SINGAPORE — Family offices in Singapore are growing more interested in investments in South Korea as Asia’s fourth-largest economy is expected to pick up, led by the robust semiconductor industry amid the global artificial intelligence boom, despite risks to US trade.

Asset managers in Singapore said the outlook for not only South Korean tech industries but also consumer sectors such as cosmetics is bright.

“Korea presents a great opportunity for family offices in Singapore seeking to diversify and grow their investment portfolios through innovation-led sectors and emerging consumer markets,” Sen Sui, CEO of Luminas Financial Pte Ltd, said in a keynote speech at ASK Singapore 2025 on Monday.

The Singapore-based fund management firm sees South Korea’s AI, healthcare and digital infrastructure as formidable growth engines, Sui said.

The Northeast Asian country’s rising consumer class presents unique opportunities for global family offices seeking diversified exposure, he added.

Kee Lock Chua, CEO of Vertex Holdings, a venture capital unit of Singapore state investor Temasek Holdings, said the city-state is home to more than 2000 family offices and could become a source of capital for South Korea’s innovation ecosystems.

About 200 investors and asset managers from Singapore and South Korea attended the first alternative investment conference held in the city-state hosted by The Korea Economic Daily.

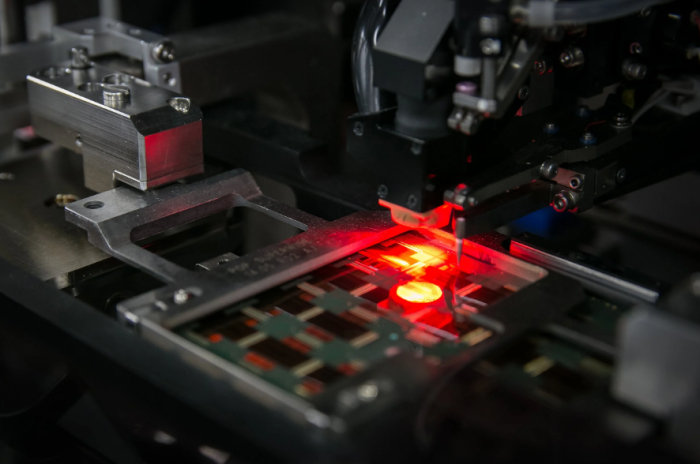

SEMICONDUCTORS TO POWER ECONOMIC RECOVERY

The South Korean economy is predicted to expand 1.9% in 2026, about double the estimated 1% growth this year, thanks to a chip supercycle, Nomura Securities Co. said.

“Amid strong AI demand, data storage and conventional server demand are driving legacy chip demand,” said Nomura Chief Economist Jeong Woo Park for Korea and Taiwan.

“Chip companies have maintained capex discipline, which is constraining their chip capacity.”

South Korea is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc. Semiconductor exports increased 16.5% to $121.1 billion in the first nine months of the year from the same period of 2024, according to customs data.

Nomura’s economic outlook is more bullish than that of the Bank of Korea, which forecasts the economy would grow 0.9% this year and 1.6% in the next. The central bank saw that the impact of US tariffs is likely to increase.

Nomura expected strong AI demand to offset tariff shock, adding that the chip cycle upswing is predicted to ease financial conditions.

South Korean startups aim to ride on the boom.

Rebellions Inc., an AI chip designer, set a goal of increasing its total addressable market (TAM) to more than $150 billion in 2027.

K-BEAUTY

Among consumer sectors, the South Korean beauty sector is one of the brightest spots for investors, Seoul-based private equity firm VIG Partners said.

The country’s cosmetics export volume ranked No. 3 in the world last year, following France and the US, and the overseas sales are expected to surpass those of the US this year, VIG said, citing the Korea Cosmetic Industry Institute.

“Domestic cosmetics players are sustaining growth as their export volumes expand across a diverse range of countries,’ said VIG CEO Chulmin Lee.

South Korea’s cosmetics exports increased 15.4% to $8.5 billion by value in January-September, a record high for such a period, according to customs data.

That highlights how K-beauty has evolved into a global consumer phenomenon, driven by innovative product design, digital marketing and the halo of Korean pop culture, industry sources said.

BOLT-ON, CARVE-OUT

South Korea is offering investment opportunities for bolt-on acquisitions and corporate carve-out deals, private equity firms said.

A bolt-on acquisition is a strategic purchase of a smaller company that is complementary to an existing business. A carve-out deal is a partial divestiture where a parent company separates a business unit to sell a portion of its equity.

Affirma Capital, a Singapore-based buyout firm, expanded its foothold in the South Korean mergers and acquisitions sector through its successful bolt-on strategy.

Affirma said bolt-on acquisitions within the same industry in the country can effectively lower blended entry multiples.

Accelerating retirement among baby-boomer small and medium-sized enterprise founders in South Korea and the country’s high inheritance tax regime are also driving a structural shift toward divestment over family succession, Affirma said.

South Korea’s inheritance tax rate is 50%, the second highest among Organization for Economic Co-operation and Development (OECD) member countries, following Japan with 55%.

GOVERNANCE CHANGE, LIQUIDITY

The South Korean tax system frustrated corporate funders about how to transform their companies within their families, causing family feuds and disputes with third parties, said Samuel Kim, a partner of Affinity Equity Partner.

Those issues, along with spin-offs, a change in corporate governance, created opportunities for the private equity industry, he said.

In addition to the opportunities, the South Korean private equity market has ample liquidity, which allows quick exits, said Joseph Lee, head of IMM PE’s head of global growth.

“One thing that I would point out is the liquidity of the Korean private equity market and we are able to get capital back to our investors in a pretty set period of time,” Lee said during a panel discussion.

REAL ESTATE

The South Korean real estate sector is likely to attract foreign investors as the central bank is likely to cut interest rates and the won currency remains weak, property market experts said.

The Bank of Korea last week kept policy interest rates unchanged, given the overheating housing market and a declining currency, but left the door open for another cut, pushing the won down even further.

“Korean assets are relatively attractive to cross-border investors, benefiting from favorable entry valuations due to the weaker Korean currency won and lower hedging premium,” said Samsung SRA Asset Management Global CIO Jae Yeon Kim.

Foreign investors are growing more interested in commercial real estate sectors beyond office and logistics, such as data centers, rental housing and hotels, according to Samsung.

Savills saw the outlook for office, logistics, hotel and data center sectors as bright.

By Jongwoo Cheon

jwcheon@hankyung.com

Jennifer Nicholson-Breen edited this article.