The commercial real estate market in the US and Europe is showing early signs of a rebound, supported by limited supply after a construction slowdown during COVID-19 and easing borrowing costs, portfolio managers said at ASK 2025 on Oct. 30.

Offices, hit hardest by high interest rates and pandemic-era social distancing, has begun to deliver positive returns since the first quarter of this year after their valuations plunged by up to 50% since 2022.

“Now is a compelling entry point for the US real estate market,” said Jonathan Epstein, managing partner at BGO, a real estate investment firm.

STRUCTURAL SHIFT

3650 Capital said the real estate market is facing a structural shift with the AI evolution and automation, adding that technology innovation will widen the dispersion of returns.

“3650 believes the US commercial real estate is experiencing input demand shift on par with those of the industrial revolution,” Justin Kennedy, co-founder and managing director at the US commercial real estate laon servicing company.

The widening gap in returns is evident not only across asset classes, but also within individual segments — even by zip code in the same city.

Kennedy cited two Manhattan office towers — Worldwide Plaza and Park Avenue Tower –located less than a 30-minute walk apart.

Worldwide Plaza is valued at about $190 per square foot, compared with roughly $1,200 per square foot for Park Avenue Tower. Worldwide Plaza boast marquee tenants, including JPMorgan, Citadel, Carlyle Group and Blackstone.

“Vast return dispersion arises from micro market distinctions,” he said.

The gap in residual land values between prime and lower-tier properties has also widened significantly

“AI and automation will drive the next wave of volatility in logistics real estate,” Kennedy said during a presentation titled “Evolving technologies drive performance volatility and dispersion.”

3650 Capital advises investors to adopt “alpha-focused, property-level targeting” rather than broad, beta-style allocation.

Epstein at BGO echoed Kennedy, saying: “Price dislocation and return dispersion makes asset selection key.”

TRANSITIONAL LENDING

With demand for non-bank credit expected to rise, transitional lending in the commercial real estate sector is set to expand, according to Wellington Management and PIMCO.

A rebound in real estate transaction volume and refinancing needs will propell growth in private credit, particularly transitional loans, while traditional lenders pull back amid tightening regulations, said Nuveen.

Of nearly $6 trillion of commercial real estate debt in the US, about $1.9 trillion of loans in the US commercial real estate sector are looming to mature through 2027, PIMCO estimated.

“A $1.9 trillion refinancing wall has created an ideal environment for private lenders to step in,” said Ravi S. Anand, head of private real estate debt at Wellington.

Transitional lending is a form of debt financing that provides borrowers with funds to execute on transitional business plans and redevelopment opportunities.

Anand noted that transitional lending is expected to offer stable and consistent income with as much low risk as that of senior loans.

In Europe, a lack of depth in capital markets, compared to the US with less competition for transactional loans given differing jurisdictions and country-specific regulations, coupled with significantly smaller commercial mortgage-backed securities market relative to the US, PIMCO said.

The real estate credit market has been heavily reliant on a highly fragmented banking system in Europe, PIMCO said.

“These factors drive a less efficient market and create opportunities to unlock relative value versus the US,” said PIMCO.

PIMCO said Europe would be more attractive than the US for transitional loan providers.

“While relative value can shift, we believe Europe currently offers a more attractive spread environment than the US,” PIMCO said. “We see attractive relative value in transitional loans,” PIMCO said.

Nuveen said that commercial real estate debt has the potential to deliver strong risk-adjusted and absolute return, adding that the real estate cycle in Europe is at or close to bottoming out.

“Lending against these lower values provides an increased level of protection to the lender relative to the recent past,” Nuveen said.

Following price declines, loan-to-value (LTV) ratios have correspondingly increased from 50-60% prior to 2022, it added.

“SILVER TSUNAMI”

The residential sector, including student and senior housing, remain attractive amid persistent supply shorages, urbanization trends and demographic shifts.

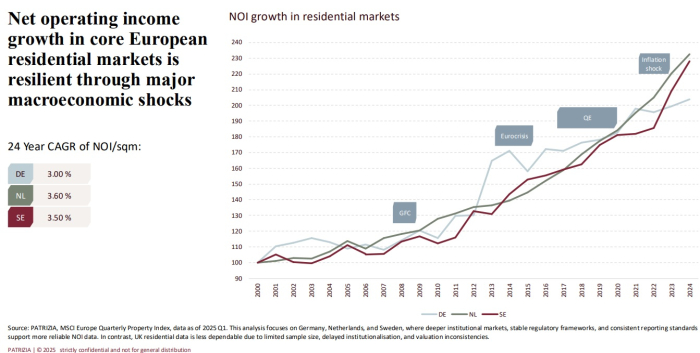

“Current construction activity is declining, mirroring the downturn seen during the global financial crisis between 2007 and 2010,” said Felix Speetzen, director and fund manager at Patrizia, in a presentation about the European real estate market outlook. “Capture an attractive market entry window.”

Since late 2024, European capital has returned to the residential sector in the region, with a strong concentration in the UK, it said,

In the US, the population aged 80 and older is expected to grow by 93% through 2040, BGO said, describing the trend as “silver tsunami.”

INDUSTRIAL PROPERTIES

Under the Trump administration’s protectionist policies, the onshoring of key industries, including pharmaceutical facilities, semiconductors plants and shipyards will also underpin the country’s industrial real estate market, BGO said.