BlackRock Inc. has scored big in South Korea’s equity market, booking estimated gains of almost 70% on its Korean portfolio built around long-term bets on the country’s top semiconductor and financial stocks.

According to the Korea Economic Daily’s analysis on Wednesday, BlackRock’s Korean portfolio based on Kospi-listed companies where it holds at least a 5% stake is valued at about 37.8 trillion won ($28 billion) as of Tuesday, equivalent to 1.1% of the market’s capitalization.

The firm invests through its advisory arm, BlackRock Fund Advisors, and counts among its holdings Korea’s four biggest financial groups – Hana Financial Group with a 6.43% stake, Woori Financial Group with 6.07%, KB Financial Group Inc. with 6.02% and Shinhan Financial Group with 5.99%

It also owns a 5.07% stake in Samsung Electronics Co., 5.01% of Samsung SDI Co. and 5% of Samsung E&A Co., formerly Samsung Engineering Co., along with more than 5% stakes in Naver Corp., Posco Holdings Inc. and Coway Co., which underscores its focus on liquid, large-cap names with global growth potential.

The US investor’s stellar returns are credited to its dual approach, with broad passive exposure through its iShares ETFs tracking Korea’s large-cap stocks, paired with long-term holdings in undervalued blue chips.

BlackRock moved aggressively to pick them up in 2018 and 2019, when trade tensions and global market jitters left export-reliant Korean firms trading at steep discounts to global peers.

BIGGER THAN SAMSUNG’S OWNER FAMILY

Samsung Electronics is by far BlackRock’s largest position, worth 25.4 trillion won, more than three times the stake held by Chairman Lee Jae-yong and even larger than the combined holdings of Samsung’s founding family.

BlackRock bought roughly 300 million Samsung shares in early 2019, when the stock traded around 45,000 won, at just 10 times earnings.

The shares closed near 85,000 won on Tuesday, leaving BlackRock with an estimated gain of 12 trillion won, or 89.3%.

Its standout winner, however, has been KB Financial Group.

The investor began buying the financial holding firm’s shares in February 2021 at about 35,000 won per share.

The stock has since surged to 115,400 won, a whopping 223% gain that translates into nearly 2 trillion won in paper profits.

Similar wagers on Shinhan, Hana and Woori Financial have also paid off.

BlackRock’s record with SK Hynix, Korea’s another chip giant, is equally striking. It lifted its stake to 5% in 2018, when the chipmaker traded at just seven times earnings, well below the market average.

Had it maintained the full 5% position, it would have delivered 319% returns. It has, however, trimmed the position below 5%.

LONG-TERM BETS PAY OFF

Market analysts say BlackRock’s Korea portfolio underscores the benefits of patient capital.

“They picked up blue-chip names when they were cheap and simply sat on them,” said a market strategist at a Seoul-based brokerage. “It’s a reminder that long-term investors outperform.”

The gains come as BlackRock looks to deepen its presence in Asia’s fourth-largest economy.

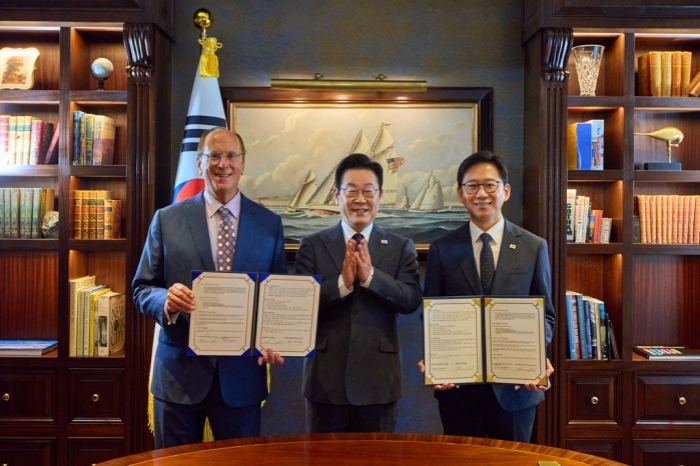

The world’s largest investor, which manages $12.5 trillion globally, signed a memorandum of understanding earlier this week with Korea’s Ministry of Science and ICT to collaborate on artificial intelligence investment.

After meeting South Korean President Lee Jae Myung in New York on the same day, BlackRock Chairman Larry Fink pledged to help position Korea as the “AI capital of Asia” by channeling global investment into the country’s fast-growing sector, according to the president’s office.

By Ye-Jin Jun

ace@hankyung.com

Sookyung Seo edited this article.