It began in 1982 as a small community bank for Korean immigrants in Los Angeles, California. Today, Hanmi Bank, under Nasdaq-listed Hanmi Financial Corp., has grown into one of the US’ top 10 Asian American-owned banks, symbolizing the rising influence of the Korean community in the world’s largest economy.

The first bank established by Korean immigrants to the US is now readying to open its first overseas office, in Seoul. The move will bridge the information gap with its home country, whose gross domestic product has soared more than 20-fold over the past four decades to $1,712.8 billion in 2023, according to the World Bank.

Hanmi is now awaiting approval from Korea’s Financial Supervisory Service (FSS) to set up its Seoul representative office. The Seoul Financial Hub (SFH), a startup incubator run by the Seoul city government, is supporting its launch in South Korea.

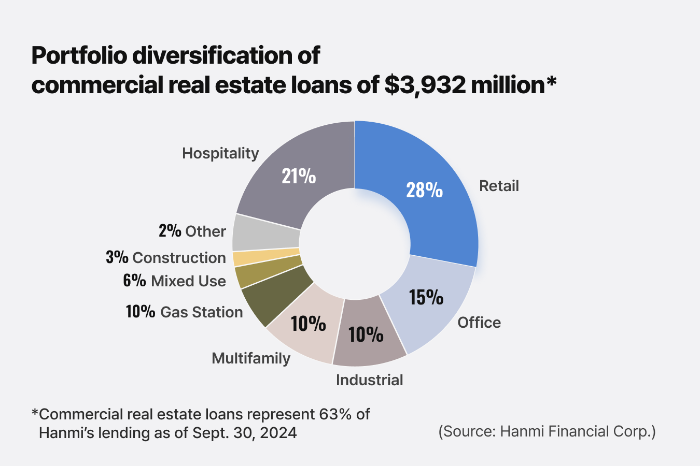

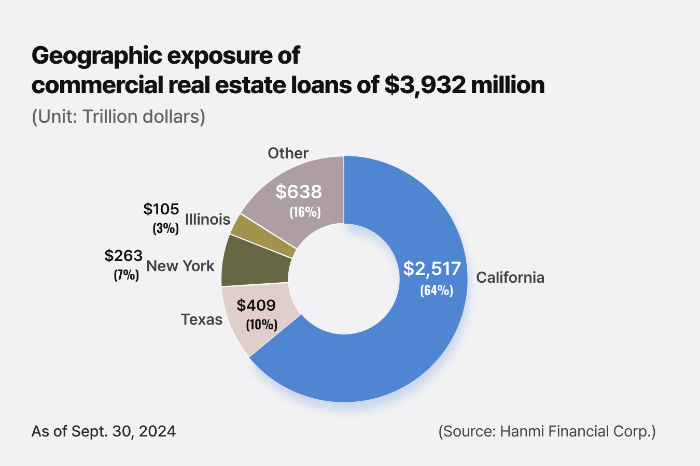

Hanmi Bank operates 32 branches and eight loan offices across nine US states and had $7.7 billion in assets as of the end of September. It specializes in real estate lending and trade finance for small and middle-market business owners.

In the US, Asian immigrant-owned banks represent the single largest group of minority depository institutions by race, according to Investopedia.

Asian Americans are the country’s fastest growing racial group and there were 71 Asian American-owned banks in the US as of the end of 2023, according to Investopedia.

Bank of Hope, founded in 1980, is the largest regional bank founded by Asian Americans in the US. It has already set up a Seoul representative office.

Its assets stood at $19.1 billion as of end-2023, more than double of Hanmi’s $7.6 billion.

OUTPERFORMING A LARGER RIVAL

Despite its smaller assets and earnings, Hanmi Financial outperformed Hope Bancorp in terms of both net interest margin (NIM) and share price in the third quarter.

Hope Bancorp’s NIM dropped seven basis points to 2.55% in the third quarter compared with the previous quarter, while Hanmi Financial’s NIM gained five basis points to 2.74% over the same period.

Hanmi Financial’s share price has advanced 28% year-to-date as of Nov. 11 in line with the Nasdaq’s 28% gain over the same period. By comparison, Hope Bancorp’s share price grew 12% since the start of the year.

Institutional investors account for about 70% of Hanmi Financial’s shareholders, according to Mansun Matthew Cho, head of its Seoul representative office.

Profile photo of Hanmi Capital CEO Bonnie Lee (far left) (Captured from Hanmi Bank LinkedIn profile)

SOLID EARNINGS

Hanmi Financial’s net income edged up to $14.9 million in the third quarter, compared with $14.5 million in the prior three months.

“These results reflect the continued success of our relationship banking model and our portfolio diversification strategy,” said Bonnie Lee, CEO of Hanmi, in a third-quarter earnings report in October.

Meanwhile, Hope Bancorp’s net income fell 20% on-year to $24.2 million in the third quarter.

By Yeonhee Kim

yhkim@hankyung.com

Edited by Jennifer Nicholson-Breen