Hanwha Systems Co. is preparing to muscle into a strategic stronghold of South Korea’s missile defense industry, challenging long-time rival LIG Nex1 Co. in a move that could upend decades of tacit division of labor in the country’s weapons development ecosystem.

Hanwha has decided to enter the lucrative engagement control system (ECS) market, dubbed the brain of modern missile defense systems, people familiar with the matter said on Friday.

The move is shattering a decades-old gentleman’s agreement that has kept Hanwha focused on radar technology while LIG Nex1 controlled the command-and-control systems that determine how and when to intercept incoming threats.

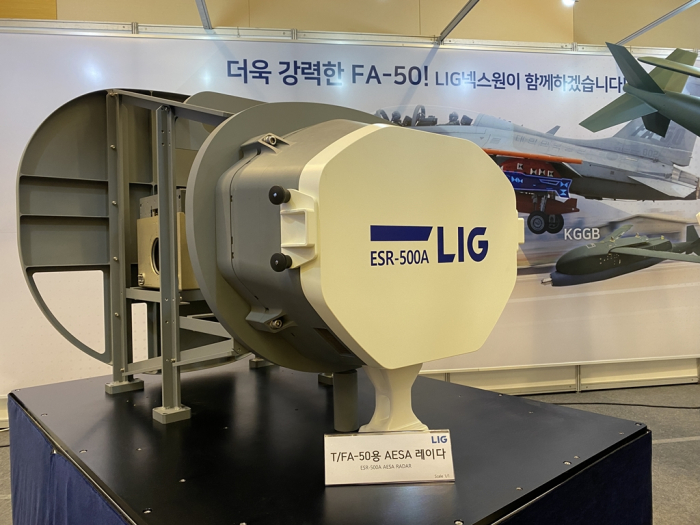

LIG Nex1, in an apparent counterattack, plans to enter the radar business – until now Hanwha’s domain, sources said.

The showdown comes as missile defense has taken on renewed urgency globally, with the Iron Dome’s performance during the recent Iran-Israel conflict heightening demand for integrated interception systems.

South Korea, under growing pressure from North Korea’s missile advances, has fast-tracked plans for its own versions of Iron Dome and terminal high altitude area defense (THAAD), fueling a multi-billion-dollar procurement cycle that defense companies are eager to dominate.

“Hanwha’s play for ECS isn’t just a commercial move. It’s an attempt to control the nervous system of South Korea’s future missile shield,” said an executive at a domestic defense contractor.

TRIPARTITE VENTURE

South Korea’s indigenous mid-range surface-to-air missile (M-SAM) system, known as Cheongung, has traditionally been a tripartite venture.

While LIG Nex1 manufactures ECS or the integrated systems, Hanwha Systems builds radar and its sister firm Hanwha Aerospace Co. makes missiles and launchers.

The trio’s collaboration helped secure export contracts for Korea’s latest flagship M-SAM, or Cheongung-II, to the United Arab Emirates and Saudi Arabia.

But Hanwha now wants a bigger share of the command structure.

Under a best-case scenario, it could mean that both the radar and ECS – two of the three major pillars of air defense – would be under Hanwha Systems’ control, with missiles made by sister firm Hanwha Aerospace.

“Hanwha is positioning itself as the sole end-to-end provider of missile defense systems,” said a defense industry executive.

IN PARTNERSHIP WITH NORTHROP GRUMMAN

Hanwha has been developing ECS capabilities behind the scenes for years and is now preparing to compete in open tenders for next-generation intercept systems, sources said.

The company is also pursuing partnerships with US defense firms, including a recent memorandum of understanding with Northrop Grumman Corp., a global leader in integrated air and missile defense technologies.

Though details of the pact weren’t initially disclosed, Hanwha insiders are now saying that the collaboration is aimed at ECS development.

Northrop Grumman is the developer of the US Army’s integrated battle command system (IBCS), the nerve center of the US’ next-generation missile shield.

LIG’S COUNTERATTACK

LIG Nex1, caught off guard by Hanwha’s challenge, is preparing its own counteroffensive.

The company is considering entry into radar development, previously dominated by Hanwha, and is expected to bid for next-generation radar contracts with the South Korean military, sources said.

The Defense Acquisition Program Administration (DAPA), South Korea’s weapons procurement agency, has traditionally preferred keeping key roles shared by several domestic defense firms to foster competition while ensuring supply chain stability.

But as defense exports soar, driven by sales to the Middle East and Eastern Europe, the business logic underpinning these traditions is being reassessed, analysts said.

BIGGER PIES LIE ABROAD

The row comes at a time when South Korea’s defense industry is transitioning from a state-led, domestically focused sector into a competitive export-driven engine.

The Korean military is expected to spend more than 3 trillion won ($2.2 billion) annually on missile defense over the next decade.

But the bigger prize may lie abroad.

The ECS market is expanding rapidly across Southeast Asia, the Middle East and Eastern Europe, as more countries seek autonomy in missile defense amid global geopolitical instability.

Industry analysts say the brewing rivalry between Hanwha and LIG Nex1 reflects a broader shift in Korea’s defense sector from a domestically focused, quasi-public utility model to a globalized, shareholder-driven industry.

“Korea’s defense firms are no longer just suppliers to the government,” said an industry official. “They’re strategic exporters – and that changes everything.”

By Sang-Hoon Sung and Woo-Sub Kim

uphoon@hankyung.com

In-Soo Nam edited this article.