K-Beauty’s rising stars are steering clear of outside capital, opting instead for self-financed growth supported by solid cash reserves, data-driven decision-making and niche positioning sharpened by digital marketing.

The Founders Inc., which owns skincare brand Anua, has lately drawn heavy interest from private equity and venture capital firms, according to investment banking sources, as investors hunt for the next breakout after APR Co.’s market cap reached 8 trillion won ($5.7 billion), and Goodai Global Inc. raised funds at a 4.4 trillion won valuation.

However, The Founders has no immediate plans for a funding round or an initial public offering as it has chosen to pursue independent growth for now.

Founded by Lee Chang-ju and Lee Sun-hyung in 2019, the company has emerged as one of the fastest-growing players in K-beauty. It owns not only Anua but also other brands such as Project 21 and From LABS.

It posted an operating profit of 145.7 billion won in 2024, more than triple the prior year, on sales of 427.8 billion won, nearly quadruple. Overseas sales accounted for more than 90% of its revenue.

MANAGEMENT AND MARKETING PROFESSIONALS

The founders, both Seoul National University business administration graduates, lacked direct experience in the beauty industry but leaned on data analysis and management strategy to build the company.

They recruited professionals with backgrounds in consulting to lead product development and marketing, emphasizing data-driven decisions.

The Founders analyzes customer reviews, repurchase rates and social media reactions to refine existing products and design new ones. Marketing strategies are guided by short-form content trends on TikTok and YouTube as well as metrics from e-commerce platforms.

Aggressive expansion into global retail channels, including Amazon.com and Ulta Beauty, has been central to its rapid growth.

K-MASKS

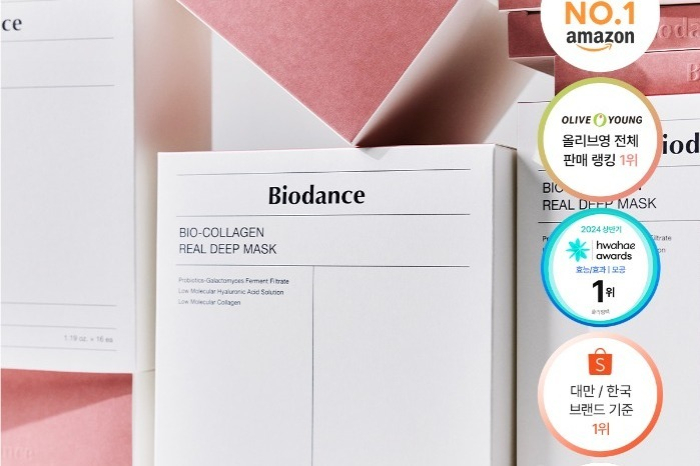

Beauty Selection Inc., the company behind the hit face-mask brand Biodance, is also on investors’ radar.

Biodance mask packs have become a global K-beauty sensation thanks to their efficacy and savvy digital marketing.

Viral TikTok clips of young women applying the creamy-white sheet mask at night and peeling it off the next morning to reveal glowing skin have propelled the brand to international recognition.

As the videos spread, Biodance masks quickly reached the shelves of Amazon.com, Sephora and Boots, and, during Black Friday and Cyber Monday, became the top-selling item in Amazon’s beauty and personal care category.

The surge in demand lifted Beauty Selection’s annual sales to 135.6 billion won in 2024, more than triple the previous year, while the company swung to an operating profit of 26.7 billion won from a 4.6 billion won loss.

The company’s strength lies not only in its savvy use of social media platforms like TikTok but also in its ability to rapidly collect consumer feedback and feed it into product design.

Founder and Chief Executive Park Jae-bin, a former Hyperconnect executive with expertise in data analysis and platform strategy, leads the company alongside co-founder and Chief Product Officer Kim Mi-hwa, a cosmetics professional in charge of product development and customer experience.

In 2022, Beauty Selection raised 300 billion won in a Series A round backed by investors including Alto Ventures. While investors are said to be exploring a follow-up round, the company said it has no immediate plans for additional funding.

“Our expansion into Europe and beyond has only just begun, and we are now in the stages of executing our organic growth strategy,” a company official said.

DATA AND PLATFORMS DRIVE RAPID GROWTH

An investment banking industry official noted that breakout players such as The Founders and Beauty Selection are fueling growth by leveraging data and global platforms, whereas older rivals often depended more on intuition and broad market trends.

“The rapid rise of these two companies has been driven by data-based product planning and development, supported by marketing tailored to multiple global platforms,” the official said.

In general, cosmetics companies with sound fundamentals do not need a steady infusion of outside capital. With an average cost-to-sales ratio of about 15%, they require relatively little working capital.

They also avoid stockpiling inventory, and their cash turnover is typically high because cosmetics are fast-moving consumer goods, allowing them to finance growth internally.

Their global expansion, likewise, does not demand massive investment in infrastructure such as warehouses or logistics centers. Instead, cosmetics brands can enter new markets quickly through international e-commerce platforms.

“A beauty brand with established global recognition can sustain organic growth with its own cash and by using global platforms, so there is little urgency to raise outside funds, which would only dilute existing ownership stakes,” another IB industry official said.

By Da Eun Choi

max@hankyung.com

Sookyung Seo edited this article.