The heads of South Korea’s largest conglomerates are heading to the US to support a Seoul-Washington summit, with investors watching closely for any announcements of fresh investment commitments in semiconductors, batteries, shipbuilding and autos.

Samsung Electronics Co. Chairman Lee Jae-yong, known in the international community by his English name Jay Y. Lee, departed for Washington, D.C., on Sunday afternoon, accompanied by senior executives, including Vice Chairman Chung Hyun-ho who’s in charge of Samsung’s business support; Samsung Heavy Industries Co. Vice Chairman Choi Sung-an; Samsung C&T Corp.’s construction unit Chief Executive Oh Se-chul; and Samsung Electronics Global Business Cooperation CEO Kim Won-kyong.

Earlier in the day, SK Group Chairman Chey Tae-won left Seoul, telling reporters he would “do his best” as part of Korea’s official business delegation.

LG Group Chairman Koo Kwang-mo and Hanwha Group Vice Chairman Kim Dong-kwan followed soon after, while Hyundai Motor Group Chairman Chung Euisun, who is on an overseas trip, is expected to join them in the US.

SMALLER SCALE BUT DELEGATION SEEKS REALISTIC RESULTS

The business entourage is smaller than in April 2023, when more than 120 companies joined then-President Yoon Suk Yeol’s state visit to the US.

This time, Seoul has opted for a more compact group of executives capable of delivering concrete investment outcomes, sources said.

Korean President Lee Jae Myung, who arrived in Washington, D.C., on Monday for his summit with Trump later in the day, is accompanied by a delegation of 15 Korean conglomerate chiefs led by Federation of Korean Industries (FKI) Chairman Ryu Jin and SK Group’s Chey, who simultaneously heads of the Korea Chamber of Commerce and Industry (KCCI).

The delegation includes HD Hyundai Co. Vice Chairman Chung Ki-sun; Hanjin Group Chairman Cho Won-tae; Doosan Enerbility Co. Chairman Park Gee-won; Celltrion Inc. Chairman Seo Jung-jin; CJ Group Chairman Lee Jae-hyun; GS Group Chairman Huh Tae-soo; LS Group Chairman Koo Ja-eun; Korea Zinc Inc. Chairman Choi Yun-birm; and Naver Corp. CEO Choi Soo-yeon.

SAMSUNG LIKELY TO ANNOUNCE NEW INVESTMENTS

Investors are keen to know whether Samsung and other major Korean companies will make new investment commitments to strengthen their business in the US and secure tax benefits and subsidies from the US government.

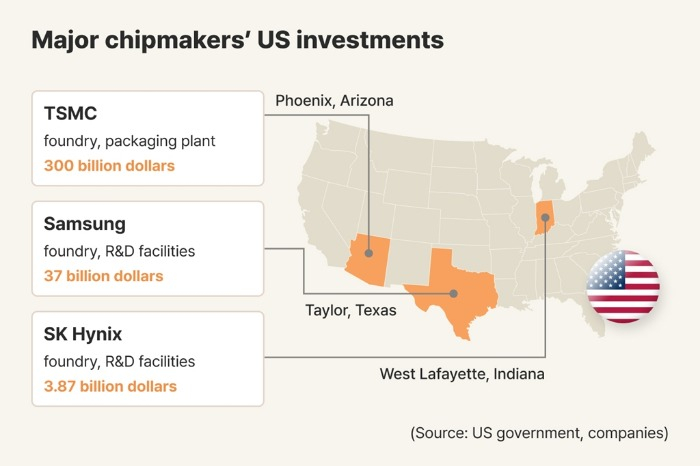

Samsung is currently building a foundry plant in Taylor, Texas, while SK is set to embark on the construction of an advanced semiconductor packaging plant in West Lafayette, Indiana, which will focus on packaging high-bandwidth memory (HBM) chips.

Samsung has pledged $17 billion in Taylor by 2030 and lifted its total US investment commitment to $37 billion last year, but all those decisions were made under the Biden administration.

Samsung has not unveiled new US investment plans since Donald Trump returned to the White House for his second term, and Washington is weighing whether to demand equity stakes from chipmakers that receive subsidies under its CHIPS Act.

During its second-quarter earnings conference call with analysts, Samsung said it expects to ramp up investments in the Tayor plant next year.

AUTOS, SHIPBUILDING

Hyundai Motor Group in March announced a plan to invest $21 billion in the US autos, parts, logistics, steel and future industries through 2028.

LG Energy Solution Ltd., a battery-making arm under LG Group, is building multiple joint and independent battery-manufacturing plants across the US.

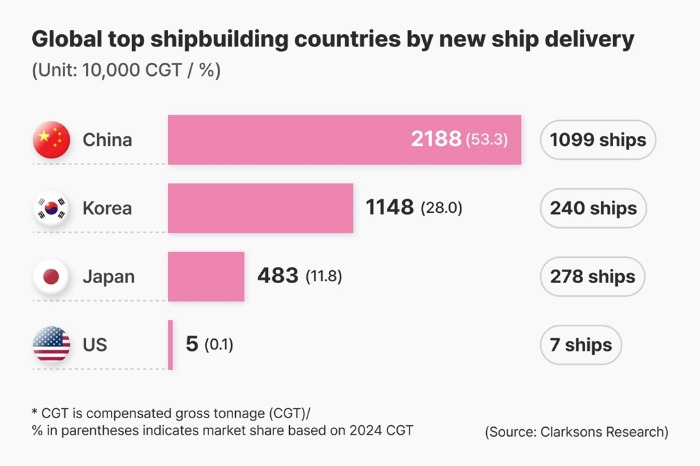

Conglomerates also in the limelight are Hanwha Group and HD Hyundai, which are expected to lead Seoul’s $150 billion shipbuilding cooperation initiative, dubbed “Make American Shipbuilding Great Again” (MASGA), aimed at revitalizing the US shipbuilding industry.

The initiative played a key role in striking the Korea-US trade deal.

Reflecting its importance, President Lee will visit Hanwha Ocean Co.’s local shipyard, Hanwha Philly Shipyard, in Philadelphia on Aug. 26, joined by senior US political and business figures.

The shipyard is central to the MASGA plan, and Hanwha executives will brief about the US shipyard’s shipbuilding plan during Lee’s visit, sources said.

BATTERIES, DEFENSE

Korean battery makers are also ramping up their activity in the US.

SK On Co. operates two standalone sites under SK Battery America, while LG Energy Solution has its own plants in Michigan, Ohio and Tennessee as well as its joint venture with GM, Ultium Cells LLC.

The Lee-Trump summit will also spotlight the defense-related warship repair business.

Hanwha, under Vice Chair Kim Dong-kwan’s leadership, acquired the US shipyard Philly Shipyard last year, while HD Hyundai Heavy Industries Co. has won contracts for US Navy ship maintenance, repair and overhaul (MRO) services.

Analysts said business executives are expected to play a visible role in the summit, not just to showcase Korea’s readiness to invest in the US but also to address some tricky trade negotiation issues.

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.