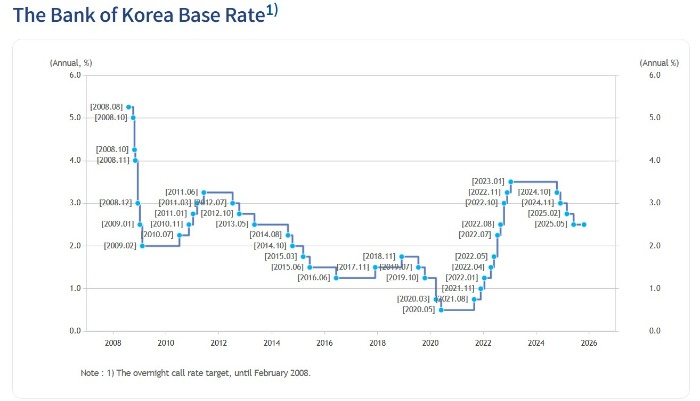

South Korea’s central bank is expected to leave its benchmark interest rate unchanged at 2.5% next week, with economists expecting policymakers to keep their focus on stabilizing the property market and volatile currency ahead of the US Federal Reserve’s rate decision.

According to a survey of 20 economists belonging to The Korea Economic Daily (KED) Economists Club on Sunday, all respondents projected that the Bank of Korea (BOK) will hold rates at its Oct. 23 meeting.

The BOK sets its policy rate once every six weeks, approximately eight times a year, with two meetings remaining in 2025 – one this month and the final review in November.

It lowered borrowing costs by a total of half a percentage point in February and May before keeping policy steady in July and August.

Economists expect the BOK will need some time to assess the impact of the government’s latest real estate market measures announced last week to rein in runaway housing prices before deciding on any further easing.

“The BOK will likely monitor how the recent government’s macro tightening steps influence financial stability before making another move,” said Park Seok Gil, head of research at JP Morgan in Seoul.

PROPERTY RISKS REMAIN KEY CONCERN

The property market remains the biggest variable in monetary policy this year.

Nine of the 20 respondents, or 45%, said housing prices and household debt trends would be the BOK’s top considerations when deciding the timing of a rate cut.

Experts are, however, skeptical that the latest government plan will meaningfully curb home prices.

All 20 respondents said the newest package would not reverse the market’s upward trajectory, with 90% saying it would only slow the pace of gains.

“Demand-suppression measures through regulations can reduce transactions but have limited impact on sellers’ pricing,” said Park Choo n-sung, research fellow at the Korea Institute of Finance.

Lee Sang-ho, head of the Federation of Korean Industries’ economic and industrial research department, said expanding housing supply would be more effective than demand controls.

Despite repeated interventions since President Lee Jae Myung took office in June, housing prices have continued to climb, driven by limited supply and redevelopment constraints.

Household debt has also swelled to near record levels.

BOK Governor Rhee Chang-yong has warned that premature easing could reignite asset bubbles and put further pressure on the currency.

FX VOLATILITY LIMITS POLICY ROOM

Economists also said growing volatility in the foreign-exchange market makes it difficult for the BOK to move ahead of the US Fed.

The Korean won briefly weakened to 1,431 per US dollar midweek last week before stabilizing in the 1,410-1,420 range later.

Seventy-five percent of surveyed economists said the won’s current level is “somewhat high,” while 10% called it “excessively high.”

Many cited delays in tariff negotiations between Seoul and Washington, shifts in investor flows and sluggish domestic growth as contributing factors.

“The won is trading higher than fundamentals suggest, influenced more by external conditions than by Korea’s current account surplus or reserves,” said Lee Yoon-soo, economics professor at Sogang University.

“With FX risks elevated, the BOK will find it hard to move ahead of the Fed before confirming a US rate cut in November,” Lee added.

Of the survey respondents, 75% expect the won to gradually strengthen toward the 1,300 range by year-end, with half predicting a 1,375–1,400 range.

RATE CUT EXPECTATIONS SHIFT

Against this backdrop, most economists expect the BOK to move slowly despite growing calls for monetary easing.

Twelve out of 20 respondents, or 60%, forecast the first rate cut in November, while the remaining 40% expect no change this year.

Among them, 10% anticipate a cut in January, 20% in February and another 10% after April.

A widening rate gap with the US would put additional downward pressure on the won, worried economists.

Some analysts also said the BOK’s urgency to cut rates has diminished as the semiconductor cycle improves and the country’s growth is expected to rebound next year.

“With chip exports recovering, the need for aggressive easing has eased,” said Ahn Ki-tae, economist at NH Investment & Securities Co.

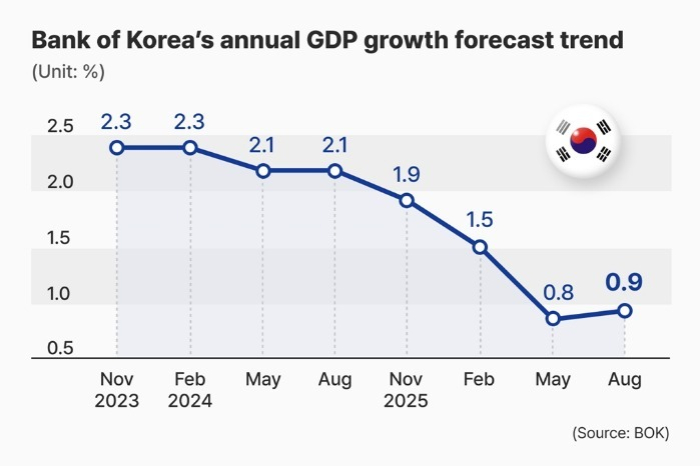

In August, the BOK kept its policy rate steady for a second straight session, with five of six board members backing the freeze, and nudged up its 2025 growth forecast to 0.9% from 0.8% as fiscal stimulus cushioned a sluggish economy.

The central bank’s growth projections align with the country’s finance ministry’s 0.9% growth forecast for this year and remain below the OECD’s 1% estimate.

Global investment banks such as Goldman Sachs and Citi have turned slightly more optimistic, citing stronger-than-expected second-quarter data.

All 20 economists belonging to the KED Economists Club projected the BOK’s base rate will stand around 2.15% by mid-2026 and 2.05% by the end of the year.

Only three respondents, or 15%, forecast a rate below 2% by late next year, half the number who expected that level in July, suggesting shrinking expectations for aggressive monetary easing.

By Jin-gyu Kang

josep@hankyung.com

Sookyung Seo edited this article.