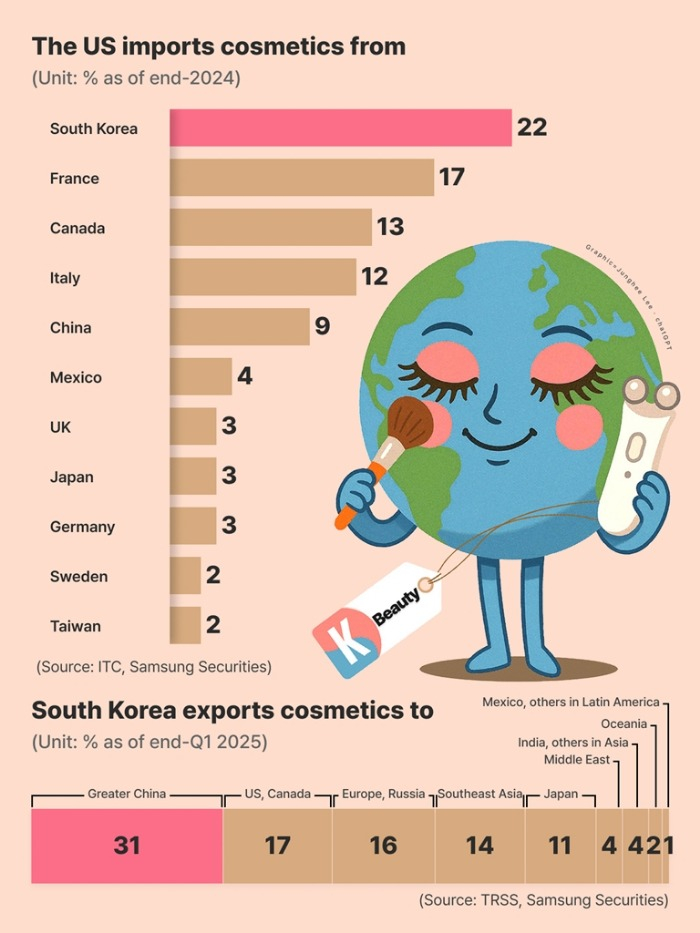

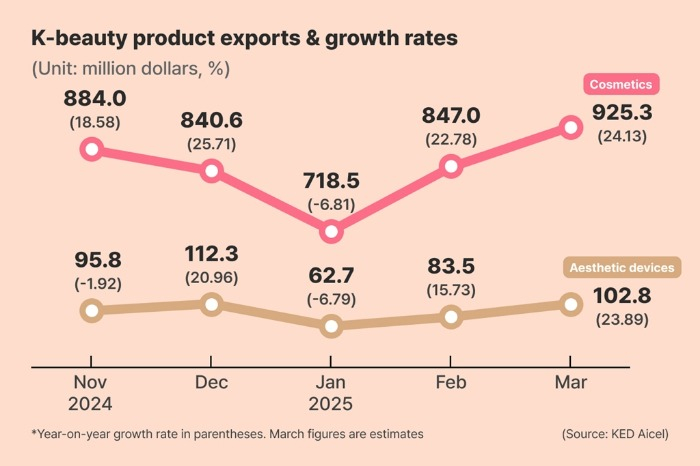

As South Korea’s independent beauty brands continue to take the global stage by storm, investors are now looking beyond the creams and serums – to the very containers they come in.

Shares in cosmetics packaging companies are surging, buoyed by the rapid ascent of K-beauty and the demand from smaller, agile brands.

The spotlight has turned to firms like Pumtech Korea Co. and SMCG Co., key players in the packaging value chain that are now riding the coattails of a broader cosmetics industry boom.

COSMETICS PACKAGING POWERHOUSE

Pumtech Korea, the leader in Korea’s cosmetics packaging market, has seen its shares climb 27.1% to 55,200 won year to date.

The firm’s earnings underscore its momentum.

The Kosdaq-listed company posted an operating profit of 48.4 billion won ($34 million) on sales of 337.5 billion won in 2024, up 37.1% and 18.6%, respectively.

Analysts expect Pumtech’s double-digit earnings growth to continue, powered not by Korea’s legacy beauty conglomerates, but by a new breed of small, independent brands.

Analysts point to the company’s edge in pre-molded packaging – ready-to-use molds – which account for 70% of its production, significantly higher than peers.

This allows for quicker, more flexible fulfillment of orders from emerging indie brands that demand unique designs at scale.

Between 60% and 70% of Pumtech’s client base consists of indie players, which rely on the company’s agile, pre-mold production system that enables rapid design customization and fast delivery.

To support this growth, Pumtech plans to open its fourth manufacturing facility later this year and launch a sales office in New York to tap into international demand.

“Export volumes from domestic indie beauty brands continue to set new records each month, translating into consistent order highs for Pumtech,” said DB Financial Investment analyst Heo Je-na, who on Monday offered her target price for the stock to 70,000 won with a buy recommendation.

GLASS MAKES A COMEBACK

Growing regulatory pressure around plastics has sparked renewed interest in glass packaging – and with it, SMCG.

The company, Korea’s top glass container maker, has emerged as another market darling, particularly following its March 7 Kosdaq debut.

SMCG saw its shares skyrocket 85% in just six weeks, from its Kosdaq debut price of 3,435 won to 6,360 won as of Monday.

Much like Pumtech, SMCG has secured deals with indie brands such as cosmetics startups Benow and Anua, as well as global brands, including L’Oréal.

SK Securities, which expects SMCG’s operating profit to surge 130% to 12 billion won this year from last year, has assigned a target price of 7,500 won.

“The glass packaging segment is positioned to benefit from broader ESG trends amid intensifying competition in the global beauty market,” said SK Securities analyst Heo Sun-jae.

Meritz Securities forecasts a 30% revenue increase this year for SMCG, following a 46% jump in 2024 revenues to 54.6 billion won.

COSMETICS ETFs

The rally in cosmetics packaging stocks has not gone unnoticed in the broader investment community.

Major cosmetics-themed exchange-traded funds (ETFs) are adjusting their allocations to capture the momentum.

Korea’s largest beauty ETF by assets, TIGER Cosmetics, has increased its Pumtech Korea weighting to 3.8% from 2.8% over the past month.

The Timefolio K-Culture Active ETF last month added SMCG to its portfolio, initiating with a 1.8% weighting.

By Jiyoon Yang

yang@hankyung.com

In-Soo Nam edited this article.