Tesla Inc., one of the world’s top electric vehicle makers, is strengthening ties with South Korean suppliers of key battery materials such as cathodes, anodes and copper foil, as the US EV maker moves to produce more of its own batteries and reduce dependence on external cell makers.

Tesla’s purchasing team has recently held a series of meetings with Korean battery materials companies to discuss potential supply deals, according to people familiar with the matter on Tuesday.

Tesla has already selected some partners for cathode and anode materials and is seeking to add others, while negotiating with at least one copper foil manufacturer for deliveries starting next year, sources said.

The move underscores Tesla’s ambition to evolve from one of the world’s largest battery buyers into a vertically integrated producer, tightening its grip on the supply chain and expanding what industry watchers call the “Tesla ecosystem.”

LEADER IN EVs, ESS

The US company, which leads the US markets for both electric vehicles and energy storage systems (ESS), has long sourced most of its batteries from China’s Contemporary Amperex Technology Company Ltd., better known as CATL, the world’s top battery maker.

But as Washington imposes tariffs of around 60% on Chinese-made batteries and blocks related subsidies under the Inflation Reduction Act (IRA), Tesla has shifted more of its procurement to Korea’s LG Energy Solution Ltd. and Japan’s Panasonic.

Now, it is doubling down on self-production, analysts said.

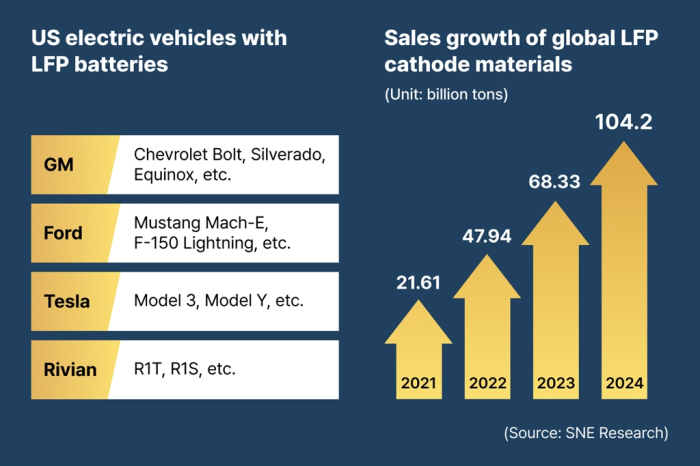

Sources said Tesla plans to use Korean materials at its battery facilities in Texas and at a new plant under construction in Nevada dedicated to lithium iron phosphate (LFP) batteries for ESS applications.

The company is also pushing ahead with in-house battery manufacturing at its plants in Shanghai and Berlin, they said.

OPPORTUNITY FOR KOREAN SUPPLIERS

For Korean battery materials makers, Tesla’s expansion represents both opportunity and relief.

Domestic cell producers have increasingly turned to cheaper Chinese inputs to cut costs, leaving local materials suppliers under pressure.

A foothold in Tesla’s global supply network would not only diversify demand but also help them escape China’s dominance.

Chinese companies control more than 80% of the global market for cathode, anode and copper foil materials.

POTENTIAL THREAT TO KOREAN BATTERY TRIO

A partnership with Tesla could also open doors to new frontiers.

Batteries underpin all of Tesla’s growth areas, from autonomous mobility and humanoid robots to its space ventures.

The shift, however, poses a threat to Korea’s big three battery makers, LG Energy, SK On Co. and Samsung SDI Co., which have built large US operations to serve Tesla and other EV brands.

As Tesla plans to expand in-house battery production using advanced Korean materials, analysts warn that cell suppliers could face declining market share and thinner margins.

“Tesla’s push for vertical integration is changing the competitive landscape,” said an industry executive in Seoul. “For some Korean suppliers, it’s a golden opportunity. For others, it’s a wake-up call.”