K Bank, a South Korean online lender, is making a new attempt to list on the Korean stock market in February 2025 as Bitcoin’s record-breaking bull run led to a sharp increase in its deposits.

But it plans to reduce its valuation and free float in view of the languid stock market, according to investment banking sources on Wednesday.

It will file a prospectus for an IPO with the Korea Exchange in January. Now that it got a preliminary nod from the stock market operator in September this year, it must to complete its listing by February as per regulations.

Despite the downward streak in the benchmark Kospi index since July, K Bank concluded that now is the right time to push ahead with an IPO because it can take advantage of Bitcoin’s rally.

K Bank serves as a platform for cryptocurrency transactions. Customers of Upbit, a cryptocurrency exchange operator, account for about 20% of deposits at K Bank.

Bitcoin price hit an all-time high of $108,353 on Tuesday.

K Bank’s existing shareholders, including card processing company BC Card and Woori Bank, are likely to unload a smaller number of shares in the IPO than they planned. K Bank will also cut the size of new issues.

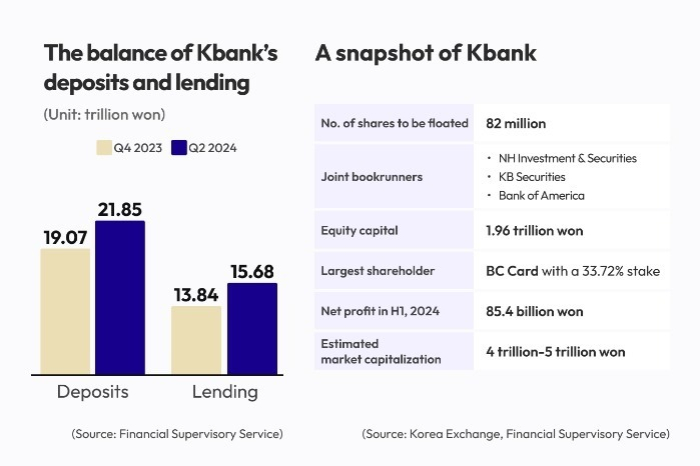

In October, it suggested a price band of 9,500-12,000 won ($6-$8.4) to raise between 779 billion and 984 billion won at a valuation of 4 trillion to 5.3 trillion won. But it withdrew the IPO as investors balked at the valuation. It was its second IPO bid since 2022.

In comparison, MNC Solution Co., a construction machinery parts manufacturer, cut its IPO price by 19% from the low end of its price guidance and reduced a free float by about 20%. It made a trading debut on the Korea Exchange on Dec. 16.

A recovery in the share price of its domestic peer KakaoBank Corp. also gave an impetus to K Bank’s IPO.

Investors bet President Yoon Suk Yeol’s impeachment in a parliamentary vote on Dec. 14. would ease political risks surrounding Kakao Corp. and its affiliates. The mobile platform group has been under regulatory and antitrust probes after Yoon criticized its business practices.

K Bank’s IPO could face a headwind, however. It may have to compete with other high-profile IPOs such as IT company LG CNS Co., Seoul Guarantee Insurance Co. and machine tool maker DN Solutions Co., which are also preparing to list on the Kospi bourse between January and March next year.

By Jeong-Cheol Bae

bjc@hankyung.com

Yeonhee Kim edited this article.