The appeal of European purpose-built student housing (PBSA) to real estate investors is growing rapidly.

In the recent 2025 INREV Investor Intentions survey, student accommodation ranked as the third most preferred sector to invest in, with 67% of respondents selecting the sector. Well above its five-year average of 35% of respondents, with only residential and industrial and logistics scoring higher.

But why exactly is PBSA is rising up investor wishlists? Here we explore six key factors.

(1) Demand for European higher education

Europe is home to more than a quarter of the world’s top universities, with 70 in the top 250 and close to 150 in the world’s top 500 ranked institutions. The quality of institutions, along with rising wealth in other parts of the world, has supported growing student numbers, particularly from international students.

(2) High numbers of international and mobile students

While international student numbers are a key driver of PBSA demand, Europe also has a large domestically mobile student population. A population that will often look to the relative ease of securing PBSA and the appeal of amenity-rich buildings, rather than enter the local private rental market.

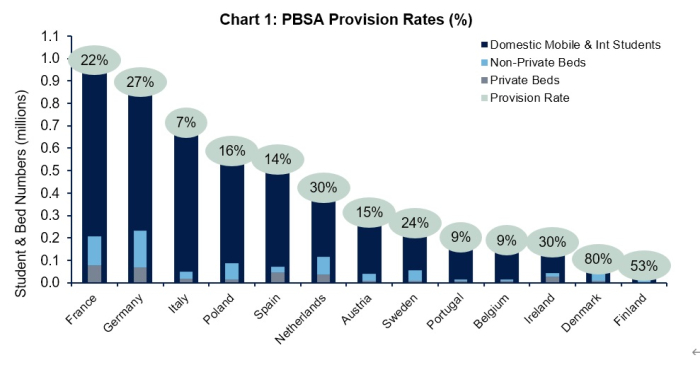

(3) Lack of PBSA supply

The provision of PBSA has gathered pace in recent years, but there remains a significant undersupply. Just one-in-five domestically mobile and international students are currently able to access a PBSA room. And it seems highly unlikely that there will be any significant respite in the existing lack of supply anytime soon.

Assuming all existing units under construction and those with planning permission get built, PBSA provision rates would increase by less than five percentage points in most markets on average.

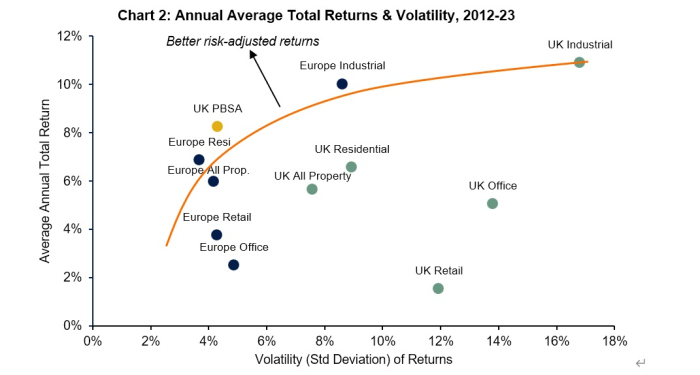

(4) Risk-adjusted returns

While long-term time series are hard to come by given the sector remains in its infancy, evidence from the more mature UK market shows that total returns display roughly half the volatility to that at the “all-property” level.

Rental growth was also twice the all-property average. Returns of 8% per annum on average over the past ten years compares favourably to the 5.5% per annum returns achieved at the all-property level, while lower volatility evidences the PBSA sector’s strong risk-adjusted returns.

(5) Downside protection

Historically, higher education participation rates have tended to rise during periods of economic weakness and rising unemployment. As fewer job opportunities push more young adults into studying and/or studying for longer the PBSA sector can provide investors with defensive characteristics to periods of economic weakness.

(6) Scalable opportunity

Despite still being in its infancy from an institutional capital perspective, the PBSA sector displays the right characteristics to ensure scalability and liquidity. Continental Europe has 3.5 times more domestically mobile and international students than the UK, but only a similar number of private PBSA beds.

Not only does this represent a significant development opportunities. But we estimate that if the private provision rate rose to 25% (as an example, one private bed for every four domestically mobile and international students), this would more than triple the current size of the market from around €45 billion, to over €155 billion. The estimate is based on the average transaction value per bed presented in Bonard’s Student Housing Annual Report 2022.

RISK FACTORS

Three key risks for European PBSA are potential demand risks, including online teaching; the affordability of study and living costs; and operational considerations. These risks are explored further in our European PBSA 101: Top of the Class paper.

In two further upcoming papers on European PBSA we set out a framework for determining where investors should focus their investment strategies and explore the issue of gross-to-net leakage and why this is an important determinant for a successful PBSA portfolio. For the full research papers and all the statistics, sources and graphs behind this article, please visit our website.

(This article was contributed by Hamish Smith, head of research and strategy (UK) of Savills Investment Management. References to Europe in this article excludes the UK)