South Korea’s electric vehicle market is showing signs of recovery after a prolonged slowdown, with both new and used car sales rebounding fast.

EV sales in July rose 67% from the same month last year to 25,148 units, according to data from Carisyou Data Research. Electric models accounted for the highest-ever 16.7% of all new vehicle sales in the month.

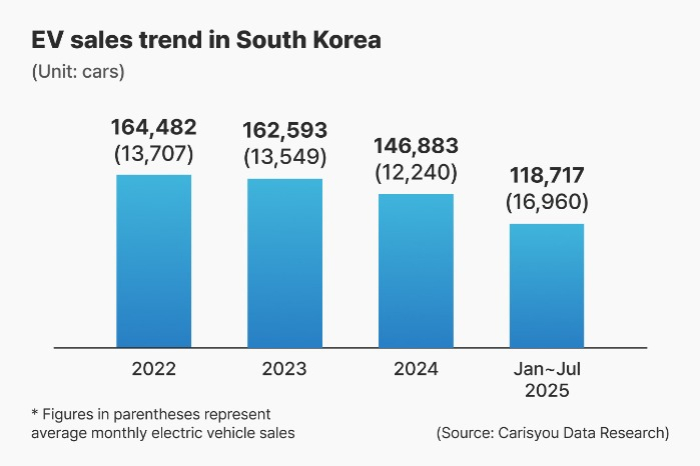

Monthly average EV sales year to date have reached 16,960, surpassing the previous peak of 13,707 in 2022.

Industry observers attribute the recovery largely to a wave of new EV model launches.

The IONIQ 9, an all-electric sport utility vehicle released in February by Hyundai Motor Co., posted its best month yet in July with 1,137 units sold. Kia Corp.’s EV4 sedan, which debuted in March, recorded 1,485 sales, up 38.4% from June.

Kia’s EV3 and Ray EV also saw year-over-year gains of 11.3% and 2.5%, respectively.

Foreign EV brands also fared better than before, with Tesla Inc.’s Model Y facelift, which hit the market in April, sold 6,559 units last month.

Thanks to solid demand for EVs, used EV prices rose 0.8% in July from January, bucking declines in gasoline and diesel models, which fell 4.9% and 4.1%, respectively.

SILVER LINING

Signs of a broader recovery are emerging globally as well.

While EV sales in North America slipped 0.8% year-over-year in the first half of 2025, Europe and China posted gains of 28.3% and 38.4%, respectively.

The strong EV demand in Europe and Asia has helped Korean EV exports bounce back recently.

In June, the country’s battery-powered car exports increased 11.2% on-year to $780 million in value and 21.4% to 22,343 units in volume. This marked the first gain in Korean EV exports since January 2024.

“The shift away from internal combustion engines toward hybrids and EVs is now being reflected in the retail market,” said an official from the auto industry, noting that Hyundai Motor now offers only one pure gasoline model, the Venue.

Some analysts see a silver lining in the prolonged EV chasm, a temporary dip in EV demand as the market struggles to move beyond early adoption.

As the European Union has further tightened regulations on car emissions this year, the bloc’s auto market has been restructured around EVs.

Still, challenges remain.

Due to a shortage of EV charging stations and related infrastructure, on top of high battery costs, premium large-sized EV sales remain stagnant.

“Right now, the market is being driven by lower-priced EVs,” said an official from the battery industry. “We’ll only know the chasm is truly over when high-end models start to lead sales.”

By Gil-Sung Yang

vertigo@hankyung.com

Sookyung Seo edited this article.