South Korea’s beauty startup scene is attracting a wave of overseas venture capital, underscoring renewed investor appetite for the country’s consumer brands and technologies.

According to venture investment platform The VC on Sunday, at least five K-beauty startups, including cosmetics e-commerce platforms and indie brand incubators, have secured foreign funding over the past year.

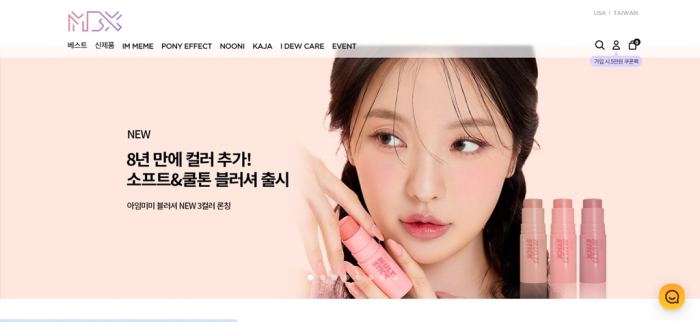

These include Memebox, Bplant, Jungsaemmool Beauty (JSM Beauty), SkinSeoulLab and Best Innovation.

Best Innovation, which runs Kopher, a skin brand, recently raised 23 billion won ($16.5 million) in a round backed by New York-based private equity group Ulysses Capital.

K-beauty e-commerce platform SkinSeoulLab received investments from Silicon Valley accelerator 500 Global and Singapore-based Blueprint Ventures.

Bplant, which operates skincare brand Kurved, attracted 7 billion won from US venture investor Altos Ventures last month.

BENOW: KOREA’S SECOND BEAUTY UNICORN AFTER APR

The surge in cross-border deals comes as the K-beauty sector produces its second unicorn, or an unlisted firm with an enterprise value of over 1 trillion won.

BENOW, a beauty startup, was valued at more than 1 trillion won in its latest fundraising, according to the Ministry of SMEs and Startups.

That makes it the first K-beauty unicorn since beauty-tech company APR Co. crossed the threshold in 2023.

APR, which went public last year, has since overtaken Amorepacific Corp. in market value, with its capitalization exceeding 8 trillion won.

Investor enthusiasm has spilled over into policy.

Korea Venture Investment Corp. (KVIC) recently added beauty-tech, including medical aesthetic devices, as a target sector for its state-backed “K-Bio Vaccine Fund”.

Domestic investors are also ramping up exposure: Seoul-based The Ventures said meeting requests from beauty-tech founders have tripled over the past year, while the share of beauty startups under its investment review jumped to 18.4% this year from 5.8% in 2024.

Analysts said the flurry of deals reflects both the enduring global demand for Korean beauty products and the growing integration of beauty with technology, ranging from AI-driven skincare diagnostics to at-home aesthetic devices.

By Eun-Yi Ko

koko@hankyung.com

In-Soo Nam edited this article.