Samsung Heavy Industries Co., a major Korean shipbuilder, has made a breakthrough in its liquefaction technology for floating liquefied natural gas (FLNG) production facilities, challenging long-standing dominance by US rivals.

The technology, known as SENSE IV, is often referred to as the “heart” of the FLNG unit, a massive offshore structure that extracts, liquefies and transfers natural gas from undersea fields.

FLNG construction usually costs between 2 trillion won and 4 trillion won ($1.5bn–$3bn) per unit, with liquefaction equipment accounting for as much as 35% of that figure.

Despite Korea’s dominance in shipbuilding, critical components such as LNG liquefaction systems have long been supplied by US and European firms, including North Carolina-based engineering firm Honeywell International Inc.

With SENSE IV, Samsung Heavy is aiming to break that reliance and drive a trickle-down effect across Korea’s industrial ecosystem.

IN TALKS WITH AN ITALIAN CLIENT FOR SUPPLY OF FLNG WITH SENSE IV

According to industry sources on Wednesday, Samsung is in talks to supply an FLNG equipped with the in-house SENSE IV technology to an Italian energy major.

Samsung-built FLNGs have so far used imported liquefaction systems licensed by US-based engineering firm Honeywell International Inc.

With the localization of the liquefaction technology, however, future orders from the Italian firm will be outfitted with Samsung’s own equipment, sources said.

While Korea has localized up to 70% of the lower hull structures in FLNGs, the topside, which includes the high-value liquefaction equipment, remains only 30 to 40% localized.

That imbalance has left domestic players exposed to foreign licensing costs and after-sales constraints, analysts said.

GTT MONOPOLIZES LNG CARGO CONTAINMENT SYSTEMS

Samsung’s development of the SENSE IV technology comes as Korean shipbuilders’ heavy reliance on GTT Group, a French engineering firm that holds a monopoly on LNG cargo containment systems.

LNG carriers are the mainstay of the Korean shipbuilding industry, with their construction costs reaching $256 million per vessel.

Korean shipbuilders, however, pay about 5% in royalties per LNG carrier they build to GTT, with contracts often bundling mandatory after-sales service.

SENSE IV can liquefy up to 2 million tons of natural gas annually and reduces energy consumption by up to 14% per ton compared to existing liquefaction equipment.

The design uses nitrogen and methane in an efficient gas-expansion cycle, reducing component count and optimizing spatial use on board, according to Samsung.

“This is a milestone in Korea’s shipbuilding history,” said an industry official. “Breaking free from foreign dependence on critical components opens the door for local suppliers to win more overseas orders.”

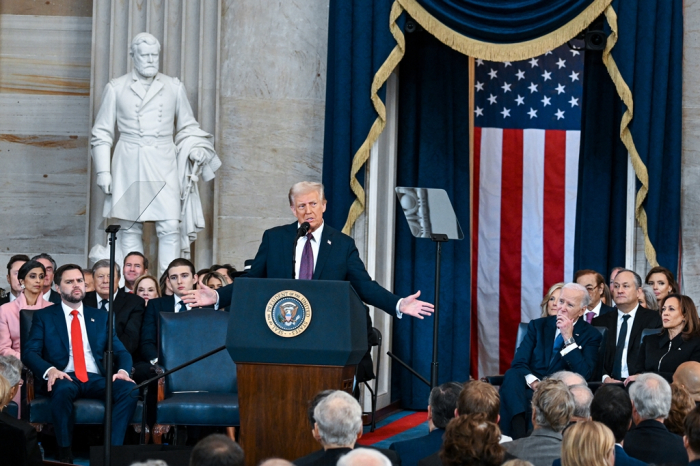

WASHINGTON’S TOUGHER STANCE ON BEIJING

Samsung began developing SENSE IV in 2021 but faced resistance from top-tier energy clients such as Shell plc, which favored US equipment.

With surging LNG demand globally, however, cost-effective and efficient alternatives, including Samsung’s SENSE IV, have gained new traction, analysts said.

Although Samsung has completed the design, manufacturing will initially be outsourced overseas, given the lack of domestic capacity.

Beyond SENSE IV, Samsung Heavy has also developed other proprietary systems for FLNGs, including fuel supply system S-Fugas, regasification equipment S-Regas, LNG transport machine X-Rally, gas ejector and liquid ejectors.

Earlier this month, sources said four energy firms – Italy’s Eni S.p.A, US-based Delfin LNG, Canada’s Western LNG and Norway’s Golar LNG – are expected to sign FLNG construction contracts with Samsung Heavy soon.

Samsung Heavy has already begun work on Eni’s Mozambique FLNG project, with the signing of an official contract now a mere formality, sources said.

Analysts said Samsung and other Korean shipbuilders stand to benefit from a geopolitical shift that has sidelined Chinese competition in the industry.

Washington’s tougher stance on Beijing is reshaping the global LNG supply chain.

In January, the Trump administration imposed sanctions on China’s Zhoushan Wison shipyard – Samsung Heavy’s only serious competitor in FLNG facility construction.

HANWHA OCEAN IN CRUDE CARRIER DEAL WITH GREEK SHIP OWNER

Korean Shipbuilders are also gaining ground as Trump-era sanctions sway tanker orders away from China.

Hanwha Ocean Co. recently signed a letter of intent (LOI) to build two very large crude carriers (VLCCs) for Greek shipping firm Capital Ship Management Corp.

Although the LOI wasn’t made public, each VLCC is usually priced at $125 million. Hanwha said it will deliver the vessels to Capital Ship Management by 2027.

Industry watchers said the deal marks the Greek owner’s turn to Korean shipyards for tanker construction after several years of favoring China.

In February, HD Hyundai Heavy Industries Co. signed an LOI with Pantheon Tankers Management Ltd., another Greek ship owner, for two Suezmax-class tankers – its first such deal with the Korean yard in five years.

Last week, Samsung Heavy won a 1.94 trillion won order from Petrobras Transporte S.A., the shipping arm of Brazilian oil firm Petrobras, to build nine Suezmax-class shuttle tankers.

“Ship owners are rebalancing their exposure,” said a Seoul-based industry executive. “Even the hint of US sanctions is nudging high-value contracts back toward South Korea.”

By Hyung-Kyu Kim and Woo-Sub Kim

khk@hankyung.com

In-Soo Nam edited this article.