Samsung Life Insurance Co., South Korea’s largest life insurer, is considering putting Samsung Fire & Marine Insurance Co., the country’s No. 1 non-life insurance firm, under its wing as a subsidiary.

According to industry sources on Tuesday, Samsung Life recently reported its plan to two financial regulatory bodies – the Financial Services Commission and the Financial Supervisory Service – for approval.

Samsung Life also must pass an antitrust review by the Fair Trade Commission to make Samsung Fire one of its subsidiaries.

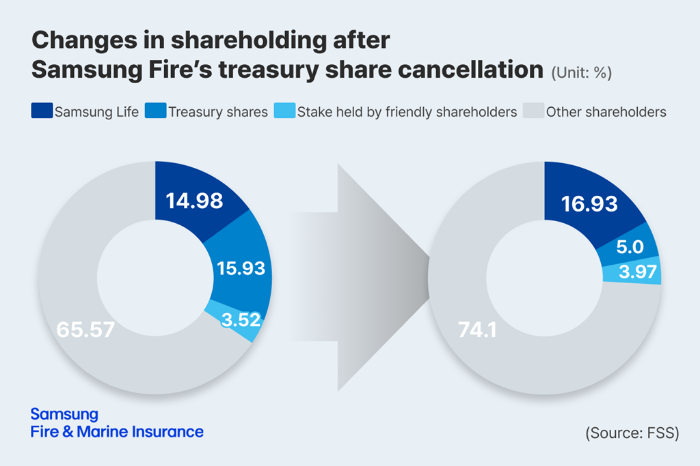

Samsung Life is Samsung Fire’s largest shareholder with a 14.98% stake.

Unlike other Samsung Group affiliates such as Samsung Card Co., Samsung Securities Co. and Samsung Asset Management Co., which are subsidiaries of Samsung Life, Samsung Fire is an independent company within Samsung Group.

TRIGGERED BY SAMSUNG FIRE’S SHARE CANCELLATION

The move follows Samsung Fire’s announcement in January that it would retire over 10% of its treasury shares from the market as part of its share value-up program.

The planned share cancellation, if fully implemented, would push Samsung Life’s ownership stake in Samsung Fire beyond the legal limit of 15% set by the Insurance Business Act.

By incorporating Samsung Fire as a subsidiary, Samsung Life aims to resolve such legal issues and enhance shareholder value for both companies, people familiar with the matter said.

On Jan. 31, Samsung Fire said in a regulatory filing that it plans to lower its treasury share ratio from the current 15.93% to below 5% by 2028.

When a company retires its treasury shares, the ownership percentage of other shareholders increases accordingly.

Analysts estimate that Samsung Life’s stake in Samsung Fire would rise to 16.93% if Samsung Fire slashes its treasury shares to 5%.

According to the Insurance Business Act, an insurer cannot own more than 15% of another company unless it obtains regulatory approval to classify it as a subsidiary.

Analysts said this means that Samsung Life must either designate Samsung Fire as its subsidiary or sell excess Samsung Fire shares.

FINANCIAL BENEFITS

Sources said a sale of excess shares is not a preferred option for Samsung Life.

Samsung Life’s offloading of its excess Samsung Fire stake directly in the market would cause a stock overhang, hurting Samsung Fire’s stock price.

Stock overhang is when a sizable block of shares, released in the market in one go, floods the market and creates downward price pressure.

With the stake sale, Samsung Life would also have to forgo a portion of its annual dividend income from Samsung Fire.

More critically, a stake sale could weaken Samsung Life’s influence over Samsung Fire and even affect Samsung Electronics Co.’s governance structure, sources said.

Under a circular share ownership structure, Samsung Fire currently owns a 1.49% stake in Samsung Electronics.

If Samsung Life lowers its stake in Samsung Fire, the governance chain linking Samsung Electronics – via Samsung Life and Samsung Fire – could be disrupted.

If Samsung Life puts Samsung Fire under its wing as a subsidiary, it would benefit from improved financial performance.

As a subsidiary, Samsung Fire’s earnings would be reflected in Samsung Life’s consolidated financial statements.

Given that Samsung Fire generates an annual net profit of between 2 trillion won and 3 trillion won ($1.4 billion-$2.1 billion), Samsung Life would see an additional annual gain of 300 billion–400 billion won on the bottom line if the non-life insurer becomes a subsidiary.

Samsung Fire’s shareholders are also stand to benefit, as a subsidiary plan would alleviate concerns over possible share overhang, sources said.

“If Samsung Life sells its stake in Samsung Fire in the market, Samsung Fire’s value-up initiative could lose its intended effect,” said an industry official.

By Hyung-gyo Seo

seogyo@hankyung.com

In-Soo Nam edited this article.