SK Hynix Inc., the world’s second-largest memory chipmaker, reported a dramatic surge in first-quarter profits on Thursday, delivering the second-highest quarterly earnings in its history, driven by soaring demand for high-bandwidth memory (HBM) used in artificial intelligence applications.

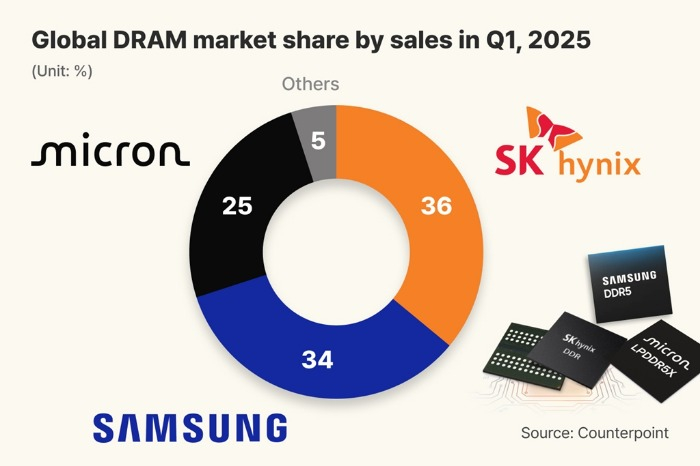

The South Korean chipmaker’s performance exceeded market forecasts and that of its domestic rival Samsung Electronics Co., underscoring its growing dominance in the premium memory sector.

The South Korean chipmaker said in a regulatory filing that its operating profit for the three months ending March reached 7.44 trillion won ($5.2 billion) on a consolidated basis, up 157.8% from a year earlier.

That’s significantly higher than the market consensus of 6.75 trillion won and Samsung’s first-quarter operating profit of 6.6 trillion won.

Revenues rose 41.9% year-on-year to 17.64 trillion won, while net profit jumped more than fourfold to 8.11 trillion won from 1.92 trillion won.

The robust results come despite what is a seasonally weaker quarter, and mark SK Hynix’s strongest-ever first-quarter performance. The figures trail only the record-breaking fourth quarter of 2024, when the company reported 8.1 trillion won in operating profit on sales of 19.8 trillion won.

STRONGER SALES OF HBM3E CHIPS

Analysts said the outperformance came largely from the rapid expansion in sales of the 12-layer HBM3E memory chips, which are critical for training large language models and other generative AI applications.

SK Hynix is the No. supplier of advanced AI chips to Nvidia Corp.

“The memory market recovered faster than expected in the first quarter, supported by AI-related demand and inventory restocking,” the company said in a statement. “We responded by ramping up sales of high-value products such as HBM3E and DDR5.”

SK Hynix’s operating margin improved to 42%, continuing an eight-quarter streak of sequential improvement. SK Hynix also reported a cash balance of 14.3 trillion won at the end of March, up 2 trillion won from the end of 2024, with debt ratios also improving.

ROSY PROSPECTS

The Korean chipmaker expects HBM shipments to double this year from the previous year, owing to its contractual model of agreeing on supply volumes with clients a year in advance.

It anticipates that 12-layer chips will account for more than half its HBM3E sales in the second quarter.

Looking further ahead, SK Hynix said it has already delivered samples of its sixth-generation HBM4 memory to key customers – the world’s first to do so – and plans to complete preparations for mass production of 12-layer HBM4 products by the end of this year.

Elsewhere, the company said it began supplying its next-generation LPCAMM2 modules for AI PCs in the first quarter, while development of SOCAMM, a low-power DRAM module for AI servers, is progressing in tandem with customer collaborations.

On the NAND front, SK Hynix remains cautious, focusing on profitability while meeting demand for high-capacity enterprise SSDs (eSSDs).

Investment discipline remains tight, with its new fab in Cheongju, M15X, and another fab in Yongin proceeding on schedule for commercial operations in late 2025 and mid-2027, respectively.

“We will continue to prioritize investment efficiency, focusing on products with high demand visibility and secured profitability,” said Chief Financial Officer Kim Woo-hyun. “As the leader in AI memory, we aim to deepen collaboration with partners, push technological boundaries, and secure sustainable profit growth through unmatched competitiveness.”

By In-Soo Nam

isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.