South Korea’s finance ministry will hold its largest-ever investor relations (IR) event for global institutional investors at the end of this month as it is preparing to issue a record volume of treasuries this year, surpassing 200 trillion won ($140 billion), according to government sources on Sunday.

The Ministry of Economy and Finance has invited some 100 global investment banks to the IR session, which will be held via Zoom. The exact date of the event has not been disclosed yet.

The ministry is now zooming in on active funds that have yet to invest in South Korean treasury bonds. It will be the largest-ever IR event hosted by South Korean government for global investment bankers in terms of the expected number of participants.

The bond issuance comes as the country is slated to join the World Government Bond Index (WGBI), one of the world’s leading bond indices, in November. The move is expected to attract substantial foreign capital, primarily from passive funds, to the domestic financial market.

“The government is targeting active funds,” said an investment banking source. “They are tapping institutional investors in China, Australia and Japan, who have not purchased Korean treasury bonds before.”

In early January, finance ministry officials visited the Reserve Bank of Australia, the country’s largest pension fund AustraliaSuper and the Australian branches of global asset managers Franklin Templeton and Vanguard.

Kim Yoon-sang, second vice minister of economy and finance, will lead the meeting. He oversees treasury issues and the government budget, as well as its fiscal policies.

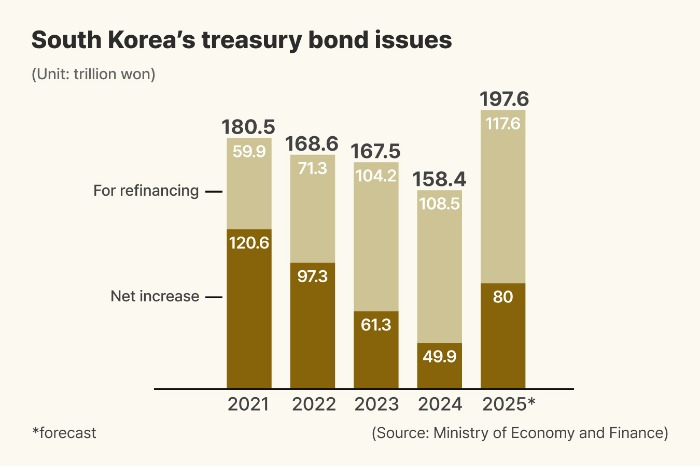

This year’s treasury bond issuance cap is set at 197.6 trillion won, marking the highest level in the country’s history.

The total issuance could exceed 200 trillion won, depending on the size of a supplementary budget, which must be entirely financed through bond sales. The ruling and opposition parties are proposing an extra budget ranging from 15 trillion to 30 trillion won.

Additionally, the finance ministry is allowed to raise up to 20 trillion won this year through the issuance of foreign exchange stabilization funds bonds denominated in the Korean currency.

This will bring the total amount of new treasury bond sales to as much as 240 trillion won in 2024, a 50% increase from the previous year.

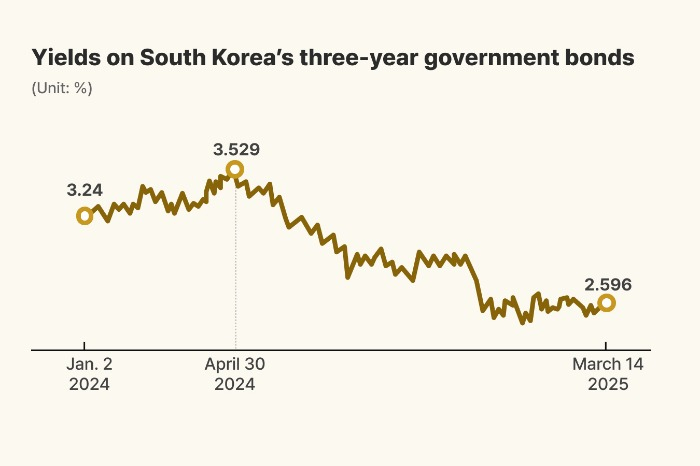

An increase in government bond supply could diminish the impact of the Bank of Korea’s interest rate cuts.

The Korea Fair Trade Commission’s investigation into primary dealers such as securities firms and banks over alleged collusion in government bond auctions could weaken demand for new bonds as well.

The domestic debt market is grappling with the fallout of hypermarket chain operator Homeplus’ filing for corporate restructuring with the Seoul Bankruptcy Court, which could deter individual investors.

APPEAL OF KOREAN BONDS

At the online IR meeting, the vice finance minister will seek to ease concerns over the potential negative impact of the new bond sales on the domestic capital market as they could absorb a substantial portion of market liquidity and restrict funding availability for Korean companies.

However, a finance ministry official said Korean treasury bonds would see price increases, or yield declines in the medium to long term as the country is expected to enjoy $50 billion in bond inflows following the WGBI inclusion.

Since last year, South Korea has eased regulations over foreigners’ investment in domestic treasuries and improved their access to the Korean foreign exchange market.

By Ik-Hwan Kim

lovepen@hankyung.com

Yeonhee Kim edited this article.