South Korea has thrown down the gauntlet in a three-way battle for the throne of the global machine tool industry, long dominated by Germany and Japan, as a wave of mergers and acquisitions gathers pace amid the sector’s rapid shift toward artificial intelligence.

At the forefront is DN Solutions Co., Korea’s top machine tool maker and the world’s No. 3 metal-cutting machine maker.

Last month, the relatively young Korean company, founded less than 50 years ago, stunned the industry with a takeover bid for Heller Maschinenfabrik GmbH, a German CNC machine tool and manufacturing systems maker with a 130-year history.

DN Solutions, formerly Doosan Machine Tools Co., is now awaiting regulatory approval in Germany to acquire 100% of Heller, industry sources said Sunday.

If cleared, the deal is expected to close in January and lift DN Solutions’ annual sales above 3 trillion won ($2.1 billion), nearly on par with the global No. 2, Japan’s Yamazaki Mazak Corp., which posted 309.4 billion yen ($2.1 billion) in revenue.

Heller itself generated 791.7 billion won in sales in 2024.

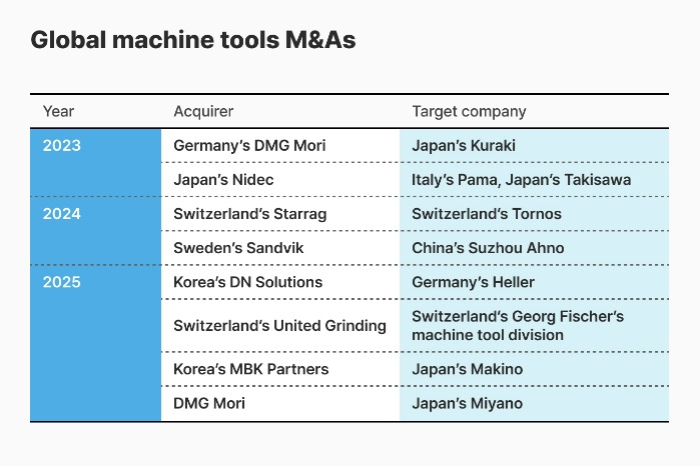

Analysts say DN Solutions’ bid for Heller is an inevitable step to remain competitive in a global machine tool sector, where consolidation has intensified in recent years.

As machine tools are considered a strategic industry, the three leading nations are expected to accelerate M&A activity in their race for the throne.

M&A FRENZY ACROSS BORDERS

This year has seen more machine tool deals than ever.

Japan’s Nidec Corp., which has scooped up local rival MHI Machine Tool and Italian machine tool giant Pama since 2021, launched a hostile bid in April for Makino Milling Machine Co., the world’s fifth-largest machine tool maker.

But the gambit backfired, as hostile takeovers carry a stigma in Japan.

Instead, North Asia-focused private equity giant MBK Partners was chosen as the preferred bidder, putting the brakes on Nidec’s rapid expansion.

Founded in 1937, Makino has long been regarded as a household name in Japan’s ultra-precision machine tools, tightly held by its founding family for nearly 90 years.

The prospect of such a storied Japanese company being sold – and not to a domestic rival but to the Seoul-headquartered buyout firm – sent shockwaves through the industry.

Germany and Japan, wary of Korea’s aggressive advance, are hardly sitting still.

DMG Mori Co., born from the merger of Germany’s DMG and Japan’s Mori Seiki, acquired Japan’s Kuraki Co. in 2023 and added Miyawaki Machinery earlier this year.

Elsewhere, smaller machine tool nations are also bulking up.

In July, Swiss grinding-machine specialist United Grinding Group acquired the machine tool division of Georg Fischer AG for about 900 billion won.

In China, Shenyang Machine Tool merged with Tianjin Tianduan Press Co., combining cutting and pressing technologies to strengthen their domestic position.

AI AND SUCCESSION PRESSURES

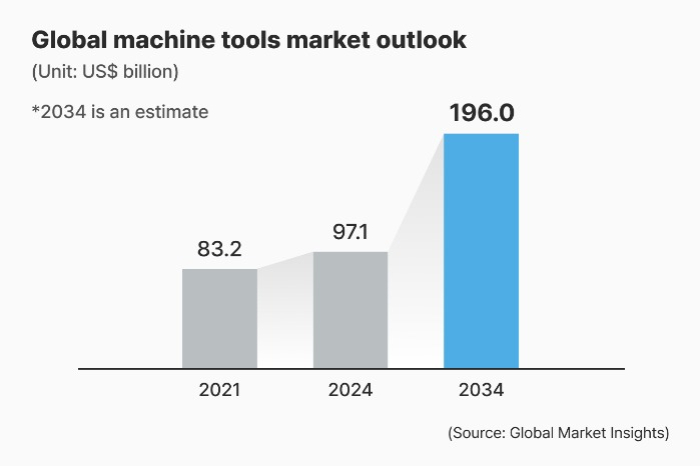

Analysts expect consolidation in the machine tool industry to accelerate further as companies grapple with the twin pressures of AI-driven automation, or AX, and succession challenges at family-run firms.

Machine tools, often called the “mother machines” because they make other machines, sit at the heart of the manufacturing supply chain.

As automakers, semiconductor producers and aerospace firms demand AI-optimized equipment, global leaders are racing to expand their product lines and integrate digital solutions.

That drive is fueling the scramble for scale and intensifying the rivalry among Korea, Germany and Japan.

Succession risk is also adding to the upheaval in traditional strongholds.

According to US investment analysis platform Ainvest, about 560,000 German small- and mid-sized firms will face succession issues by 2026, with nearly 190,000 at risk of closure due to a lack of heirs.

“In family-owned firms, it’s becoming harder to raise the massive capital required for AX,” said one industry executive.

“That’s why prized companies are coming onto the market, and the ability to capitalize on this restructuring wave will define the next generation of industry leaders.”

By Jung-hwan Hwang

jung@hankyung.com

Sookyung Seo edited this article.