOW

Aekyung Industrial’s attractiveness as an acquisition target lies in its stable cash flow and defensive business model.

Last year, the company generated 63 billion won in earnings before interest, taxes, depreciation, and amortization (EBITDA).

Despite its financial stability, Aekyung Industrial’s valuation remains significantly lower than its peers, with its price-to-earnings ratio (PER) of 8 to 9 times compared to crosstown rival LG H&H Co.’s multiple of 30.

With 7.12 trillion won in assets, AeKyung Group’s major subsidiaries include Aekyung Industrial, Aekyung Chemical Co., Jeju Air, department store operator AK Plaza and real estate developer AMPLUS Asset Development Inc.

While Jeju Air achieved record sales revenue in 2024 thanks to post-pandemic travel demand, its operating profit declined by 52.9% from the previous year due to a high dollar-won exchange rate.

By Jong-Kwan Park

pjk@hankyung.com

In-Soo Nam edited this article.