Korea Investment & Securities Co. (KIS), the brokerage unit of Korea Investment Holding Co., is exploring a strategic partnership with US private credit specialist Muzinich & Co.

KIS said on Tuesday that the partnership would aim to diversify its global bond portfolio and bolster competitiveness in the high-yield and private lending space.

The two firms held high-level discussions at Korea Investment & Securities’ headquarters in Seoul, according to Korea Investment.

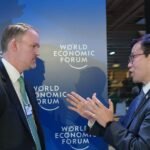

The talks were attended by Justin Muzinich, chief executive of Muzinich & Co., and Kim Jae-pil, the Korea head of KIS.

A KIS official said the two leaders exchanged views on evolving dynamics in the global private credit market and explored strategic approaches, particularly focusing on the US direct lending landscape and parallel lending opportunities in Europe.

HIGH-YIELD BOND, PRIVATE PLACEMENT SPECIALIST

Muzinich & Co. manages $37.3 billion globally across public and private credit markets.

The firm is known for its focus on high-yield bonds and private placements in the US credit market. It also specializes in bank-partnered co-lending structures in Europe.

In January, Muzinich & Co. opened a Korean office as part of a broader push into Asia.

Korea Investment & Securities has been working closely with global giants such as Goldman Sachs, the Carlyle Group and the Capital Group via strategic partnerships to offer various global financial products tailored for Korean investors.

SECOND MUZINICH FUND FOR KOREAN INVESTORS

KIS sees the potential collaboration with Muzinich as a way to strengthen its alternative investment offerings for domestic clients, particularly in higher-yielding fixed income products.

Last year, the Korean company launched its first Muzinich-linked fund, raising 10.9 billion won ($7.8 million), and has since recorded stable performance based on consistent coupon-based cash flows. It is now reviewing plans to launch a follow-up Muzinich fund, possibly as early as August.

“The discussions with Muzinich, a manager with distinct capabilities in global credit markets, mark an important step in expanding the scope and stability of our international bond portfolio,” said a Korea Investment & Securities official. “We will continue to deepen partnerships with specialized global managers to bring diversified investment options to Korean investors.”

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.