South Korea’s defense industry is once again capturing investor attention, as exports of tanks, armored vehicles and other weapons systems soar, fueling a dramatic rally in shares of the country’s top defense contractors.

Amid mounting global security concerns and a resurgence of military spending triggered by the persistent Russia-Ukraine war and the Washington-Beijing rivalry, the Korean defense, or “K-defense,” sector is thriving.

Industry leaders such as Hanwha Aerospace Co., Hyundai Rotem Co., Korea Aerospace Industries Ltd. (KAI) and LIG Nex1 Co. are all seeing their share prices surge to new highs, data showed on Thursday.

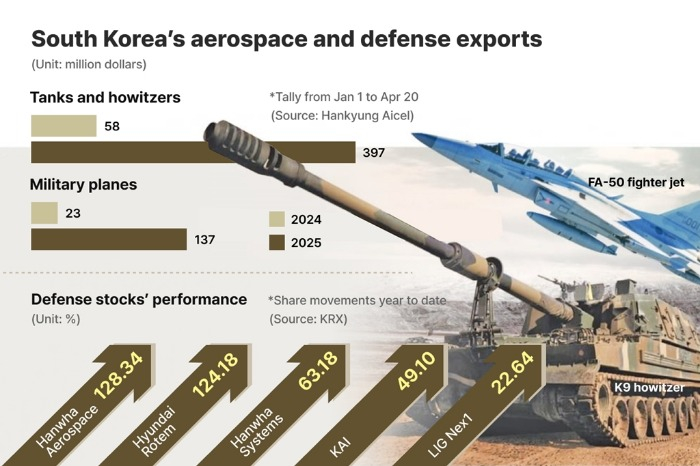

According to alternative data platform HanKyung Aicel, Korea’s exports of tanks and armored vehicles hit a provisional total of $397 million between January and April 20 – a nearly sevenfold increase from the $58 million in the year-earlier period.

Aerospace and military plane exports followed a similar trend, rising sixfold from $23 million to $137 million over the same timeframe.

CHANGWON: HOME TO MAJOR KOREAN DEFENSE FIRMS

The industrial hub of Changwon, home to key production facilities for Hanwha Aerospace and Hyundai Rotem, accounted for $393 million in defense exports in the first quarter alone, a 46% increase from the first quarter of 2024.

Hanwha manufactures its signature K9 self-propelled howitzers and Chunmoo multiple rocket launchers at three plants in the city.

Following a 1.4 trillion won ($984 million) deal for K9 howitzers and K10 ammunition-carrying vehicles with Romania last year, Hanwha signed K9 contracts earlier this year with Poland and India, worth 402.6 billion won and 371.4 billion won, respectively.

Changwon, 380 km south of Seoul, is also home to Hyundai Rotem’s K2 tank production base.

FOREIGN INVESTORS LEAD THE CHARGE

Investors have taken notice.

Shares of Hanwha Aerospace and Hyundai Rotem have more than doubled since the beginning of the year.

Hanwha Systems and KAI have also posted strong gains, up 63.2% and 49.1%, respectively, year to date.

Foreign investors are leading the charge: Hanwha Aerospace is the top pick among overseas funds, with their net purchases worth 790 billion won this year. LIG Nex1 and Hyundai Rotem rank third and tenth, respectively, with foreign net buying of the two stocks worth 236 billion won and 122 billion won each.

ANOTHER STRONG YEAR

While fears of tougher US tariffs under President Donald Trump are rattling other export sectors, Korea’s defense firms remain largely insulated, analysts said.

The European Union, for its part, has committed to an 800-billion-euro rearmament initiative, further boosting demand for advanced weapons systems as the end to the Russia-Ukraine war remains unclear.

“The outlook for Korean defense firms’ record earnings this year remains firmly intact,” said Lee Dong-heon, an analyst at Seoul-based Shinhan Investment Corp. “Most of these companies are exposed more to Europe, the Middle East and Asia than the US, which mitigates risk from Washington’s tough trade measures.”

STRUCTURAL RE-RATING

As geopolitical uncertainty continues to drive global rearmament, Korea’s defense industry is poised not only for another strong year but possibly a structural re-rating. For now, the K-defense rally shows no signs of abating.

Brokerages are racing to revise Korean defense companies’ earnings forecasts upward.

Market data provider FnGuide projects combined 2025 sales of 36.1 trillion won and operating profit of 4.7 trillion won for Korea’s four major defense players – Hanwha, Hyundai, KAI and LIG.

The sales and operating profit estimates are up 60.3% and 78.4%, respectively, from the previous year.

Hanwha Aerospace, which boasts a diverse defense portfolio, including the K9, Chunmoo rocket launchers and Redback infantry fighting vehicles, is drawing particular interest from analysts.

Korea Investment & Securities has set a bullish price target of 1.3 million won per share, a 56% premium over its current level of 830,000 won.

“Hanwha Aerospace is no longer a regional player,” said Jang Nam-hyun of Korea Investment & Securities. “With successful deals across Europe, Asia and the Middle East, there’s little justification for its low valuation versus its European peers.”

By Ahla Cho

rrang123@hankyung.com

In-Soo Nam edited this article.