Dalton Investments Inc., a US-based activist fund, has secured a 5.02% stake in South Korea’s Kolmar Holdings Co., stoking speculation the world’s No. 3 original development manufacturer (ODM) for cosmetic products would become a new shareholder activism target.

Dalton, with $4.3 billion in assets under management as of June 30, has been buying shares in the parent company of Kolmar Korea Co., in the market since early this year.

On Oct. 30, it disclosed its stake in the holding firm in accordance with South Korean laws that require shareholders with a stake over 5% in a listed domestic company to report its shareholding to financial regulators.

Kolmar Holdings controls Kolmar Korea, Yonwoo Co., a plastic packaging materials producer for cosmetic products and Kolmar BNH Co., a health supplements ODM company.

Its revenue comes from dividends and royalty payments from the subsidiaries.

INVESTMENT PURPOSE ONLY?

Dalton said in a regulatory filing that its share purchase in Kolmar Holdings was just for investment purpose.

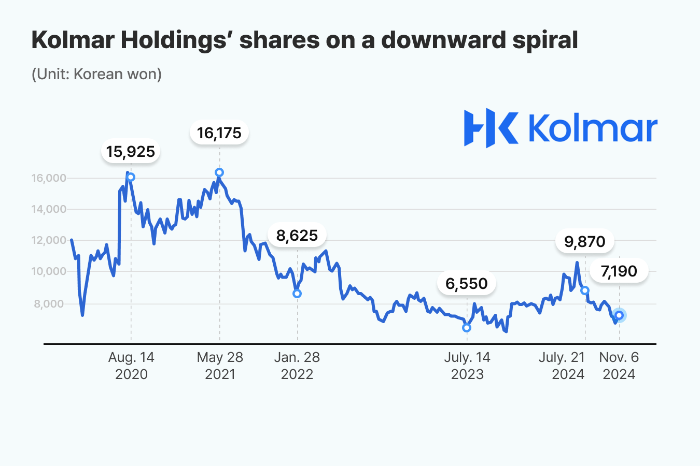

But stock market analysts expect the US investment firm to pile up pressure on Kolmar to take measures to unlock value as its stock price has been on a downward spiral.

Its share price has tumbled 41% off 12,140 won, this year’s peak touched in July, despite its announcement the same month of share canellation worth 20 trillion won ($14.3 million).

Its stock is trading at 0.44 of its book value as of Wednesday’s close.

Kolmar Holdings shrugged off concerns about Dalton’s possible move against the company for shareholder activism.

“Dalton has not requested anything in particular,” said a Kolmar Holdings official. “We view it as an investment in an undervalued company with a high future value, rather than aimed at putting pressure on our management.”

Dalton is one of leading shareholder activists in Asia.

In May, it sent a letter to Fuji Media Holdings with a recommendation to take the Japanese group private as its shares have underperformed. Dalton held a 6.55% stake in Fuji Media

In 2019 and 2020, respectively, Dalton pushed Hyundai Home Shopping Network Corp. and Samyung Trading Co., a chemical materials and products distributor, to implement shareholder-friendly measures.

In 2022, it urged SK Group, the No. 2 conglomerate in South Korea, to focus more on increasing share buybacks and cancelations than dividend payments.

The move came after it wrote a public letter to the South Korean government and the National Pension Service, calling for steps such as lowering taxes on dividends, actively exercising shareholder rights and introducing mandatory electronic voting.

By Jun-Ho Cha

chacha@hankyung.com

Yeonhee Kim edited this article.