South Korean display makers regained ground in the global organic light-emitting diode (OLED) panel market in the second quarter, elbowing out the previous quarter’s No. 1 Chinese rivals thanks to brisk sales of high-end OLED displays for information technology (IT) devices.

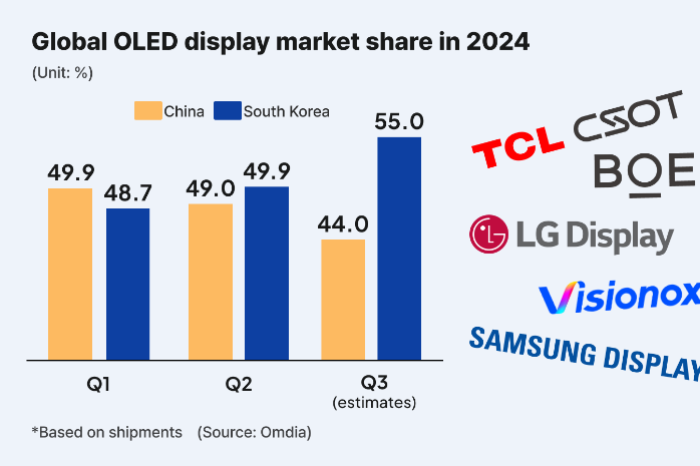

According to global technology research firm Omdia, Samsung Display Co. and LG Display Co. jointly commanded the largest 49.9% of global OLED panel shipments in the April-June period, beating Chinese players’ 49.0% share.

The result comes a quarter after Chinese display makers snatched the crown from multiyear OLED leader Korean display giants for the first time.

In the first quarter, Korean OLED panel shipments accounted for 48.7%, trailing behind Chinese OLED shipments with a 49.9% share for the first time.

Korean display makers’ comeback was driven by the robust sales of IT OLED panels, especially for premium tablet PCs. Samsung Display and LG Display supplied all of OLED sreens for Apple Inc.’s iPad Pro series launched in May.

They are forecast to have further widened the shipment gap in the third quarter thanks to the release of the iPhone 16 series. The Korean display duo supplied most OLED panels for the new iPhone series.

Omdia projected the combined share of Samsung Display and LG Display in OLED panel shipments would grow to about 55% in the cited quarter.

RAZOR-THIN GAP WITH CHINESE PLAYERS

But Chinese OLED panel makers are poised to overtake the Korean rivals soon again as their local IT companies have recently ramped up smartphone shipments.

A majority of smartphones by Chinese brands such as Huawei, Xiaomi, Oppo and Vivo are fitted with OLED displays supplied by BOE, CSOT and other Chinese display makers.

According to the Korea Display Industry Association, Chinese smartphones’ employment of Korean OLED panels plunged to 16% in 2023 from 79% in 2021.

Chinese OLED panels have also narrowed the technological gap significantly with their Korean counterparts partly due to the Chinese government’s generous aids to foster the country’s OLED industry.

Beijing has designated OLED as one of the national future growth engines and has been pouring massive investment into the development of the country’s OLED technology. It has also actively sought to encourage investment into the country’s OLED industry by offering subsidies and tax breaks.

This strategy resembles the colossal investments by the world’s second-largest economy to nurture the nation’s liquid crystal display (LCD) industry, which is now the world’s No. 1 after beating Korean LCDs.

NEXT-GENERATION OLED TECHNOLOGY

In the face of growing threats from Chinese OLED displays, Samsung Display and LG Display will strive to widen the technology gap with Chinese rivals with next-generation OLED technology, such as OLED panels powered by adaptive frequency technology for low power consumption and sunlight-readable, or high-brightness, panels.

They will focus on the development of tandem OLED that uses multiple light-emitting layers to increase brightness, efficiency and longevity, as well as low-temperature polycrystalline oxide (LTPO) thin film transistor (TFT) technology, mainly used in the iPhone Pro series and premium IT devices.

Samsung Display and LG Display controlled 72.5% of global LTPO OLED sales together in the second quarter.

With the next-generation OLED technology, the Korean display makers will accelerate their penetration in the IT OLED panel market.

Samsung Display has invested 4.1 trillion won ($2.9 billion) to build Gen 8.6 IT OLED panel lines in Asan, South Chungcheong Province, at home with a goal to begin mass production in 2026.

It will invest $1.8 billion to build an OLED line in Vietnam for small- to medium-sized panels used in laptops and tablets, the company announced in September.

In November, LG Display also decided to invest an additional $1 billion in its existing OLED panel fab in Haiphong, Vietnam.

By Chae-Yeon Kim

why29@hankyung.com

Sookyung Seo edited this article.