Global investment firms have pared back holdings in top-performing Korean stocks, including APR Co. and Korea Aerospace Industries Ltd., after their share prices have more than doubled this year, driving the benchmark Kospi index up more than 50% year-to-date.

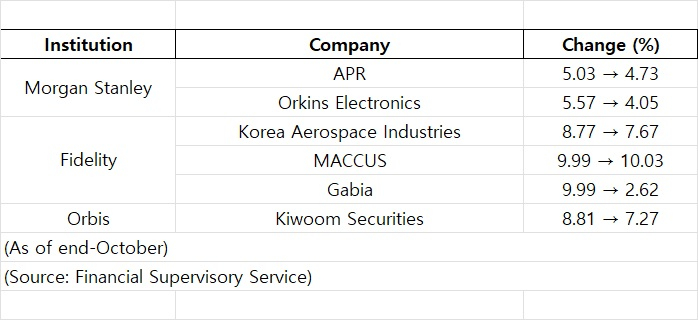

Morgan Stanley cut its stake in APR Co., a fast-growing cosmetics company, to 4.73% from 5.03% in October, according to the Korea Exchange.

The cosmetics maker is on track to surpass 1 trillion won ($687 million) in annual sales for the first time on robust exports this year, propelling its share price up 358% year-to-date and swelling its market capitalization to nearly 7 trillion won.

Analysts said the investment bank have reduced its stake in the stock on the view that the stock has already priced in the expectations of APR’s inclusion in the MSCI Korea Index.

Morgan Stanley also reduced its holding in Orkins Electronics Co., a Kosdaq-listed semiconductor testing equipment maker, to 4.05% from 5.57%.

The stock has more than doubled this year on expectations for a strong earnings rebound.

Operating profit at Orkins is projected to reach 10 billion won, boosted by new contracts from Samsung Electronics Co. Last year, it swung to an operating profit of 1.9 billion won.

Fidelity Management & Research Co. has been steadily lowering its stake in Korea Aerospace Industries Ltd. (KAI) in the second half of this year, trimming it to 7.67% in October from 9.38% in April.

Shares of the defense contractor have more than doubled this year, reflecting optimism over its export growth.

Fidelity, however, slightly raised its position in semiconductor solutions provider Makus Co. to 10.03% from 9.99%, while slashing its holding in cloud company Gabia Inc. to 2.62% from 9.99%.

Separately, Orbis Investment Management pared its stake in Kiwoom Securities Co. to 7.27% from 8.81%.